Fed Stimulus Drives Demand Ahead of Supply-Slashing Halving Event

Social and economic lockdowns have taken their toll on the U.S. economy. At the same time, crisis conditions have dramatically set the stage for crypto’s next growth phase.

We’ve now shed all the jobs added since the end of the Great Recession. 30 million Americans have filed first-time claims for unemployment insurance over the last six weeks, and gross domestic product (GDP) shrank by 4.8% during the first quarter.

Despite these unnerving facts, stocks just had their best month since 1987, and the S&P 500 Index is a mere 16% off its all-time highs.

How? Why?

Well, the Federal Reserve has essentially committed to keeping asset prices afloat no matter the outcome. Fed Chair Jay Powell pledged to push out more stimulus plans and to keep interest rates at the “zero bound” for the foreseeable future.

This is called “inflation.” It’s the primary reason stock indexes are barely off their highs ... It’s why gold is rising above multi-year highs … And it’s why crypto assets are set to take off to new highs, too …

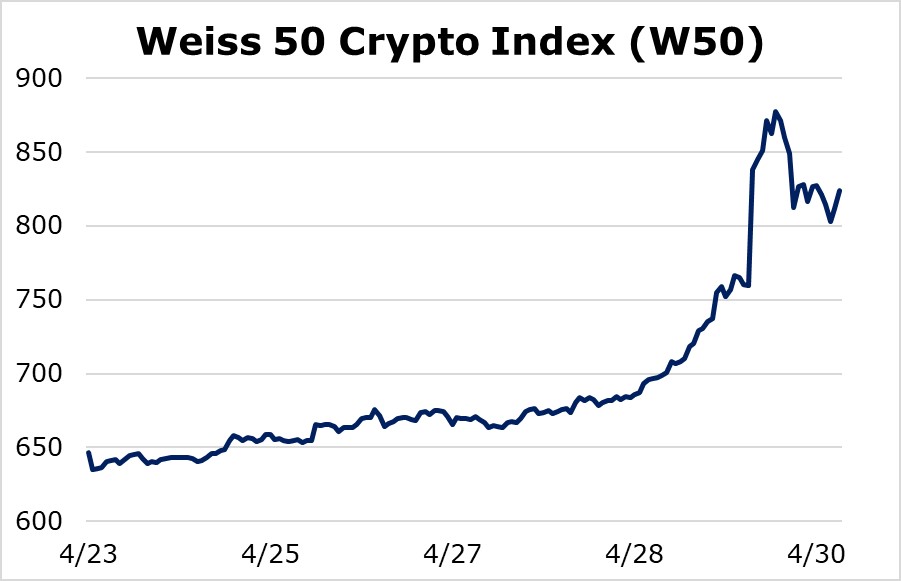

Our Weiss 50 Crypto Index (W50) took off by 27.47% on the week, virtually erasing all the losses incurred since the crash on March 12, a day many traders are now calling “Black Thursday.”

|

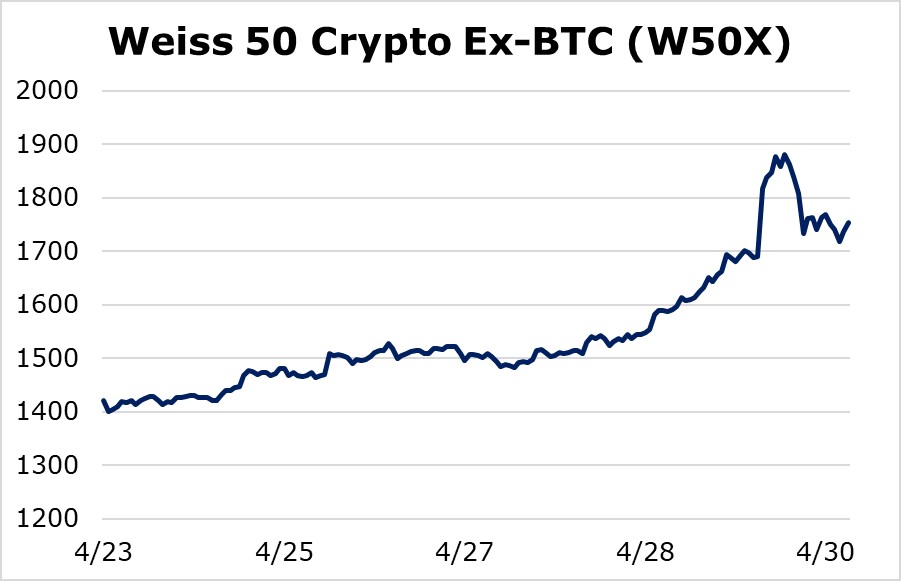

Note that the altcoins took a back seat to the King of Crypto this week, as the Weiss 50 Ex-BTC Crypto Index (W50X) rose “just” 23.45% through Thursday.

|

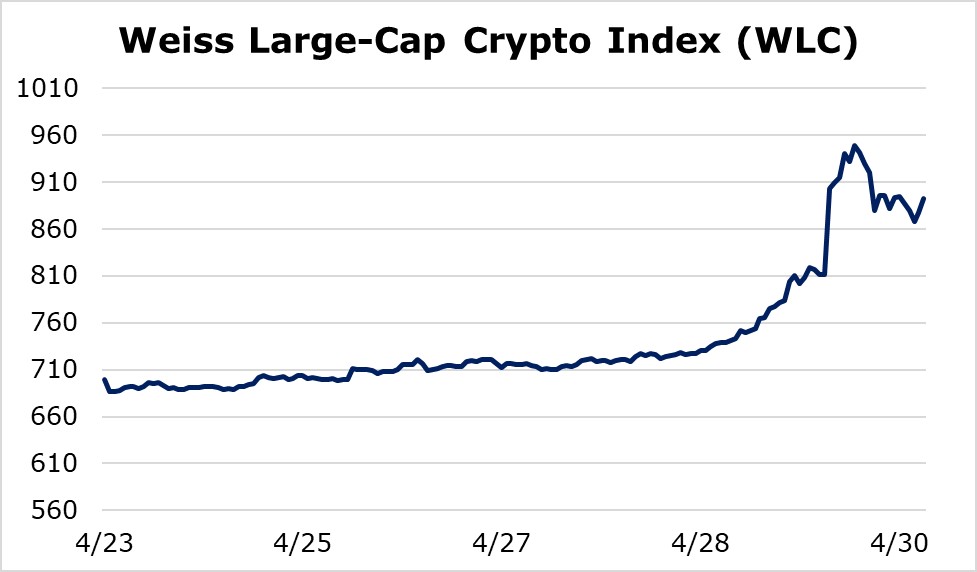

The simple conclusion based on our crypto indexes is that we’ve recovered those “Black Thursday” losses. But, if we split the sector according to market cap, we can also see that this is maturing into a “risk-on” rally with legs. Consider …

The Weiss Large-Cap Crypto Index (WLC) is up a whopping 27.54%, and that’s tame compared to ...

|

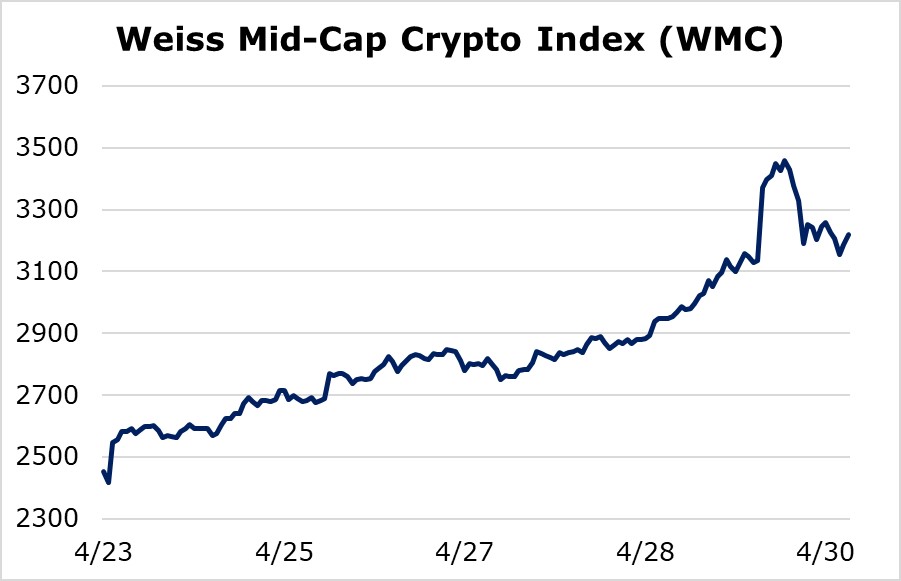

The Weiss Mid-Cap Crypto Index (WMC), which is up even more at 31.10% on the week.

|

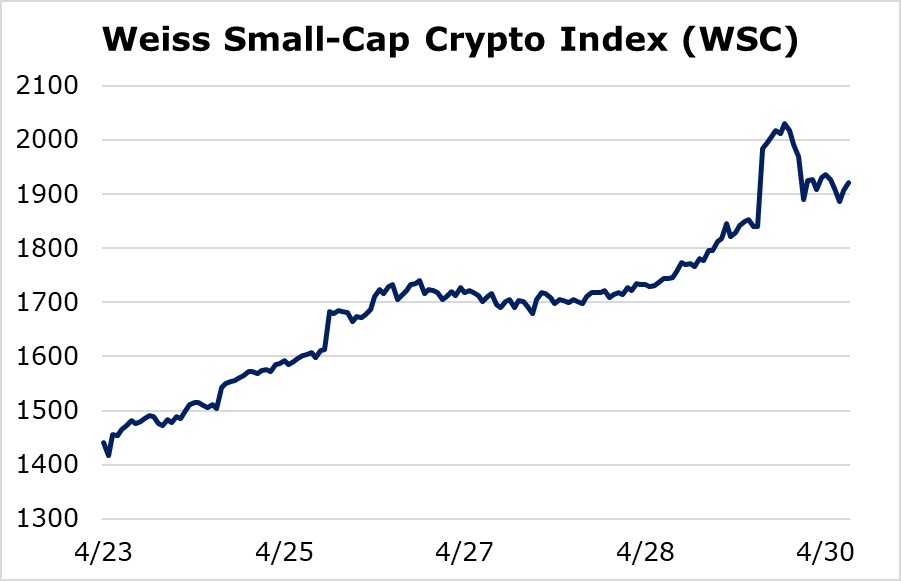

Finally — and most importantly, when it comes to that “rally with legs” — the small caps are leading the charge higher.

The Weiss Small-Cap Crypto Index (WSC) was up 33.39% during the seven-day stretch that ended yesterday.

|

That small caps are leading the way and large caps are lagging is a definitive “risk-on” sign.

The Fed’s stimulus is indeed the rising tide that lifts all boats. Among the unintended consequences of the central bank’s attempts to keep the economy stable is an exodus into asset classes outside its purview, such as precious metals and crypto assets.

Indeed, Bitcoin was created for this very reason: to be an exit ramp from a fiat-money world gone mad to a sane world of moderation and balance.

This trend will continue. And it couldn’t come at a better time, on the cusp of Bitcoin’s next halving” event. Surging demand will collide with slashed supply. Now, that’s a classic recipe for driving prices sky-high …

The bottom line? Don’t fight the Fed. Buy Bitcoin.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.