|

I can’t keep up with my kids.

I’m not talking about jogging around the track with them or staying up late to watch a movie. I’m talking about the way they use the internet to communicate with me.

“How come you never answered my email,” I asked my daughter.

“Geez Dad, nobody uses email anymore.”

That was news to me. But what does an old man like me know about being cool?

What about Facebook, which used to be my “go to” way to communicate with my kids?

“Facebook stopped being cool when parents started using it,” said one of my sons. Facetime, the video chat app, is about the only feature of Facebook that my children use.

My kids moved over to Snapchat, then Instagram, and now the app-du-jour is TikTok.

|

Tik-what?

TikTok is a wildly popular app for making and sharing short video clips and has been described as a social network for amateur music videos with a heavy emphasis on dancing. But just about any movement-based activity — gymnastics, cheerleading, lip sync, parkour and basketball — are also featured.

How popular? TikTok has been downloaded 2 billion times since its creation in 2014.

2 BILLION!

It’s the fourth app — joining WhatsApp, Instagram and Messenger — to hit that mark.

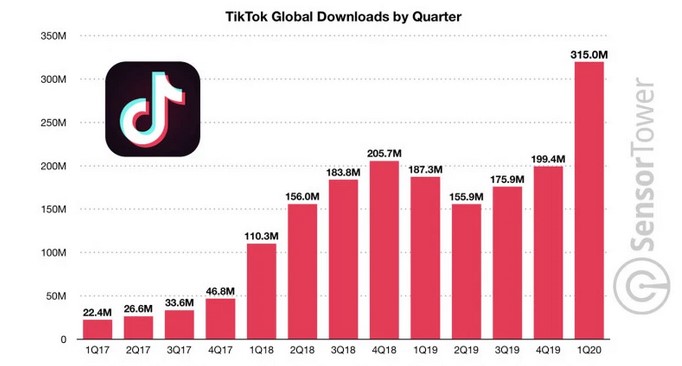

And in just the first 90 days of 2020, TikTok was downloaded 315 million times. With all of us sheltering at home, the download numbers for the second quarter will be jaw-dropping.

The bad news is that TikTok is a private company, so you can’t invest in it. ByteDance, TikTok’s parent company, counts Bank of China (XHKG), Bank of America (BAC), Barclays Bank (BCS), Citigroup (C), Goldman Sachs (GS), JPMorgan Chase (JPM), UBS (UBS) and SoftBank Group (TYO) as some of its largest investors.

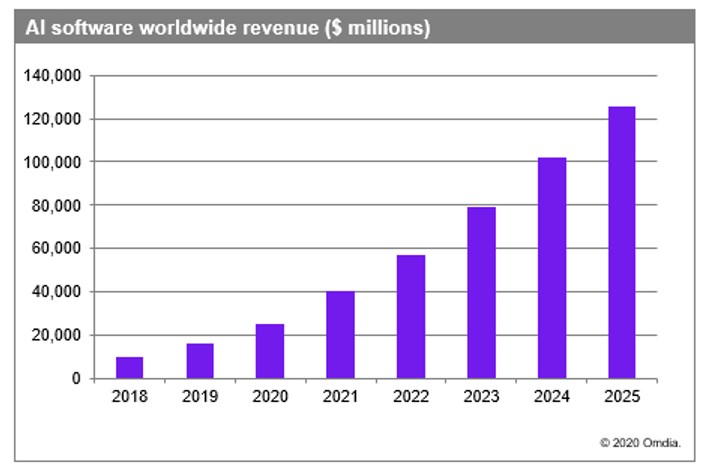

However, you can invest in the behind-the-scenes technology that has made TikTok so popular. Technology like artificial intelligence. TikTok extensively uses AI to analyze users’ interests and preferences to send them a steady stream of personalized content suggestions.

And TikTok isn’t the only company that is using artificial intelligence to grow its business. According to Statista, the global market for artificial intelligence is expected to grow by 154% to $22 billion this year.

|

What companies are on the cutting edge of the artificial intelligence revolution? There are too many to list, but the most well-known companies are Alphabet (GOOGL), Amazon.com (AMZN), Baidu (BIDU), Intel (INTC), Microsoft (MSFT) and chip-maker NVIDIA (NVDA).

However, artificial intelligence is just a relatively small part of those companies’ overall business. Three small, under-the-radar stocks that are worth looking at are Splunk (SPLK), Tencent (TCEHY) and Twilio (TWLO).

They’re volatile small-cap firms with loads of risk, as well as opportunity. And these are exactly the type of stocks I cover and recommend in Weiss Crypto Investor.

I’m not saying to go out and buy these stocks immediately, but I am telling you to keep them on your radar, especially as communications methods move further onto social media apps, leading more businesses to use AI to track user data.

Best wishes,

Tony Sagami