We’re seeing a notable move for the price of the asset most famous for its storehold-of-wealth characteristics, gold, amid a renewed sense that this crisis is just not like other that came before.

The action for Bitcoin and other crypto assets over the last seven days looks a lot like the sideways action we’ve been talking about for literally weeks now.

But, as we’ll see, deeper and longer-term-positive trends we mentioned last Friday intensified this week, particularly in the aftermath of a Saturday-Sunday swoon.

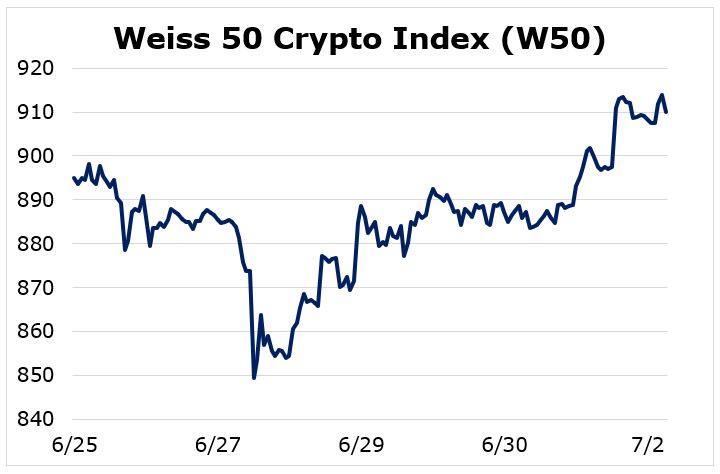

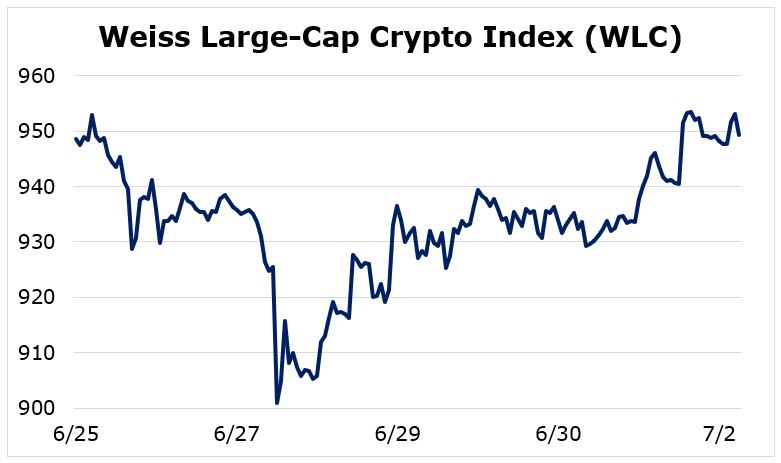

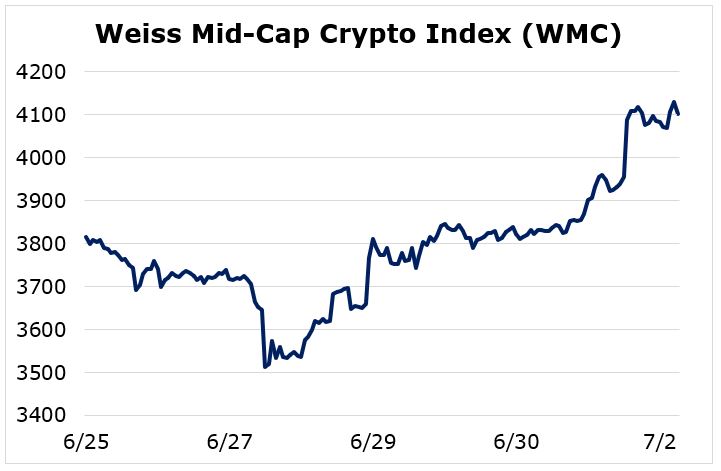

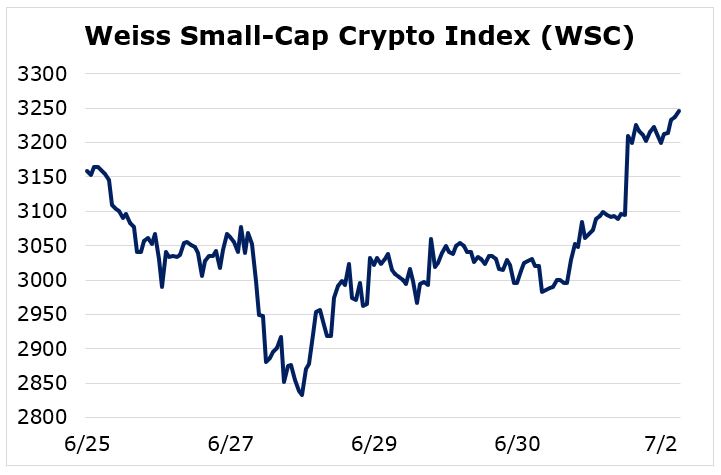

The data this week are through Thursday at 11 a.m. Eastern, cut a little short on account of the upcoming Fourth of July holiday. Still, strength into the end of the week — as concern about a “second wave” of COVID-19 infections and fear of another severe economic shutdown rose together — is clear across all the indexes.

The broadest measure of the asset class, the Weiss 50 Crypto Index (W50), was up 1.68% for the week. In the crypto context, that’s a modest move. But that bounce from the intra-week low on June 27 was 7.12%.

The Weiss 50 Ex-BTC Crypto Index (W50X) — which measures everything but the biggest name in the space — was up 1.47% through Thursday morning. This index too broke high and strong from its Saturday low, rising 8.99% from there.

Let’s take a look at the breakdown by market capitalization. The Weiss Large-Cap Crypto Index (WLC) was just about as flat as can be for the abbreviated week, with an ever-so-slight gain of 0.08%. But it looked better as the week wore on, rallying 5.36% off its low.

A pattern we discussed last week — mid-caps and small-caps leading to the upside — repeated this week, only more so this time. The Weiss Mid-Cap Crypto Index (WMC) was up 7.47% overall and surged 16.72% off its intra-week low.

The Weiss Small-Cap Crypto Index (WSC), meanwhile, was up 2.77% overall and 14.60% off its low.

OK, we talked about “a rally toward the middle of the week followed by a selloff that left asset values essentially unchanged for the seven days” last Friday.

Today, we’re looking at the bounce off that late-week selloff. And, again when we dig a little deeper, the relative strength in the mid-caps and the small-caps is even more evident.

So, is this a “breakout”? That’s probably not the most constructive way to think about Bitcoin and crypto right now.

In fact, crypto assets have largely traded in step with equities and not the traditional “safe havens” such as gold and U.S. Treasuries.

Here’s a longer-term frame to consider, one we touched on in Wednesday’s issue: What choices are the Federal Reserve and the U.S. government left but to print and to borrow their way out of whatever fresh economic damage is caused by this pandemic?

In other words, the U.S. dollar will be debased. On top of that, U.S. prestige is under relentless attack. The entire postwar institutional structure — domestic, financial, economic, geopolitical — is under relentless attack.

In the short term, prices for Bitcoin and other cryptos are likely to move as the panic does.

As time passes, though, they look like more than just reasonable alternatives — they reveal the rationality of hard currency.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.