Mercury Systems: Prepare Your Portfolio for Blast-off With This Space Technology Stock

|

I couldn't get enough of Buck Rogers.

Many of you probably remember him. Buck Rogers was a fictional space adventurer, first popularized in comic books, then radio, then movies, and lastly as an uber-successful TV series when I was a boy.

Buck Rogers was re-launched in 1979, starting Gil Gerard and Erin Gray. But like most sequels ... it sucked. (Other than the lovely Erin Gray.)

My kids, who are young adults now, never heard of him. Neither have most millennials and Gen Xers. But then again, a lot has changed over the past few decades. It's about to change a whole lot more over the next few years.

Is your portfolio ready for blast-off?

|

Space adventure is no longer a cinematic dream. Elon Musk and Richard Branson are working at warp speed to make space travel a reality for non-astronauts with money to burn.

Elon Musk started SpaceX that plans on colonizing Mars and is currently valued in the $20 billion-plus range. SpaceX is also building a constellation of communications satellites — with a new launch every two weeks — that serves commercial and military customers.

Oh yeah, there is big money to be made from space technology.

This is much more than a new toy for the rich to float 50 miles above earth.

Not from Musk or Branson, though. Their ventures are much too risky and won't be profitable for years … maybe decades.

However, investing in the companies that make space-related equipment will be investment home runs. Especially businesses that land big, juicy contracts from the U.S. government.

In December, President Trump signed the $1.4 trillion National Defense Authorization Act, which created Space Force — the first new military service since 1947.

Space Force will be part of the U.S. Department of the Air Force, and will function in an arrangement similar to the one between the Marine Corps and the Navy, which both operate under the Department of the Navy.

Military officials say the Space Force will become fully operational by 2024.

This means a tidal wave of military investment in space technology is coming … and a lot sooner than 2024.

According to Bloomberg, the Department of Defense already spends about $4 billion a year on space vehicles, launches and services. But again, that figure is only going to skyrocket as the U.S. seeks to reassert its dominance in space.

That's great news for the behemoth military contractors — such as Lockheed Martin (LMT), Northrop Grumman (NOC), Boeing (BA), Honeywell International (HON) — as well as a host of smaller companies that most investors have never heard of.

My Weiss Crypto Investor subscribers already own Mercury Systems (MRCY), a company that absolutely dominates the military drone industry with its best-of-breed semiconductor sensor chips.

In simple terms, Mercury Systems provides the highly specialized semiconductors that are used in defense electronics and power a wide variety of defense and intelligence programs.

|

|

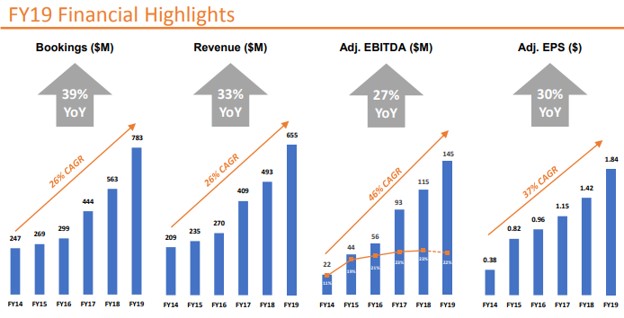

Source: Mercury Systems 2019 annual report |

Mercury chips are used in over 300 different pieces of military hardware, including:

- The Army's ground-based Patriot Missiles

- The Navy's "track and destroy" Aegis Missiles

- Surface Electronic Warfare Improvement Program or SEWIP

- Gorgon Stare ("eye in the sky")

- Paveway smart bombs

- F-35 Fighters

In short; Mercury chips are the "brains" that powers ALL the U.S. military's largest and most deadly drones.

Space spending is going to explode in the coming years and Mercury Systems is poised to collect billions more to supply Space Force with its mission critical, cutting-edge technology.

That doesn't mean you should rush out and buy Mercury Systems tomorrow morning. As always, timing is everything, so I suggest you wait for it to go on sale.

Even better, there are a handful of space-supplier stocks that I expect to do even better.

Best wishes,

Tony Sagami