An Open Letter to Weiss Ratings: The Case for Bitcoin

| Tristan Amzallag, a Bitcoin old-timer and veteran crypto educator, has written us this open letter. Although we disagree with some of his conclusions, he provides objective analysis that’s worthy of a continuing debate. We will respond to his commentary later this week. — Martin |

Weiss Ratings initially gave Bitcoin a C+ and recently upgraded it to a B-. I applaud this uptick for Bitcoin; it is an important move both technically and psychologically that places Bitcoin slightly above most other cryptocurrencies in their ratings list.

As the first of its kind, it should be recognized as a top crypto. But does Bitcoin deserve to be rated even higher?

|

| Weiss Ratings initially gave Bitcoin a C+ and recently upgraded it to a B-. |

Bitcoin isn’t just a new technology; it’s an entirely new way to look at the value of any asset. The world is full of diverse and disjointed assets, providing multiple vast markets that need many different solutions to satisfy their various nuances. Bitcoin wasn’t designed to address 90% of the market’s needs, and thus the emergence of new coins and technologies to address those nuances was inevitable.It is true that Bitcoin has lost ground from a commanding position of 90% market dominance in the beginning of 2017 to as low as 32% just a year later. That is a massive drop in such a short time. However, when you’re up, there is only one way to go — down.

This need for diversification has led to the creation of over 1,500 new coins on the market today. Holding 32% of any market with 1,500 competitors is, on its own, impressive. But looking at Bitcoin today, we can see that it has regained some ground and stands at 41% of the total market. Even more impressive.

The Weiss analysis on the Bitcoin fundamental index is very thorough. Bitcoin does have some fundamental problems with regard to its capacity to handle a high volume of transactions. Its network has been clocked at being able to handle 3-5 transactions/second. This is far from adequate for a system of money, given today’s global transaction volume. Furthermore, Bitcoin can cost users some high fees.

These problems are being addressed, with network improvements such as SegWit. This led to the Bitcoin Cash fork, and improved the Bitcoin network as well as the Lightning Network that will support off-chain transactions and smart contracts at higher processing rates. In fact, Weiss Ratings also cites the increase in Lightning Network adoption as a reason to bump Bitcoin up and this will only continue as it is developed further.

In addition to these two technologies, there are other groups working on improving the network and offering greater support tools for it every day. I would argue that Bitcoin plus Lightning provide as many fundamentals as Cardano or NEO in their current state, both of which received B level ratings.

Bitcoin’s technology is simple and straightforward when compared to third-generation cryptos.But this simplicity gives it an advantage — the highest level of security to store value today. In a world where hacking and data loss seem to be as common as sexual harassment suits, Bitcoin provides a light.

It is near-impossible to hack into the Bitcoin network to affect a value change in anyone’s holdings:

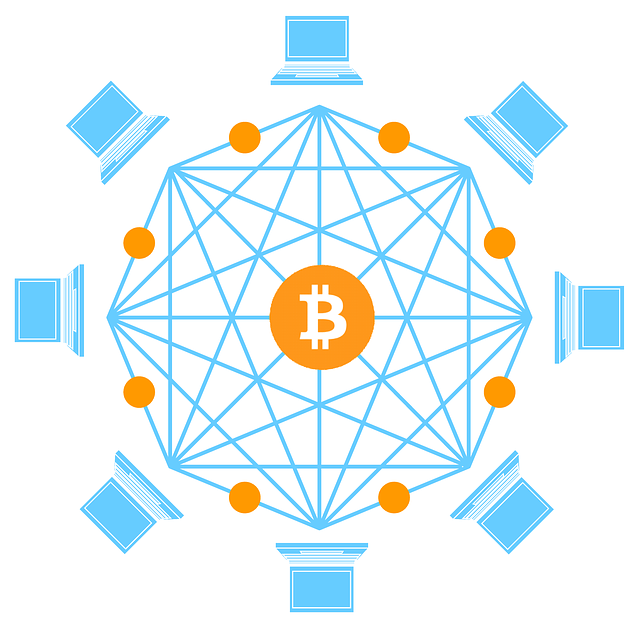

First of all, data cannot be stolen. That’s because it is freely distributed to anyone who cares to download the Bitcoin blockchain.

Second, in order to change any information on the network, you would need to have enough computing power to rival 51% of the current mining power being thrown at Bitcoin’s security.And as we keep hearing, that’s a lot of power — greater than that of some countries.

Some have argued that Bitcoin is a terrible store of value due to its price volatility, and they are right: We’ve all seen the impressive rises of 2,000% and falls of over 70% in the value of Bitcoin in 2017. And since many are new to the market, they might mistakenly believe this is the way crypto is.

However, it’s important to look at the complete history of Bitcoin, not just the last year. Prior to 2017, Bitcoin enjoyed a very stable base of around $500 for two years. It would bounce up and down around that number, but for a while you were fairly assured that $1,000 USD put into Bitcoin would be a safe store of that value and you could retrieve that $1,000 when you needed it.

So, while 2017 was not a good example of stability for Bitcoin, we have seen periods of price stability. Those times will return. In fact, after the last great rise of Bitcoin (the fourth in its history), we may well be entering another stable period around the $10,000 range.

There are two final points to be made in the case for Bitcoin: Liquidity and ubiquity.

Unlike many of the other coins out there, Bitcoin enjoys the largest trading volume. Bitcoin is the gatekeeper to the entire crypto world. When any investor, speculator or user wants to enter these markets, they will sooner or later encounter Bitcoin.

|

| Exchanges offer the ability to play the entire crypto market … and they use Bitcoin to do it. |

This is because the majority of transactions involving cryptocurrencies require Bitcoin as the basis.It is accepted on every exchange and used as the trade basis for every other crypto out there within those platforms.

There are some exceptions. For example, Coinbase has chosen fiat currency as its basis. And you can use that fiat to purchase Bitcoin, Ethereum, Litecoin and Bitcoin Cash. But those are only four coins available to an investor in a sea of many others. To access all the others, the investor will most likely need to use Bitcoin.

Coinbase also sits in a different category to an exchange. It is an “On ramp.” It opens the door to the crypto world, but you can’t go beyond the four coins I mentioned. Exchanges offer the ability to play the entire crypto market … and they use Bitcoin to do it.

This is at the core of Bitcoin’s strength today, and why I feel even a B- is low. In a sense, Bitcoin mirrors the U.S. dollar on the global stage. People talk in terms of petrodollars, and there are many economies in the world that accept the U.S. dollar as a form of currency. No other currency enjoys such supremacy, and this gives it intrinsic value beyond U.S. borders or even beyond monetary policy.

Giving Bitcoin a C+/B- rating is like giving the USD a C+/B-. And if Weiss Ratings feels the greenback deserves such a grade, then perhaps Bitcoin does as well. But to me, Bitcoin today is the King of Cryptos … and its grade should reflect that reality.

The Weiss Ratings will change in the future, and they should, given the rapid and dramatic changes in the market on a day-to-day basis. As a result, I would hope that Bitcoin’s rating will also change. As the King of Cryptos today, Bitcoin supports the rest of them. Should it be relegated to the same levels as Decred or Litecoin when it has shown greater utility, liquidity and ubiquity? I say “no.”

Sincerely,

Tristan