For several weeks we had been warning that, while crypto markets are firmly bullish both on a medium- and long-term basis, crypto markets were overdue for a short-term correction.

Now, it appears that correction is finally underway, as our Weiss 50 Crypto Index (W50) — our broadest benchmark for the crypto industry as a whole — is down 14.29% on the week ending yesterday.

|

And this time, it’s the altcoins — not Bitcoin — that are leading the way down, as the Weiss 50 Ex-BTC Crypto Index (W50X) is down slightly more, off 18.04% on the week.

|

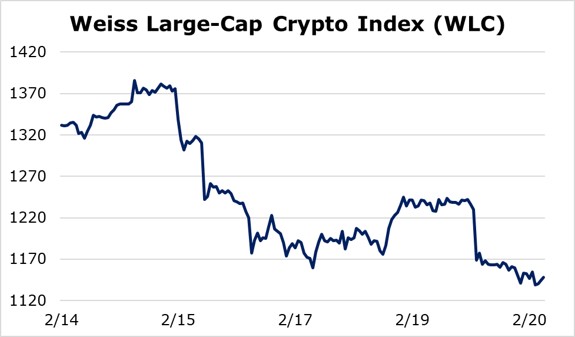

Splitting the sector by market cap, we again see an interesting pattern:

- The Weiss Large-Cap Crypto Index (WLC) is down the least — 13.75%. We always point out that “hard times” are typically not so hard for large caps, and that pattern shows here. So far in this pullback, they’ve been the most resilient.

|

- Sure enough, the Weiss Mid-Cap Crypto Index (WMC) is down more sharply — 17.88% on the week. Comprised of more speculative names, it’s no surprise to see the mid-caps underperform on a clearly red week for crypto assets.

|

- The pattern doesn’t quite hold this week for the small caps: The Weiss Small-Cap Crypto Index (WSC) is down 15.77%.

Since they gained the most during the rally phase, it’s a bit odd to see them pull back slightly less than the mid-caps. In a true “risk off” scenario, we’d expect this index to fare the worst.

|

Overall, our indexes are telling us the selloff is probably not yet done. The small caps especially seem to have more downside coming, as crypto markets work off their short-term overbought conditions.

Some pundits are blaming the selloff on a sophisticated trader who pulled off a “heist” by exploiting flaws on Ethereum’s nascent DeFi ecosystem.

That may have been a trigger event. But the fact is, as we’ve been saying all along, these markets were poised to go down in the first place.

Moreover, the news itself isn’t as negative as it may appear. The event exposed flaws in the way some decentralized lending markets are being set up. Fixing those flaws will ultimately make the industry more resilient.

Overall, the crypto bull market is intact, and our models tell us the upwards momentum should return as soon as crypto assets work off the froth — precisely the buying opportunities we’ve been patiently waiting for.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.