Small Caps Stoke Hope of Broad-Based Crypto Rally

Big crypto names took a bit of a break from their runaway moves this week.

That said, when we get below the surface, we see that the same catalysts that have catapulted the asset class to new 2020 highs are very much still in play.

Ethereum continues to push higher, with a significant upside breakout last night. And this is on the back of ongoing enthusiasm for all things “decentralized finance,” or DeFi, of which ETH is a prime beneficiary. That’s highlighted by market leaders such as Chainlink (LINK, Weiss Liquidity/Availability Grade “B”) blasting to new all-time highs this week.

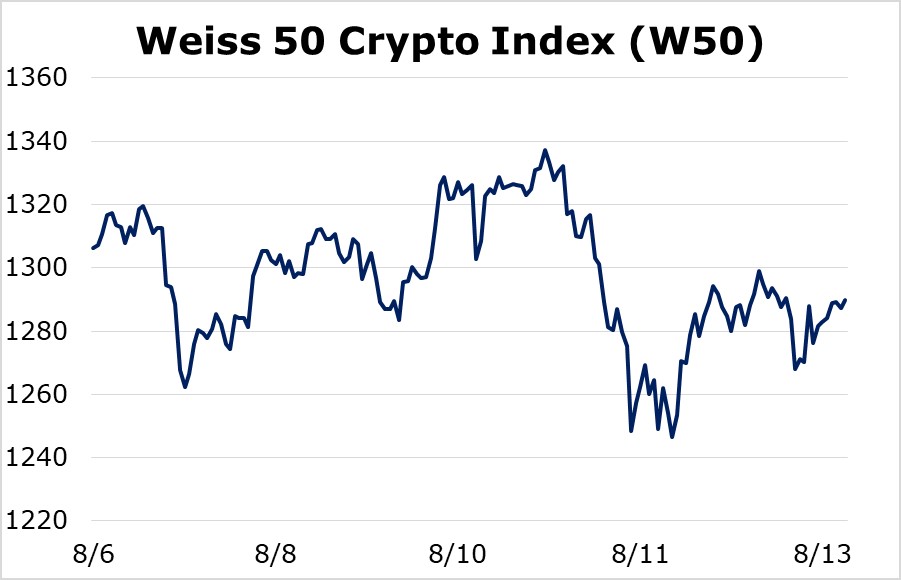

Though enthusiasm in key growth areas of the crypto space hasn’t translated into a broad rally, as the Weiss 50 Crypto Index (W50) actually shed 1.25% over the seven-day trading week ending on Thursday.

Following in the W50’s footsteps, the Weiss 50 Ex-BTC Crypto Index (W50X) basically tread water, posting a slight decline of 0.52%.

The discrepancy between these two key indexes and the Ethereum/DeFi complex is important. It tells us that even though we continue to see bullishness in the crypto space, we’re not yet at a stage where every asset is moving higher regardless of its fundamentals.

This suggests we have room on the upside before we reach the levels of complacency typical of market tops.

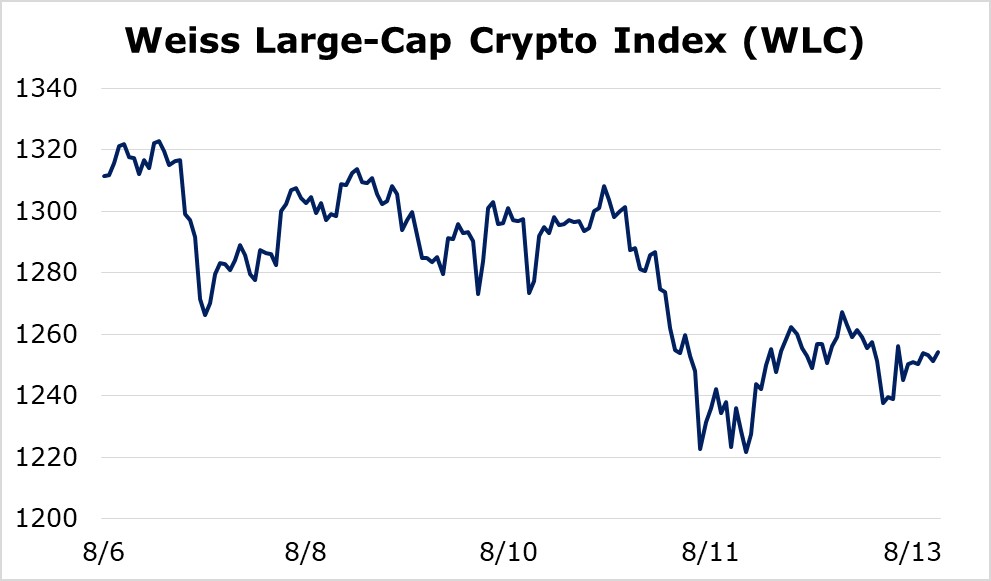

Splitting the industry by market capitalization provides further illumination. The Weiss Large-Cap Crypto Index (WLC) looked a lot like the W50 and the W50X — only more so, with a 4.35% slide for the seven-day stretch.

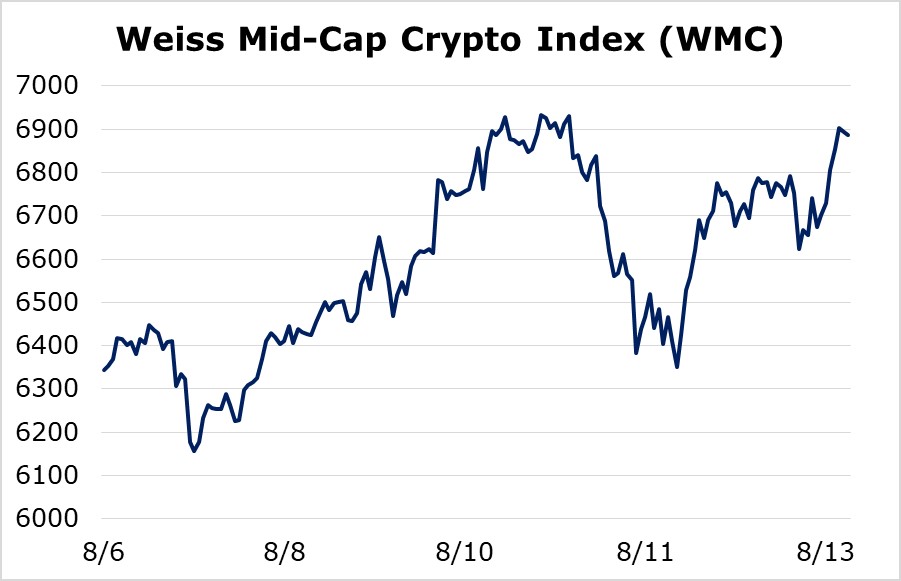

Beyond the bigger projects, the embers are still burning. Indeed, Weiss Mid-Cap Crypto Index (WMC) moved up 8.59% on the week.

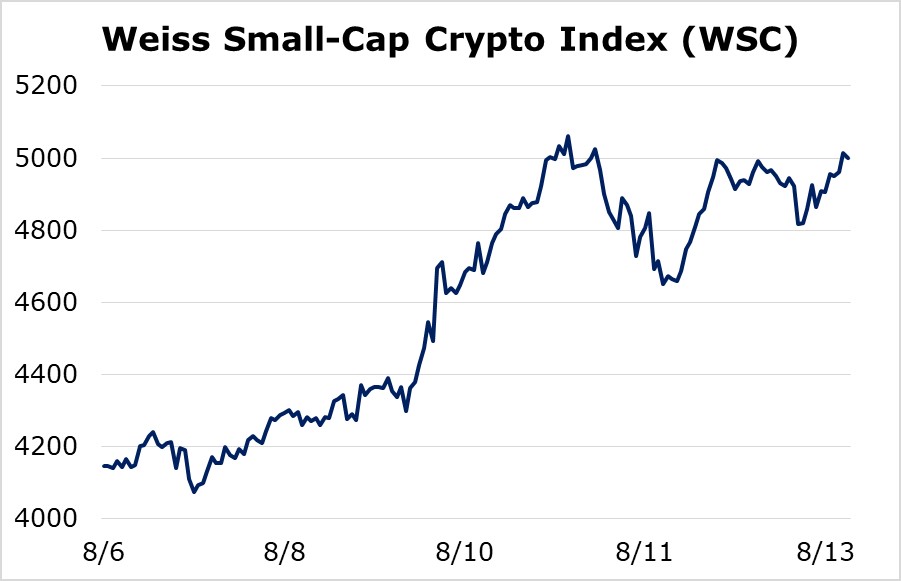

And the Weiss Small-Cap Crypto Index (WSC) also did a fair amount of catching up, rising a robust 20.56%. If you remember, the small caps had been lagging of late.

This type of inter-market rotation — where we see one sector of the market take a pause, while the other sectors catch up — is typically what we see during sustainable crypto asset rallies lasting several months. As long as we don’t see a broad-based selloff, we have cause to believe the entire crypto asset space will push higher before encountering any meaningful resistance levels.

Looking beyond crypto to old-school financial markets, it’s highly encouraging to see the engine of the current rally (Ethereum, DeFi) doing so well and Bitcoin holding its ground firmly on a week where other safe havens, including gold, Treasuries and even silver took beatings.

This tells us that the internal dynamics of the crypto asset space are robust enough to keep the positive momentum going all on their own.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.