The Long-Term Fundamentals Continue to Favor Crypto

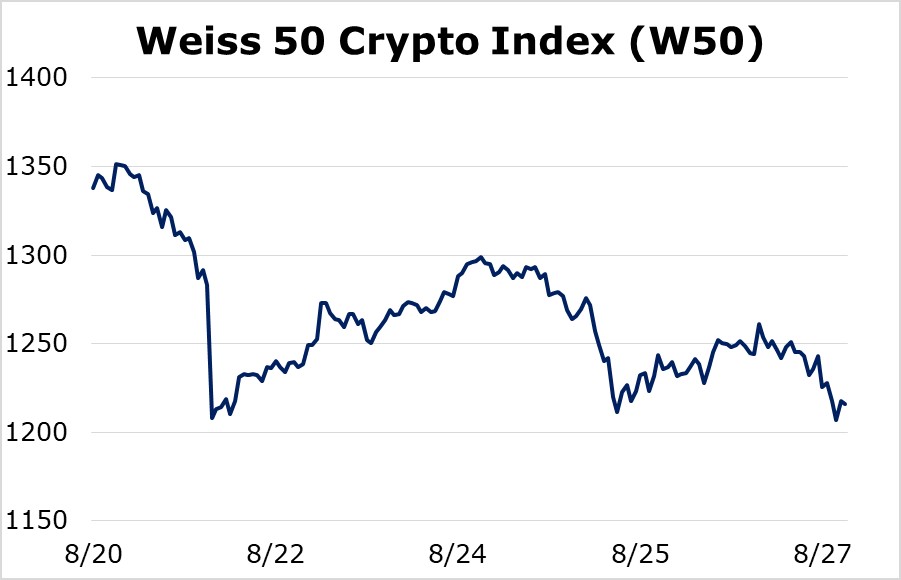

The drift that we discussed here last week accelerated into a short-term selloff before crypto asset prices settled into more sideways action as the seven-day trading week wore into Thursday.

This is the kind of price action you often see in the early days on long-term bull markets.

Here’s the good news: The timing of this correction is well in line with our general expectations. Our timing model warned of a pullback starting in the second half of August and lasting into early September.

Indeed, the crypto market was basically down double-digits from Aug. 20 through Aug. 27.

The Weiss 50 Crypto Index (W50) — the broadest industry benchmark — shed 9.12%.

Stripping out Bitcoin (BTC, Tech/Adoption Grade “A-”), of course, puts the spotlight on the altcoins. And the Weiss 50 Ex-BTC Crypto Index (W50X) was down 12.30%.

This makes perfect sense, as Chainlink (LINK, Availability/Liquidity Grade “B”) and Ethereum (ETH, Tech/Adoption Grade “A”) are leading the way down.

We hasten to add, however, that these two assets were the main beneficiaries of the previous rally. As such, they’re good leading indicators of what the rest of the market will do in terms of price performance.

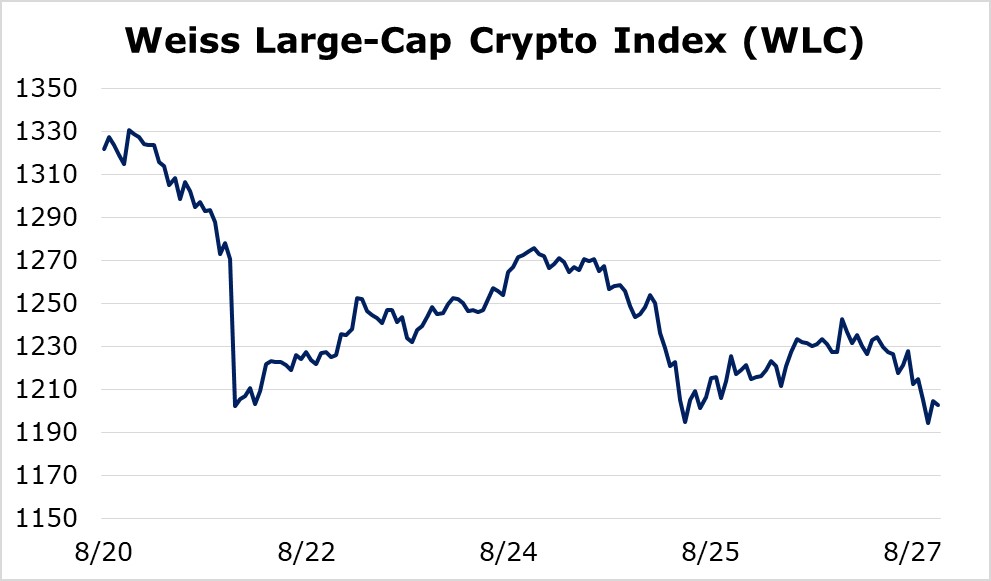

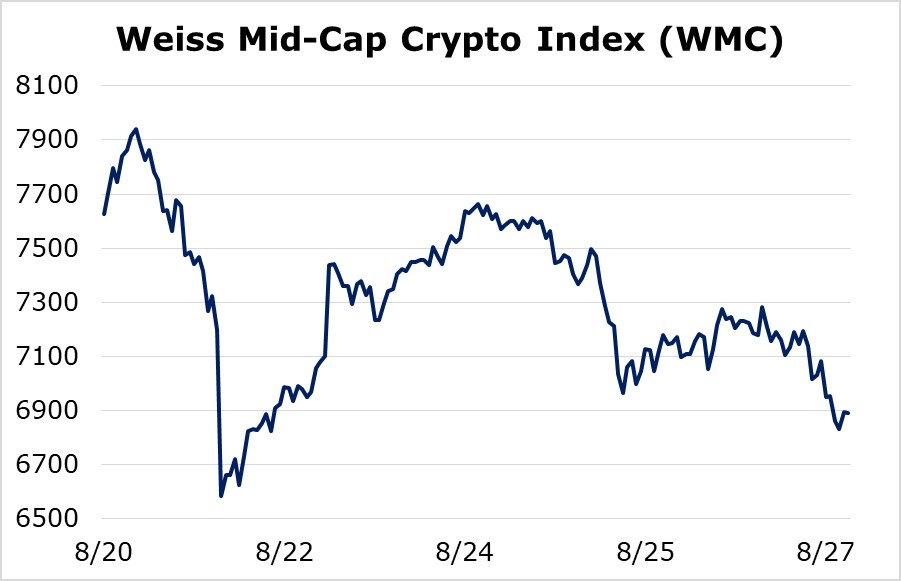

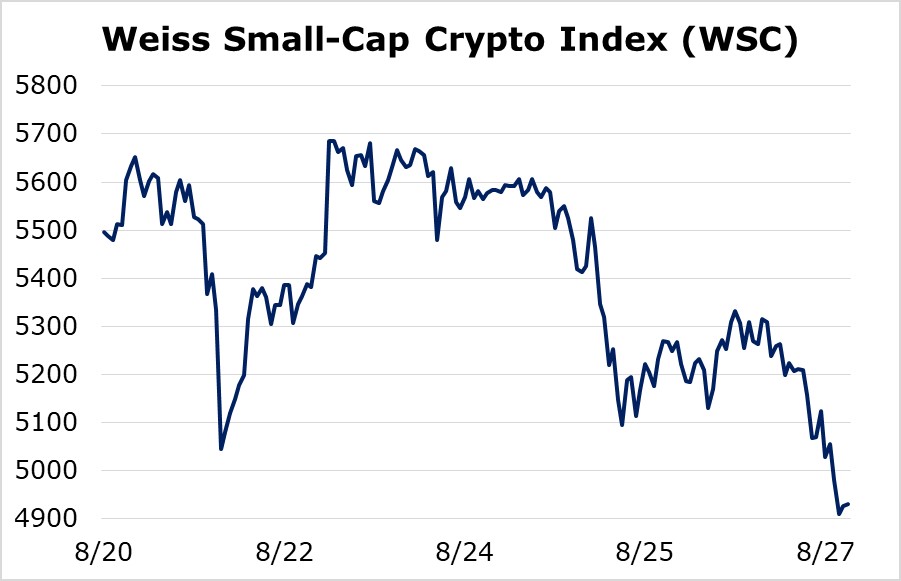

Now, let’s split the industry by market cap …

The Weiss Large Cap Crypto Index (WLC) was down 8.97% for the week.

And the Weiss Mid-Cap Crypto Index (WMC) was down 9.67%.

Finally, the Weiss Small-Cap Crypto Index (WSC) was down 10.31%.

The bottom line is we’re seeing a broad-based correction this week, and it’s unlikely the low has been reached.

As we noted, our timing models point to early September before the low is established.

Looking beyond short-term gyrations, we continue to see a robust bull market in the making.

Consider that most crypto assets are still trading well below the all-time highs established between December 2017 and January 2018.

One of the main drivers behind crypto bull markets is innovation. This was true in the first bull market, when Bitcoin was invented, and in the second major bull market, when Ethereum burst into the scene and enabled smart contracts and initial coin offerings.

We see the same enthusiasm now, with “decentralized finance,” or DeFi.

The reckless money-printing policies currently pursued by most major central banks around the world is no doubt a long-term catalyst for crypto asset price appreciation.

But we’d be remiss if we didn’t point out that the explosion in DeFi innovation is also a catalyst for higher prices — in the short, medium and long term.

It’s against this fundamental backdrop — money-printing and DeFi — that we can conclude what lies beyond this pullback is a run to higher prices for leading crypto assets. What we’ve seen so far is the new crypto bull starting to stretch its legs.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.