Wall Street is full of so-called “experts,” but I tune most of them out because they’re more often wrong than right.

My good friends Martin Weiss and Sean Brodrick are the rare exceptions. Martin is the founder of Weiss Ratings, and Sean is an expert in market cycles.

They have nothing to do with the Wall Street crowd. And they’ve accurately called nearly every major turn in stocks, gold and the economy.

If you want to get their stunning forecasts for 2018-2022, TODAY is the last day to register for their free three-part online series, which starts tomorrow at 2PM Eastern Time.

Click here to register before midnight tonight, and you’ll immediately get an email back with instructions for attending.

Meanwhile, most Wall Street experts are also dead wrong about technology and especially about cryptocurrencies.

I think it’s because they’ve never started and owned a tech company of their own.

|

| Remember the TV ads, “When E.F. Hutton talks, people listen”? As it turned out, they weren’t too smart and got caught in a massive check-kiting scandal in 1980. |

I did. It was a successful software company, and I sold it for a nice profit. So I know what it feels like to fret about making payroll, writing seven-figure checks for hardware, and trying to stay one step ahead of formidable competition.

Ivy League degrees, Gucci loafers and a Manhattan address do not make you a tech expert.

The people whose opinion I do pay careful attention to are the Silicon Valley insiders whose personal fortunes are directly tied to the accuracy of their opinions.

One such person is Sergey Brin, a co-founder of Google. Not only is he one of the most brilliant technology minds in the world, but he’s worth a whopping $55 billion.

Unlike E.F. Hutton, when Brin talks, I listen. And he recently spoke at a blockchain conference in Morocco, where he told the audience that he’s been mining Ethereum coins.

|

This isn’t the first time Brin has praised cryptocurrencies. But it’s the first time he’s revealed that he’s actually mining a specific crypto coin. And he seems particularly fond of Ethereum.

His own words:

“There are several factors at play in this boom of computing. First, of course, is the steady hum of Moore’s Law, although some of the traditional measures such as transistor counts, density, and clock frequencies have slowed.

“The second factor is greater demand, stemming from advanced graphics in gaming and, surprisingly, from the GPU-friendly Proof-of-Work algorithms found in some of today’s leading cryptocurrencies, such as Ethereum.”

From its first trade in 2015, Ethereum has jumped by as much as 45,000%.

|

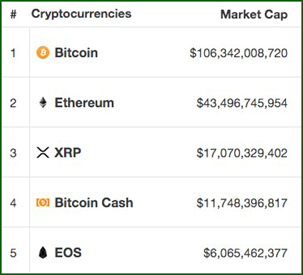

| Several wannabe Ethereum killers are coming to market. Yet, despite big traffic jams on the Ethereum network, it’s going to take time for them to catch up with Ethereum’s No. 2 slot in market cap. |

Why? It was the first to support smart contracts and continues to merit a Weiss Rating of “B-,” thanks to excellent adoption and good technology.

Why is its technology just “good” and not “excellent”? A key reason is that its network is too clogged to support all the companies trying to jump onto its platform with new decentralized applications (dApps).

Still, its accomplishments are historic: Ethereum has attracted more than 200 companies — including Intel, Microsoft, JPMorgan, Bank of America, BP and Thomson Reuters — to form the Enterprise Ethereum Alliance (EEA).

Bank of America has launched an Ethereum-based service (with the help of Microsoft) that’s designed to improve the security of digital transactions and become the trusted pioneer in blockchain transactions.

There are more than 1,300 cryptocurrencies, but Ethereum has some of the most promising blockchain applications. That’s why of the biggest companies in the world are adopting/integrating Ethereum into their long-range technology plans.

Related story: 3 Shocking Reasons to Own Crypto

I’m not suggesting that you rush out and buy Ethereum coins tomorrow morning. As always, timing is everything. But I can tell you that shares of forward-thinking companies that are integrating blockchain technology are bound to skyrocket in value.

Best wishes,

Tony