Why Blockchain Will be a Big Beneficiary of a Friendlier Fed

|

The stock market has been on fire since the Federal Open Market Committee met last Wednesday and pretty much told the stock market that it will do whatever it takes to keep the bull market running.

Fed Chairman Jerome Powell opened the post-meeting press conference by stating that he has "one overarching goal, to sustain the economic expansion."

The Fed didn't cut interest rates, though, and left them at the midpoint of its target range at 2.375%.

However, the Fed made it clear that it plans to cut interest rates at least one time this year and perhaps more in 2020.

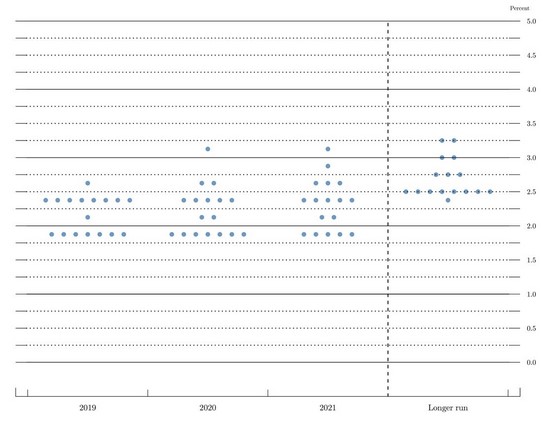

The Fed's dot plot, which is a visual representation of where each of the Federal Reserve officials believe interest rates are going, is screaming for rate cuts.

|

Seven FOMC members expect two 25-basis-point rate cuts before the end of the year, and one member expects one cut. So, you have eight out of the nine members planning on cutting rates in 2019.

And the consensus forecast is for the Federal Funds rate to drop from 2.375% to 2.1% by the end of 2019, down from 2.624% in March.

In short, the direction of monetary policy is abundantly clear: Interest rates are headed LOWER!

Lower interest rates by themselves have nothing to do with cryptocurrencies and blockchain on the surface. But what this new, friendly Federal Reserve means is that investors have been given the green light to invest in high-reward/high-risk stocks.

You see, when investors are scared, they flee high-volatility stocks and stampede into defensive stocks, like utilities, consumer staples, and health care. These stocks typically have betas below 1.0.

Beta is a measure of a stock's volatility. A stock that swings more than the market has a beta above 1.0, but if a stock moves less than the market, the stock's beta is less than 1.0. Utilities, consumer staples, and health care stocks typically have a beta below 1.0.

When investors are confident, like today, they dogpile into tech stocks. I believe blockchain stocks will be one of the biggest beneficiaries from the friendly Federal Reserve.

[You know what else has a lot of beta and, potentially, a heck of a lot of profit potential? Cannabis stocks. Just a few moments ago, my colleague Sean Brodrick finished answering a whole bunch of our readers' questions about those (including individual stocks that people were asking about). PLUS, Sean revealed a "green chip" cannabis stock poised to soar, along with ETF-crushing "super stocks" for 2019. To listen to the replay and get all the details, simply hit this link now.]

Listen to Powell's pledge to "sustain the expansion." It is telling me that now is the time to load up on blockchain stocks. And if you want to know which ones to buy, I'll give you a place to start when I release my new No. 1 blockchain recommendation in the next issue of my Weiss Crypto Investor. Click here to learn more.

Best wishes,

Tony Sagami