‘ZIRP’, Debasement & Crypto’s Long-Term Bull Market

Crypto assets gave back some more of the post-March 13 gains during the trading week that ended Thursday, as an emerging correlation with traditional “safe-haven” assets seemed to stall.

The bulk of the selling took place yesterday, a day after the Federal Reserve pledged to keep interest rates near zero at least until 2022. That announcement spooked market participants who’d hoped the economic recovery in a post-COVID-19 world would be swift.

It also sent gold and U.S. Treasuries flying … yet it seems to have the opposite effect on crypto assets. This breakdown of crypto’s relationship with those old-school “safe” assets is likely only to be temporary.

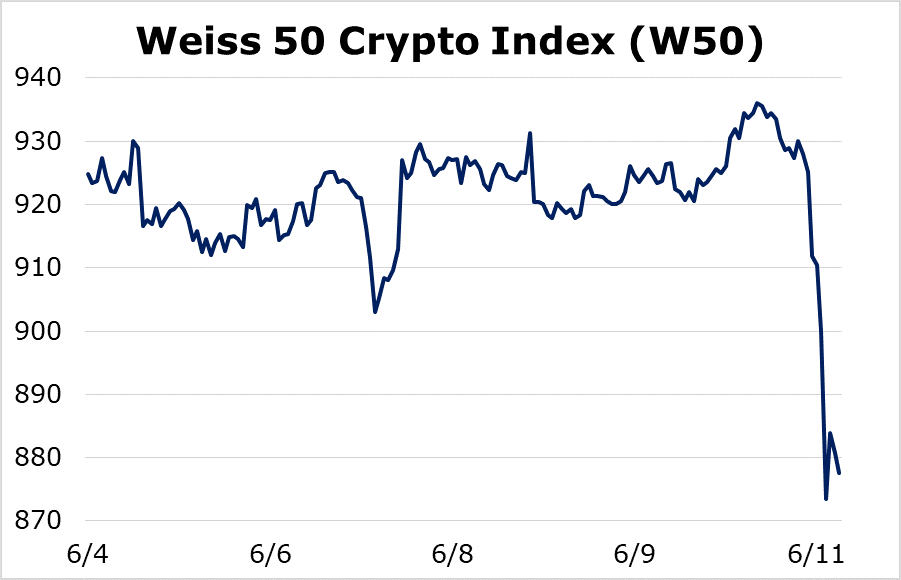

The Weiss 50 Crypto Index (W50) is a great place to begin to understand why that’s the case. This index is our broadest benchmark of crypto asset market performance as a whole. It was down 5.11% over the seven days through Thursday.

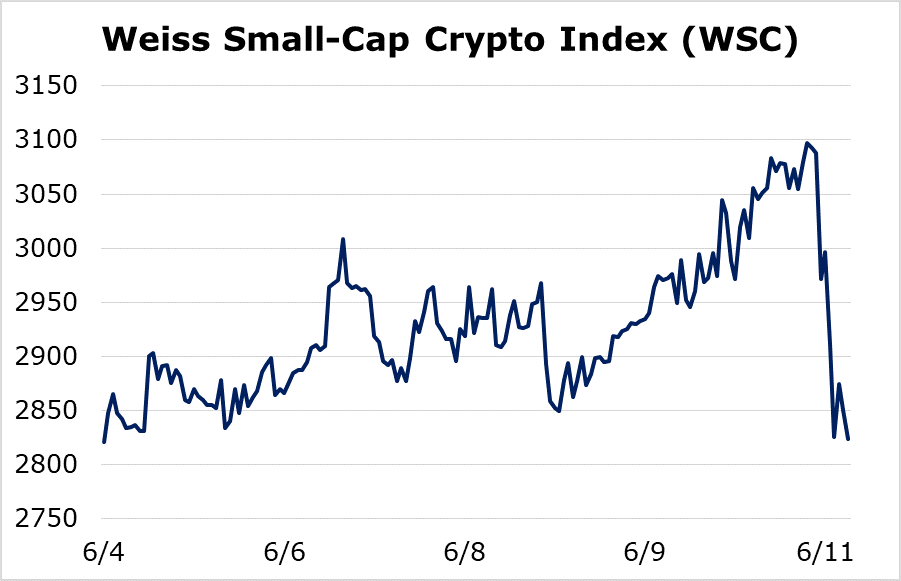

Note, as the chart below reveals, that the bulk of the selloff took place yesterday — the day after the Fed pledged to keep rates at zero for an extended period.

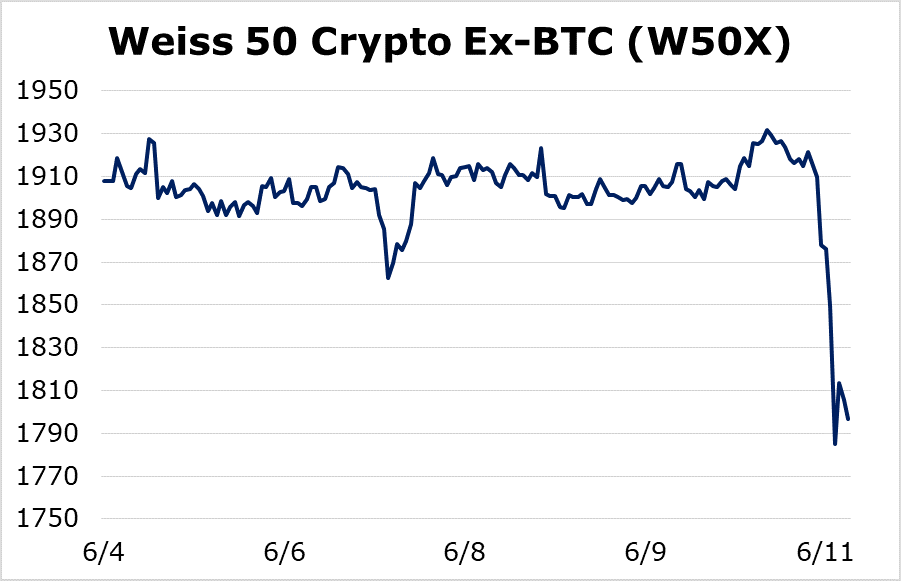

As for the altcoin space, the Weiss 50 Ex-BTC Crypto Index (W50X) was down 5.83%. You can see here that the sell-off affected the entire crypto asset space …

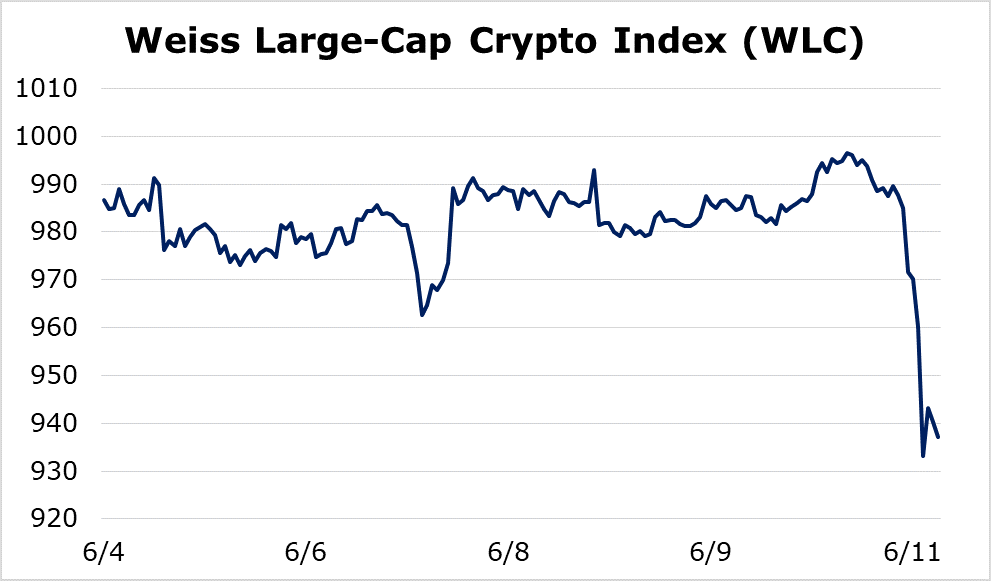

Let’s split the industry by market cap. The Weiss Large Cap Crypto Index (WLC) was down 5.02% on the seven-day stretch ending yesterday.

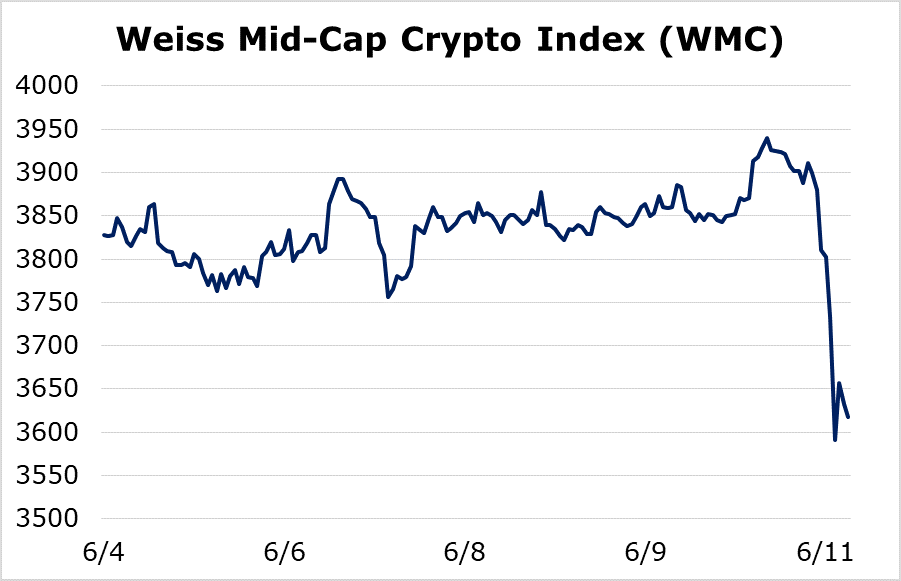

The Weiss Mid-Cap Crypto Index (WMC), meanwhile, was down 5.47%.

Finally, we have an outlier: The Weiss Small-Cap Crypto Index (WSC) was basically unchanged on the week, with a slight gain of 0.10%.

It’s odd to see the small caps outperform relative to the rest of the market in a week underscored by weakness.

This is the primary reason the selloff we saw this week may have simply been a knee-jerk reaction to what is otherwise a positive macroeconomic outlook for crypto assets as a whole.

After all, the Fed had thus far been the only major central bank to “buck the trend” and keep interest rates above zero. “ZIRP” — or “zero interest rate policy” — actually imposes a penalty on holding government-issued money for the long term.

And, now that we’ve arrived at a moment where no major currency protects the holder from the very real risk of debasement, the only logical conclusion is this will boost the valuation of alternative safe havens like precious metals … or crypto assets.

It’s due to this fundamental backdrop that I tend to dismiss the weakness we saw this week as no more than a temporary pause in a long-term bull market.

Best,

Juan