Have you ever wondered who the largest money manager in the world is? Spoiler: It’s BlackRock, Inc. (NYSE: BLK). The company now has approximately $9.5 trillion under management.

For the first time ever, BlackRock saw its exchange-traded funds (ETFs) exceed the $3 trillion threshold as investors continue to seek exposure to the global equities market.

Looking specifically at Q2 2021, the company saw a net $75 billion flow into its ETFs, up from $51 billion in the same period last year.

Combining these numbers with a Wall Street Journal article from earlier this month that proclaimed “Themed ETFs Are Hot” makes me think that individual investors want to get in on the trends that they are hearing about, but for one reason or another, aren’t comfortable picking individual stocks.

And with some of the unprecedented events we’ve seen in the market this year, who could blame them? — I’m looking at you, GameStop Corp. (NYSE: GME).

We could spend all day going back and forth about the benefits of individual stocks versus ETFs, but in the end, there wouldn’t be a clear winner.

Instead, I want to direct your attention to the Weiss Ratings ETF screener.

This tool allows you to look for ETFs that are in line with your individual investing goals to see which ones meet your needs.

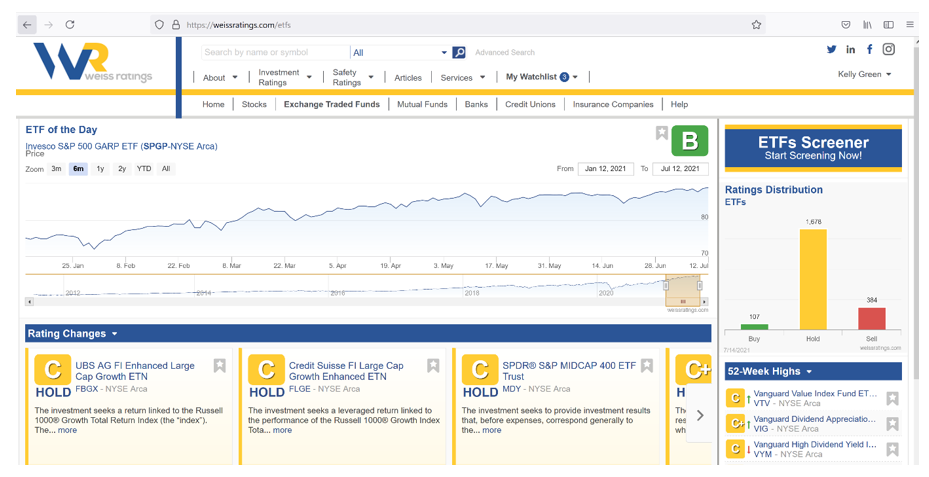

Here’s a screenshot of the ETF section on the Weiss Ratings website:

|

You’ll see that there’s a variety of useful information. You are able to quickly see which funds have had rating changes recently and which have hit 52-week highs.

You can also see the current distribution of all ETFs that we rate. If you quickly want to see the list of all “buys,” you can simply click the green bar on the right side of the screen for a complete list.

Once you’re on the next page, you’ll see the button for the full ETF screener.

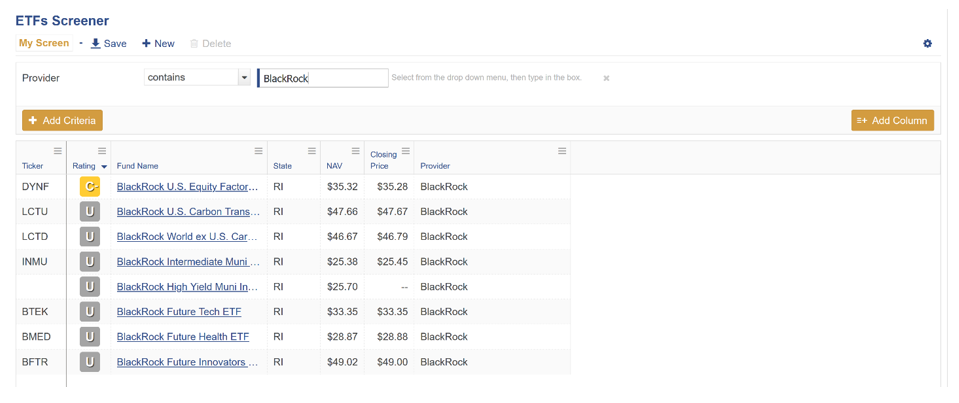

On the screener page, you’ll see that you can add many combinations of different criteria. I wanted to take a look at the funds managed by BlackRock.

So, I clicked “Add Criteria,” “Company Info,” then “Provider,” and then clicked “Add Criteria.”

In the search bar, I then typed in “BlackRock.”

|

I found eight funds, and the majority of them were listed as “unrated.”

These particular funds showing “unrated” are all newer funds created less than a year ago, meaning there’s not enough information for them to show a rating yet. But we also know that BlackRock has ETFs under the provider iShares as well.

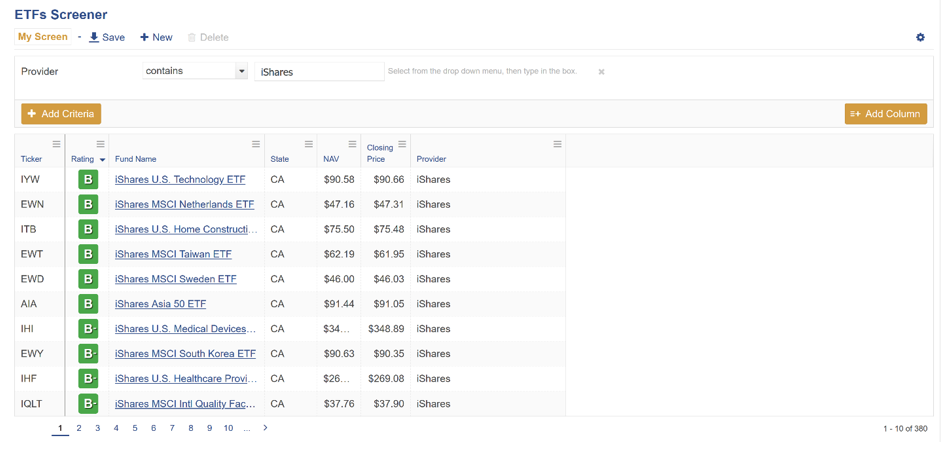

Here’s what popped up when I did that same process mentioned above and typed “iShares” into the search bar:

|

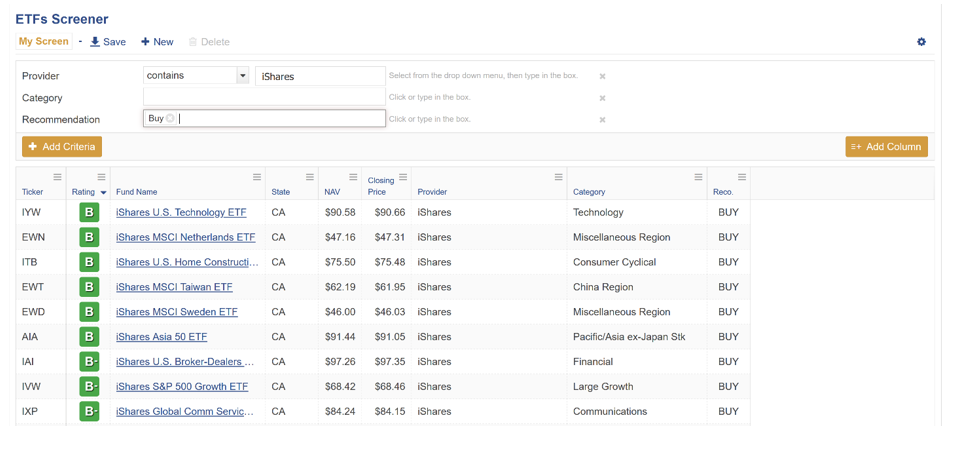

This resulted in 380 ETFs. I easily narrowed the results down further by adding criteria for Category or Recommendation:

|

And, in case you were wondering, there are 24 “buy”-rated iShares ETFs right now with goals in a variety of categories.

You can also set different criteria to see funds by pricing data, past performance, Weiss Rating or fees.

I know all of that sounds like a lot, but you’ll quickly see how easy this whole search process is.

With a few clicks, you’ll be able to generate a short list of ETFs that fit into your investing goals.

I know I’ll certainly be checking for all my ETF investing needs.

Best,

Kelly Green