In mid-September, while at the Las Vegas Money Show, I had the opportunity to moderate a panel of cannabis company executives and interview a handful as well.

And while I was at the conference, mega-investor Doug Kass, the president of Seabreeze Partners, told Bloomberg Radio that cannabis shares are at a “generational low.”

• Kass said buying cannabis shares now may be like buying the S&P 500 Index when it hit a low in March 2009 amid the financial crisis.

“Cannabis could be the greatest reward vs. risk of any sector I’ve encountered within the last decade,” Kass stated. “I’m accumulating shares aggressively.”

I, for one, believe he’s right.

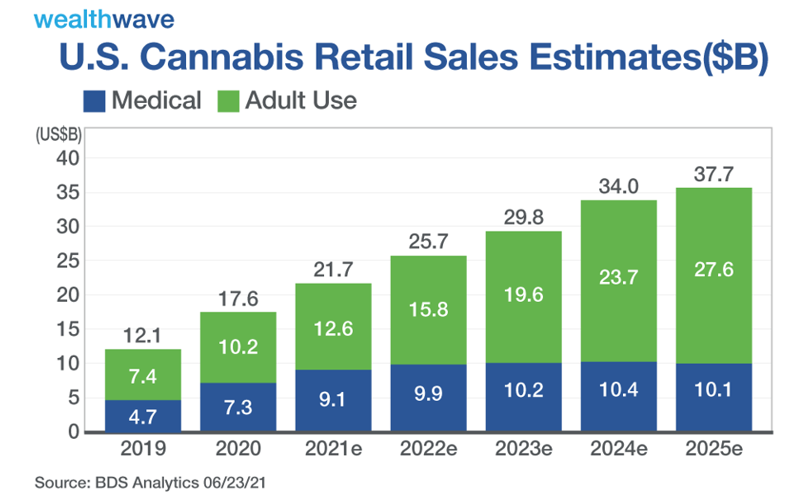

Look no further than projected cannabis retail sales in the U.S. through 2025:

|

Those estimates presume the trend in expanded legalization at the state level will continue and could soon be bolstered by federal legalization.

The initiative to federally legalize marijuana is supported by the people, corporations and the Democratic majority in government. It’s just a matter of time before the industry cuts through the red tape.

• Americans want legal marijuana: Gallup’s poll from the end of 2020 showed that 68% of the American population thinks it should be legalized — double the support that it had two decades ago!

Large corporations — like Amazon.com (Nasdaq: AMZN) — are throwing their weight behind the cannabis movement. Amazon officially backed federal legalization and even removed its marijuana drug-testing policy for most of its employees.

Investment banks are also beginning to lobby for the industry.

Lawmakers are pushing for federal legalization, and Senate Majority Leader Chuck Schumer already proposed a bill to help make that a reality. It’ll likely face opposition, but the Senate’s Democratic majority hopes to cross the finish line sooner rather than later.

In the meantime, we’ll continue to see additional state-level legalizations.

How to Play the Bounce

There’s no question that individual stocks will give you bigger reward for your investment buck … but individual stocks inherently carry higher risk.

So, what’s another way — a potentially safer way — to play the anticipated recovery in the industry?

Here are two ideas:

1. Instead of gambling on which company might emerge as the best grow operation or ancillary service … lower your risk by using exchange-traded funds (ETFs) that hold a basket of stocks in that industry.

2. Another way is to use the Weiss Cannabis Stock Rankings we publish in our Marijuana Millionaire Portfolio as part of our stock selection process.

This system is proving the worth of its price tag, guiding subscribers to gains even when the cannabis industry as a whole has been under pressure for months.

And today, as a treat, here’s a list of leading (but not all) cannabis stock ETFs, according to the Weiss Cannabis Rankings:

|

To be sure, the rankings do change from week to week. And these ETFs vary in what stocks they hold more than you might think.

If you’d like more information on these rankings and the rapidly blossoming marijuana industry that could be in a “generational low,” I recommend you click here now.

Remember to do your own due diligence before buying anything.

All the best,

Sean