The our current zero-interest rate environment isn’t going anywhere anytime soon. As we’ve said before, that means if you’re looking for income, you have to look a little harder than usual. Low interest rates are bad news for lenders, but good news for borrowers.

According to bankrate, the rate for a 30-year fixed mortgage has dropped to 3%. For a 15-year fixed mortgage, that rate is down to 2.4%. Here in South Florida, houses are hitting the market and finding new owners in less than 24 hours.

The coronavirus has a lot of people reconsidering where they want to live and the amount of space that they need. Remote work and education allows for more flexibility, but at the same time, it creates demand for designated work spaces in the home. Hence, many people are moving to adjust to these changes.

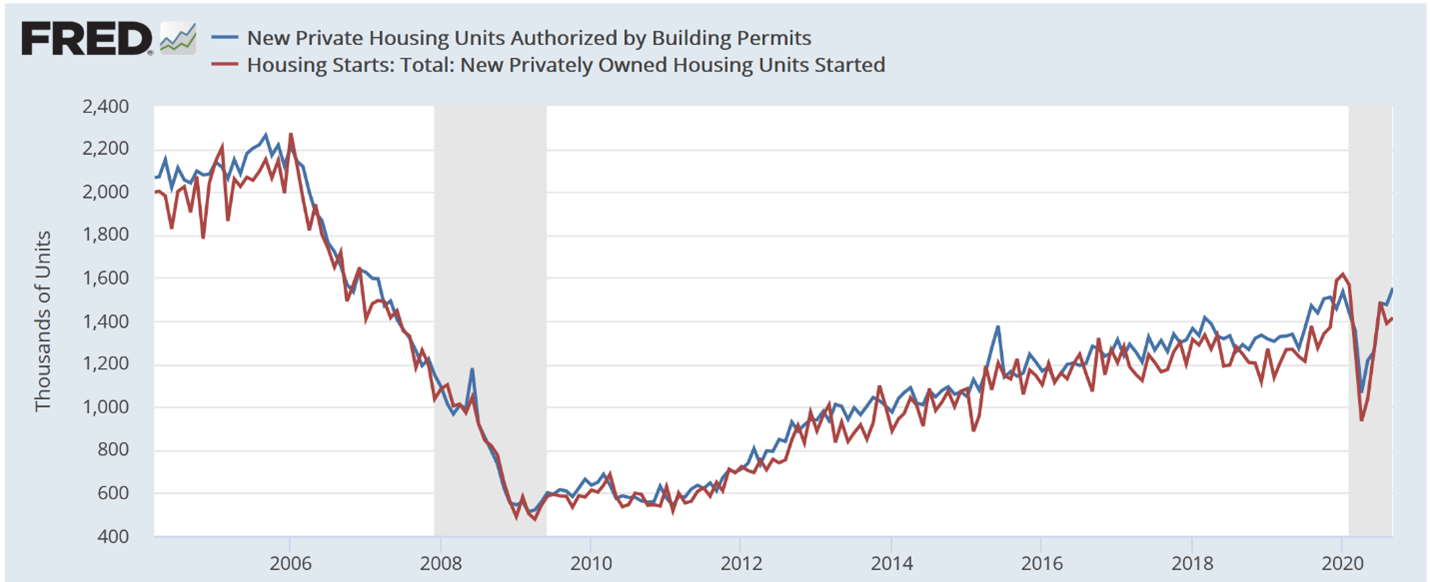

As a result, the U.S. housing market is starting to become a real bright spot even in this still uncertain economy. Check out the following chart from the St. Louis Fed FRED database.

|

The blue line shows the number building permits authorized. That’s only a part of the story since a permit doesn’t mean it will actually be built. The red line shows the number of housing unit starts.

Both are about to recover to their pre-March levels. Some stats even show that construction on new homes in July exceeded 2019 numbers by 23%.

There’s a clear trend happening … so I headed to the Weiss Ratings stock screener to see which home building stocks were rated a “Buy.”

First up is Meritage Homes Corporation (NYSE: MTH, Rated “B”). It is the seventh-largest public homebuilder in the United States. It offers a variety of homes in nine different states and has designed and built over 125,000 homes in its 35-year history. The company’s website touts that it is “virtual homebuying made easy.” Meaning that you can find, tour, finance and purchase the home of your dreams without even leaving your couch.

Over the past few years, the company has bounced back and forth in the “C” and “B” range. In March, the company fell from that “B” range to a “C+” as the whole market struggled. By July, it had been upgraded to a “B-” and then a “B” in August, making it a clear buy signal to jump in on this trend.

Next up is D.R. Horton, Inc (NYSE: DHI, Rated “B”). D.R. Horton has been the largest homebuilder by volume in the United States since 2002. With operations in 88 markets in 29 states, the company is engaged in the construction and sale of high-quality homes through its diverse-brand portfolio. Having a diverse-brand portfolio allows it to have homes ranging from $100,000 up to $1,000,000.

Just as we saw with Meritage, D.R. Horton was downgraded in March, but has since climbed back up into the “Buy” range. The Weiss Ratings system recognizes an improvement in its potential total return and its solvency index standing.

Last, but not least, is TopBuild Corp. (NYSE: BLD, Rated “B”). This company is a leading installer and distributor of insulation and building material producer to the U.S. construction industry.

TopBuild was upgraded to “B” last month due to a noticeable increase in its financials. Operating cash flow increased 44% and earning per share jumped 16 cents. The added bonus with this particular play is that it provides to many of the giants in field. So even if there is another correction and houses sit empty, these materials have already been purchased and installed.

I don’t think that we are going to see the housing market come crashing to a screeching halt. There are clear indicators that this is a trend ramping up. And by using the Weiss Ratings, we can make sure that we’re putting our money in the safest place to profit from it.

But if investing in the housing market isn’t your cup of tea, there is one other opportunity I need to mention: the possibility of pocketing up to $1,000 every week.

Intrigued? In this low-rate world, any investor should be. And it’s not just talk: Investors who followed this strategy pocketed up to $860 ... $1,134 ... and $1,212 in the last three weeks respectively.

For all the details, check out our video, “America at a Crossroads: Instant Income Revealed” now. We’re taking it offline tonight, so this is your last chance to see it.

Best,

Kelly Green