‘Buy’-Rated Stocks Top 1,000 as Earnings Season Winds Down

We are winding down one of the most important earnings seasons to date. I call it one of the most important earnings seasons because of the timing ... the numbers give a lot of insight into how companies are faring on this side of the pandemic.

Don’t get me wrong. I’m not saying that the effects of the pandemic are over. The effects will linger for a long time. But enough time has passed that we can get a good idea of how well companies pivoted and how they are planning to move forward.

Now that earnings season is winding down, we are moving into what is historically the worst months of the year for the stock market. August and September have historically been the two weakest months of the year. Some even label September the “danger month.”

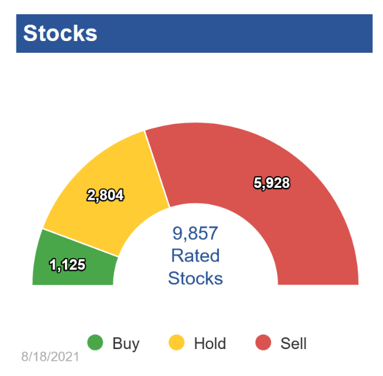

But there’s no need to panic if your portfolio is made up of solid, safe companies that will continue to perform well over time. Right now, the Weiss Ratings system has marked 1,125 stocks as a solid “Buy.”

|

| Ratings gage on Aug. 18 |

That’s 25% more than when we checked our ratings distribution back in May.

|

| Ratings Gage in May |

And more than double the 508 “Buy”-rated stocks we found when we checked in February.

Even though we had 896 “Buy”-rated companies back in May, only two of them sported “A” grades.

Today, we have five in the “A” range to take a quick look at.

Oracle (NYSE: ORCL) is our top-rated company with an “A” rating. The company provides cloud software for a variety of applications. Its mission is to help its customers see data in new ways to discover insights and unlock endless possibilities. And, as we know, data is one of the most valuable assets that a company can have these days.

Since the beginning of 2019, Oracle has generally held a “Buy” rating with just two brief dips down into the “Hold” range. Shares are up 44% year to date and the company pays a 1.2% dividend.

Next up is Alphabet (Nasdaq: GOOGL). This is one company that doesn’t need much explanation; Google is a household name. Its name is synonymous with “internet search” and it’s the powerhouse behind Chrome, Android, YouTube and much more.

Since the beginning of 2016, Alphabet has only dropped briefly dropped into the “Hold” range twice. And at the beginning of August, it received yet another upgrade, climbing into the “A-” range. Shares are up 58% year to date and 129% over the past two years.

In the middle of the pack is Norvo Nordisk A/S (NYSE: NVO). The company engages in the research and development of pharmaceutical products. It operates under two segments: diabetes/obesity care and biopharmaceuticals.

NVO has been “Buy”-rated since February 2020, and recently got back up to an “A-.” Shares are up 48% year to date and up 110% over the past two years. Plus, it pays a 1% dividend.

After that, we have Intact Financial (TSX: IFC). This Toronto-based company provides property and casualty insurance products to those in both Canada and the United States.

Since 2014, the company has one dropped into the “Hold” range for three short instances. This one pays a dividend of 1.9% and shares are up 17% year to date.

Finally, there’s Expeditors International of Washington (Nasdaq: EXPD). This giant logistics company is based in Seattle but has a global network of 176 offices in over 60 countries spread over six continents.

The company is service-based, so they don’t own the aircraft, ships or trucks they use every day. This also allows them to be incredibly flexible to find the best route for the best price.

EXPD has only dropped into the “Hold” range twice since 2014. The company pays a small dividend of 0.89% and shares are up 25% since the beginning of the year.

The best news is that if none of these five companies excite you, there are 1,120 others in the “B” range that still hold a “Buy” rating.

To see the full list, head over to weissratings.com.

You’ll see the stock distribution that I showed above. Simply click on the “Buy” slice and the entire list will propagate in the stock screen. There, you’ll be able to add any columns that you’d want to sort by.

Don’t let the August and September doldrums get you down … instead, make sure the companies you’re investing in are solid and safe to withstand the market moves!

Thanks to the Weiss Ratings Stock Screener, I know I sure will be.

Best,

Kelly Green