|

It's interesting to see one area of the crypto world that is getting a lot of interest lately: cryptocurrencies backed by metals. Including gold.

To me, this seems to take things full circle. Cryptocurrencies are electronic. But these "stable-coins," with a metal foundation, aim to add the surety of gold and other metals to the most ephemeral of currencies.

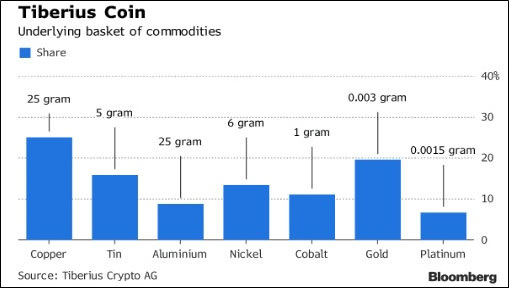

For example, one new crypto token is being offered by Swiss asset manager and commodities trader Tiberius Group AG. Its new Tiberius Coin is going to have a value that tracks a basket of copper, aluminum, nickel, cobalt, tin, gold and platinum.

|

"We have chosen a mix of technology metals, stability metals and electric vehicle metals," Chief Executive Officer Giuseppe Rapallo said in press reports. "This will give the coin diversification, making it more stable and attractive for investors."

The new coin will also stand apart from other cryptos in that it won't have an Initial Coin Offering, or ICO. Instead, it will be offered at about 70 cents and will be sold under Swiss law. The supply will be purely based on demand and only be limited by the availability of the underlying metals, Rapallo said.

The coin will initially list on the Estonia-based LATOKEN exchange, chosen because it fulfills the necessary regulatory standards.

This may remind some investors of E-Gold …

That was a digital gold currency operated by Gold & Silver Reserve Inc. It allowed users to open an account on their website denominated in grams of gold (or other precious metals) and use that E-Gold to pay for things. It ran afoul of Russian and Ukrainian hackers. Finally, regulators came up with new laws under the Patriot Act which basically made E-Gold's platform illegal.

And there are other cryptocurrencies linked to gold. These include GoldFinX, GoldVein, AgAU, Doradocoin and more. You can find a list of gold-backed cryptos here. All claim to allow users to own gold through cryptocurrencies. Some have already launched. Some are launching now or in the near future.

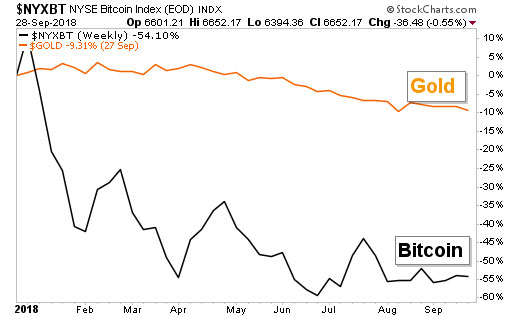

The problem for many of these stable-coins is that gold has been in a slump since peaking in February. Gold is down 9.3% for the year. Still, it's doing better than Bitcoin.

|

So maybe that will be a selling point for Tiberius Coin — it spreads its risk and reward across the metals space.

As with other metals-based cryptos, Tiberius will allow holders to swap its tokens for physical metals. But Tiberius asks for a minimum fee of $10,000 for swapping the coins into the underlying.

Still, one person who isn't impressed with any of these "stable-coins" is Adrian Ash, research director at BullionVault.

"They're trying to solve a problem that doesn't exist — all of this can be achieved without the additional cost of a distributed ledger," Ash said in press reports.

BullionVault, for example, lets its 70,000 clients around the world trade metals peer-to-peer on an online platform. No blockchain or cryptocurrency is involved.

Personally, I think gold IS poised for a rally. A big one. But the way I want to play it is through miners leveraged to the underlying. We could easily see rallies of 200% or 300% — or more — in select miners even if gold rallies just $300 an ounce, or 25%.

However, I don't think that's why many people buy cryptocurrencies. Each to his own. I hope that things work out for investors in these new hybrid currencies. Just be sure to do your due diligence before investing in any asset.

If you're curious how cryptocurrencies and their underlying technology works … to learn which cryptos and crypto stocks look like buys in today's market … and to see what the Weiss Crypto Team is saying about where cryptos are set to trade net, check out the wealth of free information that they provide on the Weiss Cryptocurrency Ratings site by clicking here.

All the best,

Sean