We’ve just released an urgent e-book, Future Shock Opportunities.

And we wanted to give you this opportunity to read it for free before we offer it to the general public for sale.

We’ve written it for one reason: to help you avoid the pitfalls — and profit immensely — from one of the greatest disruptions in the history of mankind.

This is no exaggeration, and it’s no joke. We see it happening all around us. And most of us have even experienced it directly in our own lives.

We call it “Future Shock 2021,” and it’s radically upending our lives more quickly than we’ve ever seen before.

The original concept of “future shock,” as described by author Alvin Toffler 50 years ago, was rapid change that shocks society.

Now, Weiss Ratings, which also began 50 years ago, has completed a major study that demonstrates Future Shock 2021 is even bigger.

But future shock also represents the single biggest investment opportunity of the next two years.

In our e-book, we name 15 blue-chip stocks that could be wrecked by this megatrend. They’re all big and well-known, including some of the largest in the S&P 500 Index. They all merit a Weiss Stock Rating of “D+” or lower. And each one could sink your portfolio with wipe-out losses.

We show you how Weiss Ratings has issued “Buy” signals on the biggest tech winners.

We name the next six opportunities that could deliver similar gains:

• The first is based on a poorly understood megatrend that’s destined to grow into a $7.1 trillion mega-industry by 2023.

• The second, once restricted to experiments that no one understood, is now bursting into our lives with gale force.

• The third is driven by a sudden transformation that has swept through 190 countries around the world.

• And all six opportunities are rich with immediate and long-term profit potential.

We walk you through the steps that could help you achieve 159.8% average annual returns.

If you’ve ever wanted to grow your retirement funds swiftly without crazy risks, this is the single best chance to do so. And it couldn’t be coming at a better time.

Our goal is to make sense out of what’s happening in the world and give you a roadmap for navigating through it.

We hope you’ll be able to do two things:

First, free yourself — and your money — from the crushing blow the pandemic continues to deliver to huge swaths of our economy.

Second, we hope you can use that freedom to profit from the select few companies we believe are immune from the economic fallout. And better yet — that have the best potential to ultimately help save America from this disaster.

For the entire e-book in one place, go here.

Or, you can watch the 3-part video version here.

Chapter 1: Why the Next 24 Months Could Be Among the Most Profitable of Your Life (Even While Many Stocks Stink)

When the pandemic and lockdowns first hit, the economy tanked like never before.

But since late March of 2020, the stock market has enjoyed one of its sharpest rallies of all time.

It begs the question: What gives? Why this disconnect?

But it’s not just a disconnect.

It’s also a bifurcation — a split between two entirely different worlds moving though time along two divergent paths — the traditional world of brick and mortar, which remains in crisis, and the modern digital world, which is soaring.

Based on everything we know and everything that is known by the U.S. Congressional Budget Office, the World Bank and the IMF, the most intense (and potentially most profitable) time will be the next 24 months.

The brick-and-mortar economy is still in shambles.

But as you’ve seen, there’s also another world — one where people work online from home … students rely on distance learning … shoppers buy nearly everything they need with a few clicks of their mouse … and millions attend virtual concerts or conventions from the comfort of their living room or from anywhere on the planet.

Welcome to the Brave New World of FUTURE SHOCK!

The pandemic has triggered a veritable Big Bang, injecting great energy into a whole new class of assets.

As we write, these assets are exploding higher — not despite these difficult economic times, but because of them.

The best news: This megatrend is just getting started.

Unfortunately, some people fear these changes. But the fact is, once you understand them, you can relax, embrace them, and turn this situation into a serious profit opportunity.

In fact, Future Shock 2021 represents one the biggest investment opportunities in our half-century in business.

And that’s saying something, considering how closely Weiss Ratings has tracked and rated technology stocks from our earliest days.

Regardless of market ups and downs, technology has always been a driving force of our business. We’ve always been early adopters, not just on the rating of tech stocks, but in the adoption of new technologies.

Weiss Ratings + Technology Stocks = Big Gains

We began rating technology stocks toward the end of 1999, when the Nasdaq was reaching bubble-level peaks.

But while Wall Street firms were unanimously touting them, we issued a landmark report called “Seven Horsemen of the Internet Apocalypse.”

Our ratings showed us what should have been obvious to everyone: Internet stock valuations were off the charts.

Their share prices were up in the stratosphere. But their earnings were down underground.

In fact, most of them had no earnings whatsoever — just losses.

Even knowing that, we were shocked with the results of our model: Not a single stock on the Nasdaq got a Weiss “Buy” rating! Almost every one was a “Sell.”

Needless to say, we received a good deal of blowback from the media and the Wall Street crowd — even some outright mockery.

Then, just two months later, in early 2000, the dot-com bubble burst, and our model proved to be right on target, despite what all the “experts” were saying.

By 2003, investors had lost three-quarters of their money — on average. Many investors lost a lot more.

How We Promised 1,000% Profits, But the Actual Returns Were Far Greater

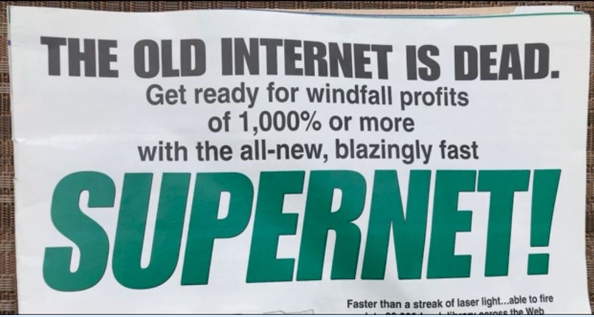

This takes us to the next major report we published, with the bold headline: “The old Internet is dead. Get ready for windfall profits of 1,000% or MORE with the all-new, blazingly fast SUPERNET.”

This 2003 Weiss report correctly predicted the greatest tech boom of 21st century:

At the time, most investors had abandoned tech stocks.

And most experts said we were promising far too much.

But as it turned out, we greatly understated the true potential. With time, the returns were far larger.

Here’s the key:

Even while the internet stocks were crashing and investors were running for the hills, the engineers were still hard at work, making major advances in the speed of the internet.

In our 2003 report, we predicted that telecom engineers will someday fire gigabytes of data through fiber optic cables.

We predicted that “sophisticated computer software and video games will download in seconds.”

We predicted that “web videophones will give you crisp, full motion video of the people you’re chatting with, instantly.”

Back then, people said it was “science fiction.” Today, it’s the driver behind some of the greatest profits of our era.

How big could the next round of profits be? We’ll answer that question in Chapter 2.

For the entire e-book in one place, go here.

Or, you can watch the 3-part video version here.

Best,

Martin D. Weiss and Jon D. Markman