|

Governments and businesses around the world are coming to grips with the coronavirus. Is the fear overdone? Sure. But I’ll tell you one thing:

The government reaction to the coronavirus practically guarantees higher gold prices.

Let’s start with my view that fears of the coronavirus are overdone. I must be mad, right? The virus has killed 642 people, nearly all of them in China, through Friday morning. So far, there have been 12 reported cases in the U.S. with no deaths.

Well, when it comes to sheer numbers, the regular flu is much, much worse.

At least 19 million people in the U.S. alone have experienced flu illnesses this season. That’s according to CDC estimates. About 180,000 Americans have been hospitalized so far. And an estimated 10,000 have died, including 68 kids.

So yeah. In comparison, the coronavirus hysteria is overdone.

But how will this push gold higher?

Because governments overreact. They feel the need to show they’re on top of the problem. And that creates fertile ground for gold gains to grow.

We’re already seeing governments react to fears that the coronavirus outbreaks will drag on global economic growth. They’re cutting interest rates and firing liquidity cannons, and more “preventative” action will follow.

In liquidity, China is leading the way. The People’s Bank of China just injected $71.5 billion into the banking system to support liquidity. That’s on top of the $174 billion injected in the previous session.

Before we get smug about that, consider that in the U.S., the Fed is pumping hundreds of billions of dollars into short-term financial markets through repo operations.

As for rate cuts, Thailand cut its benchmark interest rate to a record low 1%. The central bank of the Philippines also cut rates this week. They chopped 25 basis points to 3.75%. And Iceland has lowered its interest rates by 0.25 percentage points, from 3% to an annual rate of 2.75%.

And now, the Reserve Bank of Australia is considering cutting rates. They’re blaming the decision on the economic impact of the coronavirus and the massive brush fires that have recently ravaged that continent.

Japan and the European Union central banks already pushed their benchmark rates negative. And I don’t think they’ll be the last. Recently, $17 trillion of government bonds worldwide had negative yields. That’s roughly 30% of the investment grade debt in the world.

Here’s the funny thing about cutting interest rates: Thanks to inflation, when benchmark rates go very low, real interest rates — which take inflation into account — go negative. Sometimes this happens even if the benchmark rate is still positive.

If the current 10-year treasury yield is 1.637% (which it is) and the projected inflation rate is 1.9% (which it is), then an investor buying a 10-year treasury gets an effective minus 0.263% real return.

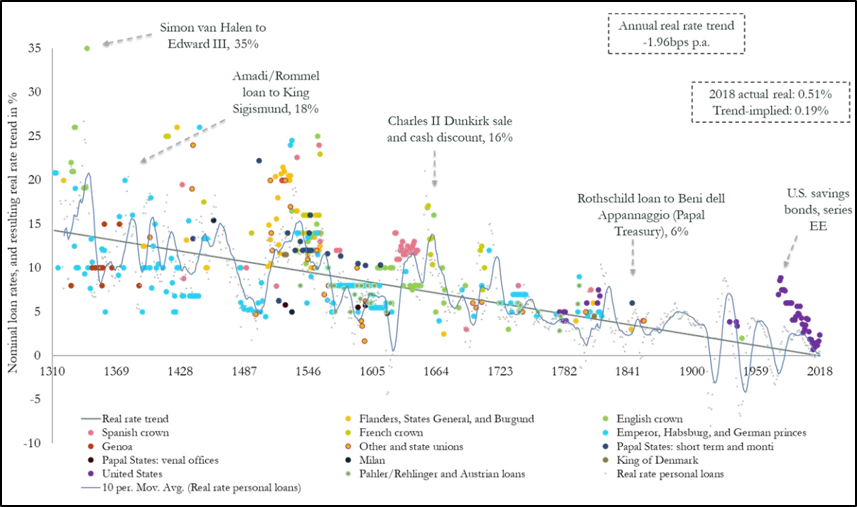

To be sure, the recent cut in interest rates is part of a centuries-long decline. Here’s a chart from Paul Schmelzing, visiting scholar at the Bank of England:

|

|

Source: Visual Capitalist |

But to come back to my original point: What does this have to do with gold?

Well, one of the complaints about gold is it doesn’t pay interest. When interest rates are negative, neither does government debt. That lifts a weight of gold. Historically, when real interest rates go negative, gold goes higher. Potentially much higher.

And this adds to other fundamentally bullish factors for the yellow metal. Like the supply/demand squeeze that is brewing in gold.

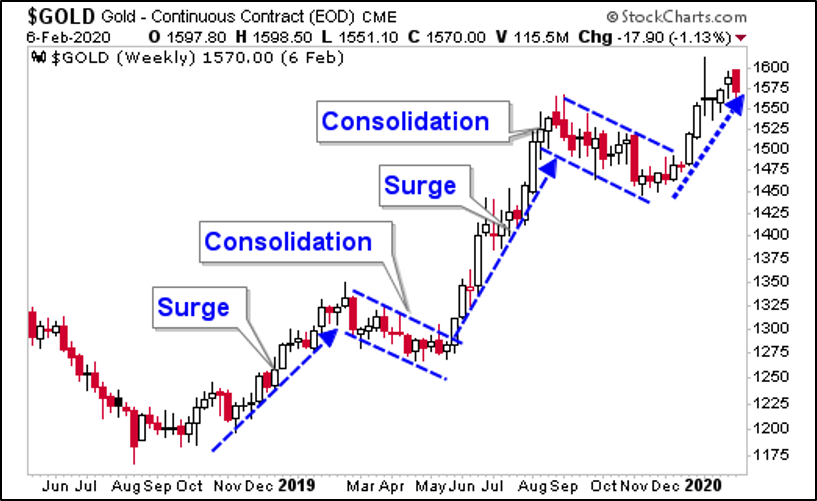

Here’s a chart of gold, an update of one I’ve shown you recently. It’s looking more bullish ...

|

You can see that gold is in breakout mode after a months-long consolidation.

In fact, I see three good reasons for gold to surge from $1,600 to $3,000 and beyond … BEFORE year-end. If you want to get my FREE full gold forecast when I release it TOMORROW at 2 p.m.— plus 3 stocks you can buy NOW for potential profits of 229% ... 370% ... even 1,186% — click here and I'll send you details for attending.

This is your last chance to register, so don’t wait.

The bottom line is that gold is bullish for all sorts of reason. But the government reaction to the coronavirus adds more fuel to the fire. Pullbacks can be bought.

If you’re doing this on your own, be careful. And learn to ride out short-term pullbacks for potentially huge longer-term gains.

All the best,

Sean