3 'Buy'-Rated Stocks to Own Before the Holidays

It’s only the second day of fall and I’ll admit, I’ve already tried the autumn drinks at a few of my local coffee shops. My family will surely be tired of me adding cinnamon, nutmeg and cloves to everything long before we get to Thanksgiving dessert, but that won’t be a deterrent.

Retailers have already rolled out Halloween decorations, and we can expect Christmas ones to make an appearance shortly. Behind the scenes, many retailers are scrambling to make sure they have everything ready for the holiday season.

But the supply chain still hasn’t fully recovered.

Walmart (NYSE: WMT) is chartering its own vessels, and it made sure that some of these were small enough to unload at secondary ports to avoid delays. Lululemon (Nasdaq: LULU) has added extra air shipments to avoid overburdened ports.

I’ve already seen the news using these facts to “warn” consumers their favorite products might be more expensive or harder to come by. But we know that won’t slow down the season.

Even if shoppers aren’t getting their number one choice, the holiday season will still equate to spending money. The decorations, the gifts, the feasts … it all means more money being thrown in the direction of consumer staple and consumer discretionary companies.

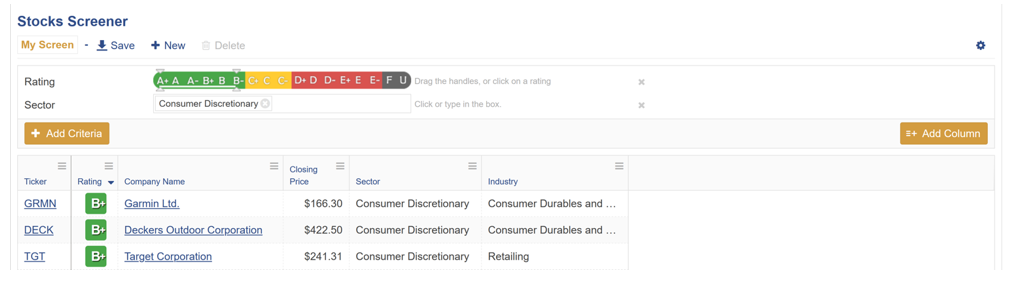

So, I headed over to the Weiss Ratings stock screener to see which consumer discretionary companies are top-rated right now.

|

First up is Garmin (Nasdaq: GRMN) with a “B+” rating. When I think of Garmin, I remember standing in line on Black Friday in the late 2000s to make sure there was a GPS device for my grandfather under the Christmas tree.

The company’s first ProNav system was quickly adapted by the U.S. Army in 1991. And by 2000, Garmin had sold over 3 million GPS devices. The company’s products span a variety of uses — like aviation, marine and automotive.

They also dominate the outdoor recreation, sports and fitness categories. Plus, the company now offers a wide selection of smartwatches.

Garmin currently pays a 1.5% dividend. Shares are up 41% year to date and 78% over the past year.

Next up is Deckers Outdoor (NYSE: DECK), also with a “B+” rating. The Santa Barbara, Calif.-based company began selling flip flops and now holds other lifestyle apparel brands, including Uggs, Teva, Sanuk and HOKA.

This specialty retailer has managed to stay in the “Buy” range for the majority of time since 2018. Shares are up 49% so far this year, and 97% in the last year.

Last but not least is Target (NYSE: TGT). Although considered a consumer discretionary company, Target’s offerings include many consumer staples. The company started increasing the availability of grocery products in 2003, and by 2010, its shoppers started seeing fresh groceries as well.

The company will not only see people gifting presents from Target, but also stocking up on food items. The company has been rated a “Buy” for the majority of the time since 2019 and resumed its “B+” status earlier this month after total capital increased.

Target shares yield 1.2% in dividends. Shares are up 37% year to date and 58% over the past year.

All three of these companies are sure to see increased spending over the next few months. And my quick screen showed 123 “Buy”-rated consumer discretionary companies ready to profit from holiday spending.

Best,

Kelly Green