How the DeFi Revolution Fits Within the Great Digital Transformation

Cryptocurrency is almost literally the hottest thing on the planet right now.

It’s even entered the debate about global warming. In fact, some of its biggest promoters — in addition to hosting long-running, late-night, sketch-comedy TV shows — are talking to major miners about this issue.

And prices are volatile. Bitcoin (BTC), for example, the world’s largest cryptocurrency by market capitalization, suffered a 26% slide a couple weekends ago, inflicting all sorts of damage during nontraditional trading hours.

But most signs — including a still-rising chorus of institutions and big-name investors singing use-case and/or store-of-value tunes — suggest crypto is here to stay. Indeed, it’s a major element right now in the broader digitization of just about everything.

Jon Markman’s beat is this “great digital transformation.” On April 30, he wrote once more about crypto, again putting it in context of a bigger trend.

Jon has a really good bead on where and how the decentralized finance (DeFi) revolution “fits.”

And he has a really good idea for equity investors to play it:

It’s time for investors to look into Coinbase Global, Inc. (Nasdaq: COIN).

Coinbase is the premier platform for the exchange of cryptocurrencies … and right now, they have an incredible advantage and lead in the race.

Most investors understand that Bitcoin (BTC) is being mainstreamed by big brands. Square, Inc. (NYSE: SQ) and PayPal Holdings, Inc. (Nasdaq: PYPL) began accepting the cryptocurrency as legal tender last year. Tesla, Inc. (Nasdaq: TLSA) managers announced in February that customers could use the digital coins to buy its electric vehicles. Yet standardization is only one part of the investment story.

Coinbase is an extremely profitable business, making most of its profit from charging fees to customers to buy and sell cryptocurrencies, most notably Bitcoin and Ethereum (ETH).

The company is expected to have made $1.1 billion in earnings before interest, taxes, depreciation and amortization (EBITDA) and around $750 million in net income in Q1 2021. Coinbase usually charges around 1.5% commission on trades for their retail-facing platform, but customers are able to get lower commissions (around 0.5%) for large amounts on Coinbase Pro.

It’s especially important to point out this net income number because it is more than the company earned in all of 2020.

While the business metrics are impressive, it’s equally important to note that Coinbase has become the most trusted platform in the space. To date, databases at the San Francisco-based company have never been breached, nor have any coins been stolen, ever.

Mastercard, Inc. (NYSE: MA) and Visa Inc. (NYSE: V) dominate credit cards; Square and PayPal are tops in digital wallets because these firms have the infrastructure in place to swiftly deal with trust issues.

Coinbase logged $1.14 billion in sales during 2020, up 139% year over year. Profits came in at $322 million versus a loss of $30 million. Gross income surged to $527 million, up 2,000%. And managers said two weeks ago that revenue during the first quarter was $1.8 billion, up 900% from a year ago. Profits are expected to be in the range of $730 million to $800 million. If you take the midpoint, that is a year-over-year increase of 2,300%.

The business looks a lot like Mastercard, Visa, Square, PayPal et al., and it is not by accident. Coinbase is operating a purely transaction-based platform where customers must pay to play. They pay a lot because Coinbase is the most trusted platform.

Overall, it looks like a good business, and the valuation really isn’t that crazy. The stock is more speculative than most, meaning more downside and upside, but there is a lot to like.

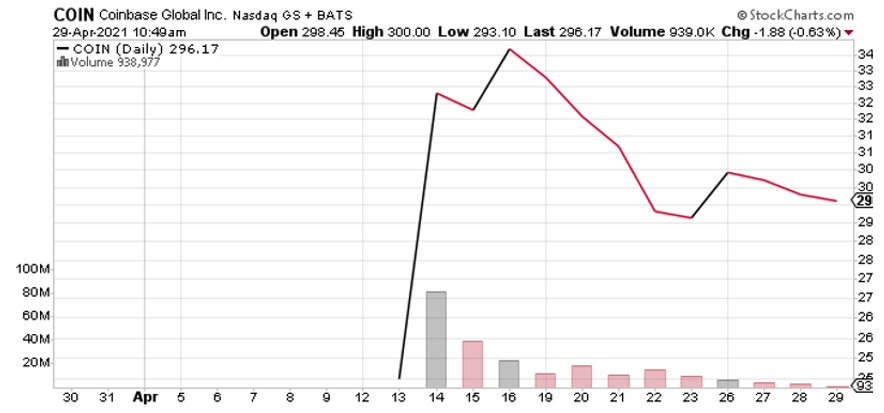

Shares debuted April 14 at $250 and promptly surged to $430. Since then, the stock has fallen back to around $294.60. Savvy investors should strongly consider using recent weakness as a buying opportunity.

Coinbase has actually slipped further from its immediate post-IPO highs to the $242.50 neighborhood amid heightened volatility for the crypto market in May. Remember, the “DeFi revolution” and the “great digital transformation” are long-term trends.

And we’re just getting started.

Click here to follow Jon’s Pivotal Point.

Best wishes,

David Dittman