How to Set Up for the Travel Revival ... Without Letting Your Money Sit Stagnant

We’re coming up on one year since the travel industry came to a screeching halt. But now travelers are tired of being cooped up in their homes. CEOs are ready to see money starting to flow back in their companies.

As of right now, over 32 million people are fully vaccinated in the United States, with over 70 million worldwide. The CDC has said that those who have been vaccinated can visit indoors without masks but should still wear them in public.

It’s progress moving forward. But they are still discouraging people to start ramping up the travel just yet. That’s not discouraging companies from getting ready for the inevitable ramp-up no matter how long it takes.

United Airlines Holdings, Inc. (Nasdaq: UAL) is taking this time to order more The Boeing Co. (NYSE: BA) 737 Max airplanes — 25 to be exact — for delivery in 2023. It also moved the delivery of 40 previously ordered planes up to next year.

Cruise lines are announcing new ships, new features and even some new destinations, although cruisers might not be able to experience them until next year.

Whether travel will resume later this year or even next year is less important than the fact that the travel revival will happen. And that means there will be money to be made for investors.

How can you make sure that you don’t miss out on this trend? You could buy shares now and just sit and wait ... and wait ... and then maybe you have to wait a little more for the money to start to flow back into these companies.

I consulted the Weiss Ratings, and I couldn’t find a single cruise line or airline that wasn’t flashing a solid “Sell” rating. So, it’s not time to get in yet.

But you do want to take a few steps to make sure you don’t miss out when these stocks start recovering.

This is where the watch list of your Weiss Ratings account comes in.

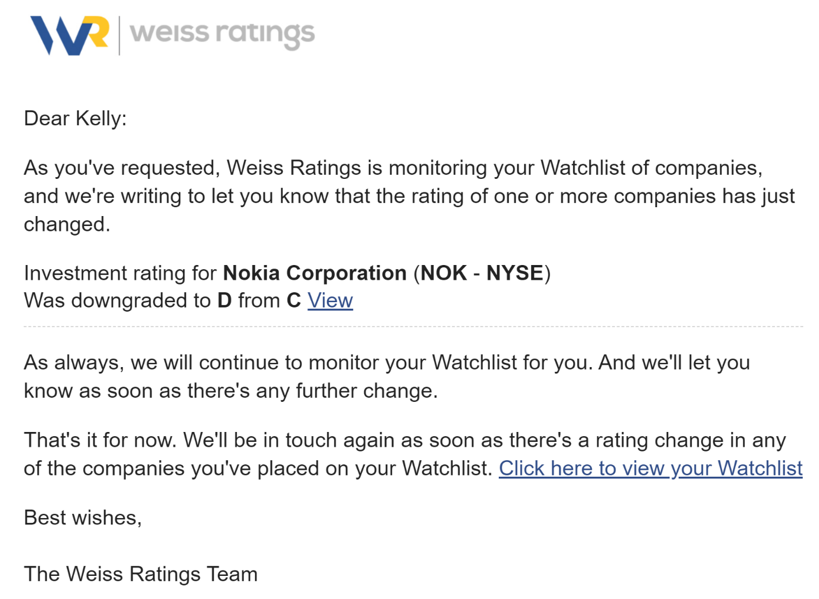

When you add companies to your watchlist, you’ll get an alert when one of them has a change made to its rating. It will be sent right to your email.

Here’s an example of what I’m talking about:

|

This particular alert was showing me a downgrade, but you’ll also be alerted when a company starts to climb up the ratings.

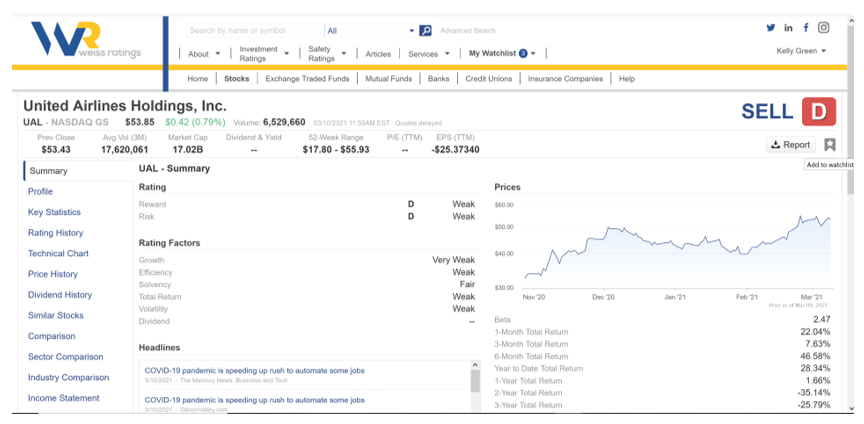

Plus, it’s super easy to add companies to your watchlist. Just type them into the search box and pull up the company profile.

|

On the right side just under the current rating is a button featuring a flag with a star cut out. All you have to do is click on it and you’re all set.

Taking a few seconds now saves you from letting your money just sit dormant in the market, but at the same time, will remind you so that you don’t miss out on this inevitable trend.

Once those shares start to reach the line between “Hold” and “Buy”, you’ll be ready to act.

Best,

Kelly