In an Uncertain World, the Ratings Are Your Best Friend

U.S. Stock Rise on Stimulus Hope

The S&P 500 Will Surge About 12% by September 2021

Stock Sell-Off May Still Have A Ways to Go

S&P 500 Futures Drop as Trump Warns of Delay in Election Outcome

These are just a few of the headlines that I saw in the past 24 hours. And the conclusion is clear ... we’re in for a rocky few months at the very least.

That’s where having access to the Weiss Investment Ratings can put you ahead of the other investors.

Using our ratings system can help you maximize gains and minimize risk. Plus, our system is easy to understand since it’s broken down into a letter grade system and can be translated into “Buy,” “Sell” and “Hold”.

An “A” rating indicates a strong “Buy” signal. It means that stock has a high probability of stability even in severely adverse environments.

A “B” rating is also a “Buy” signal. Although not as strong, it still indicates the company will probably be stable even in an adverse environment.

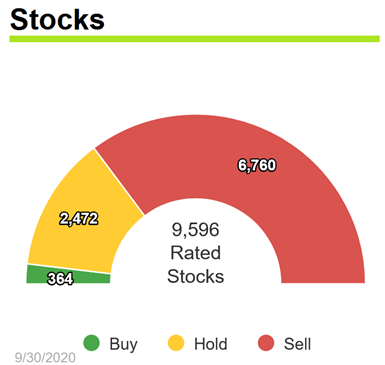

Out of the 9,596 stocks that we rate, only 364 of them are in that “Buy” range.

|

Out of those 364 buy rated stocks, only two of them are in the “A” range: Dollar General Corp. (NYSE: DG, Rated “A”) and WestBond Enterprises Corp. (TSX: WBE, Rated “A-”).

I’ve brought up DG before and have no doubt it will keep succeeding in this rocky environment. WestBond manufactures and sells disposable paper products for medical, hygienic and industrial uses in North America.

That leaves us with 362 stocks in the “B” range. So how do we sort through all those? Well, more impressive than maintaining a “Buy” equivalent rating through 2020 are those companies that earned a “B” rating, despite the volatility of this year.

So today, I wanted to see which stocks had been upgraded despite the recent movements in the market. To do this, I headed over to the stock screener and selected all “A” and “B” rated stocks. Then I added the “rating change” criteria. This identifies the most recent change if one has taken place within the last five trading days. I selected upgrade.

Let’s see our top three for today.

First up we’ve got Adobe Inc. (Nasdaq: ADBE, Rated “B”). Adobe is a diversified software company known for its Creative Cloud which combines its iconic Photoshop, InDesign, Illustrator and Acrobat. The company was upgraded from a “B-” to a “B” on Sept. 24.

Adobe has been in the “Buy” range since April 2016. And as you can see, investors have fared well since.

|

Next up is Xcel Energy Inc. (Nasdaq: XEL, Rated “B”). Xcel Energy is a regulated electric and natural gas utility headquartered in Minnesota. It has over 3.7 million customers in Minnesota and surrounding states.

The company has slipped into a “Hold” (“C”) range twice so far in 2020 but was upgraded from a “B-” to a “B” on Sept. 23.

Our runner up today is Security National Financial Corp. (Nasdaq: SNFCA, Rated “B”). Security National engages in life insurance, cemetery and mortuary and mortgage businesses. On Sept. 28, the stock was upgraded from a “B-” to a “B.” It seems like the company might be able to hold that status now, despite its history of being stuck in the “Hold” range from July 2017 to June 2020.

But, if you check the chart of share prices, it all lines up.

|

Shares were in fact mostly flat through that range, indicating hold was the most desirable action.

Looking for shares that have recently upgraded should help you identify which stocks are now more desirable than they were a few days ago.

You could also use the rating change field to show downgrades as well. This could be helpful if you’re looking for candidates for selling puts or another “short” strategy.

This is just one more example how getting creative with our built-in stock screener can save you time ... and hopefully make you a nice sum of money.

Best wishes,

Kelly Green