Is Your Bank 'Robbing' You? Here's What Our Analysis Shows ...

Is your bank "robbing" you? The answer might be YES if it's raking in more interest than it "should."

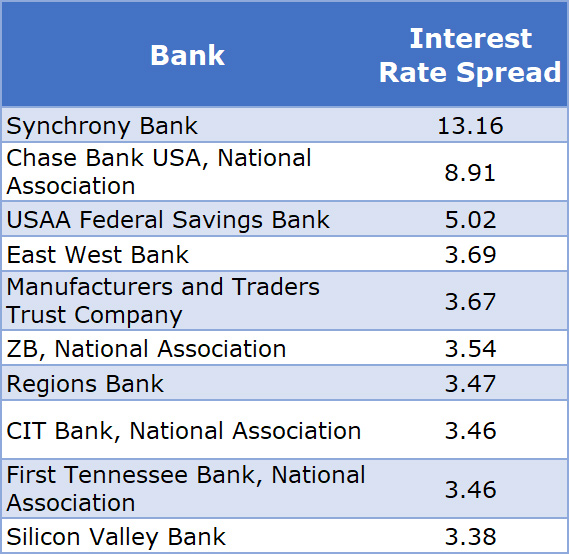

So, to find out which banks fit the mold, we dug into our data. We started by looking at interest rate spread figures. The "spread" is simply the difference between what banks pay their savers and charge their borrowers.

The average net interest spread is 3.25 percentage points, or 325 basis points. This chart shows the top 10 highest interest-rate spreads for the top 50 largest banks by total assets in our coverage universe. We excluded banks that are credit card companies.

|

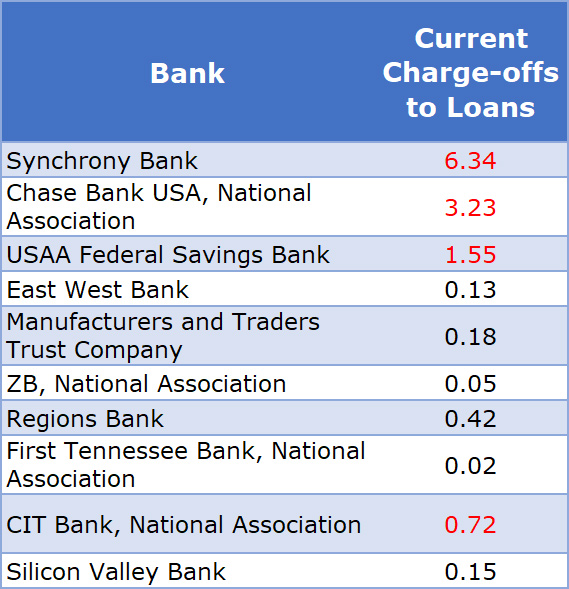

Next, we analyzed costs for these institutions. After all, banks justify their high spreads by claiming that they have to charge higher rates to compensate for higher costs, such as those associated with defaulted loans.

So, we analyzed net charge-offs to loans. Charge-offs are debts that have been written off by a bank because they know they won't receive payment on them.

We looked at charge-offs as a percentage of overall loans; the industry average for this metric is 0.47%.

The table below shows this figure for the same banks from the first table. The highlighted banks are those in the top 10 for the highest proportion of charge-offs to total loans.

|

You can see that four of the top 10 companies have a high level of charge-offs to loans. These banks could theoretically use that as a justification for their high spreads. But the other six have below-average charge-off rates, meaning the argument doesn't hold water.

Next, we looked at operating profit — revenue generated from the core business of a company, minus the costs generated from those core business operations.

The industry average level of operating profit is 1.63.

The chart below shows the level of operating profit for the same banks. The highlighted companies have operating profits that among the top 10 highest out of the top 50 banks by assets.

|

All but one of the banks with the highest interest-rate spreads also have higher operating profits than the industry average. Six of the companies have operating profits that rank in the top 10.

This shows that these banks are generating a large amount of profit from core operations, which would be the transfer of money from savers to borrowers.

Bottom line: Our analysis suggests these banks lack the evidence to justify the large interest spreads they're earning. If you don't want to get "robbed," you're betting off banking elsewhere.

To find a safe and sound bank in your state, use the Screening tools available at the Weiss Ratings website to search for those with the highest possible grades.

Best,

Gavin Magor

Director, Weiss Ratings

Weiss Ratings LLC financial analyst Shane Moore contributed to this report.