Our Latest Ratings Data Shows Mixed News on the Life Insurance Front

|

|

A number of life-changing events can make people think about purchasing life insurance. If you just got married or had a newborn, chances are you’re concerned about the future a lot more now than ever before. You want to make sure that your loved ones are taken care of financially in any circumstance.

Finding the right insurance company that will be there for you at all times is critical. After all, your relationship will be long-term — almost like a marriage. Making sure you’re compatible, and the insurer is worthy of your business, is critical. And that’s where Weiss Ratings can help you with your search.

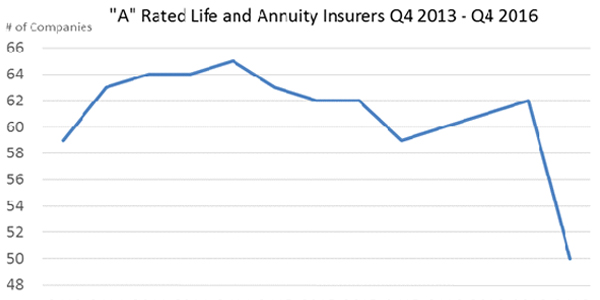

Looking at recent ratings trends, the news is a mixed bag. On the negative side, our Q4 2016 data indicates that the elite list of “A”-rated life insurers has shrunk 23.1% over the past two years. It also shrank 19.4% quarter-over-quarter, dropping from 62 to 50 companies.

But all is not lost. Even with the latest decline in A-rated companies, there are plenty highly rated insurers to choose from.

Indeed, B-rated companies increased by 5.8% quarter-over-quarter to 309 insurers. Or in other words, while some “As” were downgraded to “Bs,”some “C” rated insurers received an upgrade. You can click here for a complete list of upgrades and downgrades.

Meanwhile, here is an overview of what the latest ratings distribution looks like for life and annuity insurers:

As you can see above, nearly half, or 47.1%, of 656 rated life insurers receive the “B” rating and are considered to offer good financial security. “C” ratings are the second most populous group representing 29.1% of the industry in Q4 2016. These companies offer fair financial security and are currently stable. “D” and “E” companies represent 12.2% and 4% of the industry respectively, and are considered to be weak.

So in total there are 359 either A- or B-rated life insurers to choose from, representing 54.7% of the industry. Not all of them may write business in your area so be sure to contact them and check. And be sure to use our Weiss Ratings website on an ongoing basis to see if companies you do business with get upgraded or downgraded.

Think Safety,

Gavin Magor

Insurance Insights Edition, By Gavin Magor, Senior Financial Analyst Gavin has more than 30 years of international experience in credit-risk management, commercial lending and insurance, banking and stock analysis and holds an MBA. Gavin oversees the Weiss ratings process, developing the methodology for Weiss’ Sovereign Debt and Global Bank Ratings. Gavin has appeared on both radio and television, including ABC and NBC as an expert in insurance, bank and stock ratings and has been quoted by CNBC, The New York Times, Los Angeles Times, and Reuters as well as several regional newspapers and trade media. |