|

I hope you’re all enjoying the long holiday weekend! I’d like to use this opportunity when the markets are closed to pause and take a look at where we’ve been recently. After all, it’s the best way to determine where we’re going.

Last week saw the broad market pull back. Gold and miners were pulled along for the ride. Part of this was due to a bounce in the dollar, which is getting a bounce from multi-year lows.

I wonder how long that dollar bounce will last? After all, the Congressional Budget Office now predicts that the federal budget deficit will hit $3.3 trillion this year. That’s just the yearly deficit, not the debt which is north of $26 trillion — and climbing fast.

Regardless, I’m okay with gold taking a break. It had to happen eventually. And the bottom line is we’re in a big bull market. Pullbacks are buying opportunities. Patience will be rewarded.

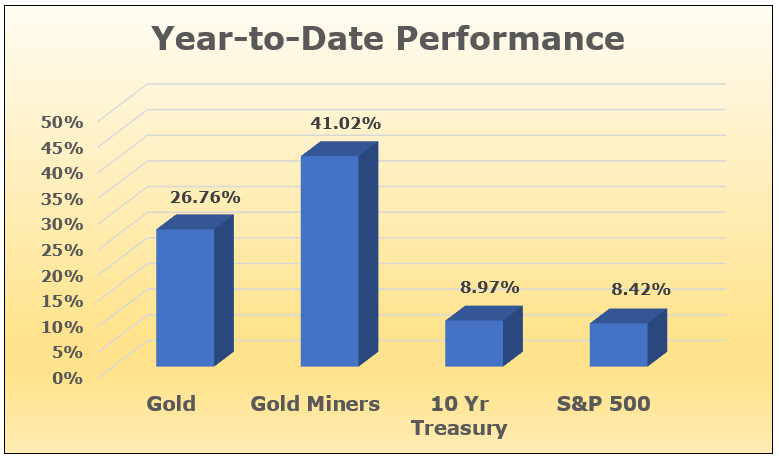

Just look at graph I made showing the performance of gold, miners, the 10-year Treasury and the S&P 500 since the start of the year.

|

Gold is doing very well. And miners are doing even better. Heck, through last Thursday, even the 10-year Treasury outperformed the S&P 500.

Going forward? No one has a crystal ball. But a loosey-goosey, easy money environment like the Fed is forcing on us is PERFECT for a continued rise in metals. And that should bode even better for miners.

Investors big and small think so. Heck, exchange-traded funds that hold physical gold are stacking up the bars.

This year, they’ve bought 26.4 million ounces. That’s more than in 2018 and 2019 put together! Meanwhile, total gold held by ETFs rose 32% this year to 109.3 million ounces.

And then we have all the other bullish forces that are lining up for gold, forces that I’ve covered in previous columns: A rising tide of negative-yielding debt, a tightening supply/demand squeeze, peak gold and more!

Now, the worrywarts and gold bears will point out that central banks’ net purchases of gold are slowing down — below nine tons in July, which is the lowest since 2018.

But everything moves in zigs and zags, especially gold. We’ve seen two years in a row of the central banks stacking gold up to the ceiling. Of course they’re going to take a break now and then.

So, When Is the Next Opportunity?

If you’re watching gold miners, you noticed something funny during last week’s pullback: Miners sold off on Friday morning. Then the bids came in later in the day.

We can’t be sure, but this is typical of institutional money snapping up what they see as bargains.

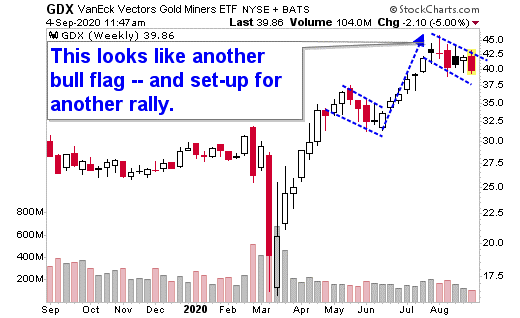

Let’s take a look at the VanEck Vectors Gold Miners ETF (NYSE: GDX, Rated “B-”). While it pulled back this week, its fall was “cushioned” by gold …

|

That sure looks like a chart pattern called a “bull flag,” and the saying on Wall Street is “flags fly at half-mast.”

What’s more, the GDX did the same thing back in May and June, and that opened the door to a 35% rally. Gold always zigzags, and miners even more so.

Smart investors will use this pullback as a golden buying opportunity.

All the best,

Sean Brodrick