My Favorite Way to Collect Dividends From Private Companies

I don’t have enough money where I can wave it around and invest before everyone else.

I don’t qualify as an angel investor or a venture capitalist … but maybe one day. Instead, I do most of my investing in a TD Ameritrade account.

It’s incredibly similar to every other retail broker that I’ve ever used. There are no commissions unless I trade over the counter (OTC) stocks, I can easily implement dividend reinvestment across my entire portfolio and it’s just fairly easy to use.

And most importantly, it’s easy to trade one of my favorite types of stocks — business development corporations (BDCs).

BDCs were created in the Small Business Investment Incentive Act of 1980. Collectively, these were a group of amendments to the Investment Company Act of 1940.

The initial act included limitations that prohibited any private equity or venture capital firm from being beneficially owned by more than 100 people. That essentially prevented them from being able to go public.

BDCs are similar to the REITs because in exchange for tax benefits, they are legally required to distribute at least 90% of their taxable income to shareholders.

They’re also required to invest 70% or more of their assets in U.S.-based private companies. And they must offer management assistance to the companies that they invest in.

This creates on of my favorite combinations: access to private companies and mandated dividends.

So, let’s take a look at three of my favorite BDCs.

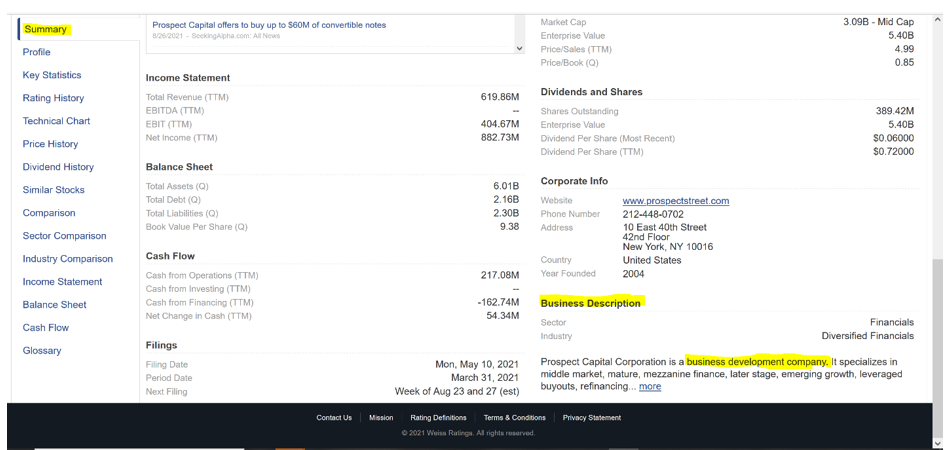

Prospect Capital Corporation (Nasdaq: PSEC): Rated “B-”

Year Founded: 2004

Dividend: 9.0%

Assets under management: $6.3 billion

Share Price Gains: 13.6% in the past six months and 74.5% in the past year

Some portfolio names you might recognize: Staples, ACE Cash Express, Candle-Lite Company, Dunn Paper, Shutterfly.

Hercules Capital (NYSE: HTGC): Rated “B”

Year Founded: 2003

Dividend: 7.5%

Assets under management: $2.6 billion

Share Price Gains: 11.4% in the past six months and 65% in the past year

Some portfolio names you might recognize: 23andMe, Ancestry.com, DocuSign (Nasdaq: DOCU), Impossible Foods, Lyft (Nasdaq: LYFT), Nextdoor

PennantPark Investment Corporation (Nasdaq: PNNT): Rated “B-”

Year Founded: 2007

Dividend: 7.4%

Assets under management: $5.2 billion

Share Price Gains: 19.8% in the past six months and 97% in the past year

Some portfolio names you might recognize: Wheel Pros — a national distributor of aftermarket wheels and related accessories, Dominion Voting — global provider of end-to-end election tabulation solution, Ox Engineered Products — building materials supplier

Remember, these are just three of my favorites, you might find other BDCs that tickle your fancy. And you can find these on the Weiss Ratings website, there’s just an extra step.

BDCs fall into the financials sector and the diversified financials industry. But they are not the only companies that you will find in there either.

You’ll also find REITs. Don’t get discouraged; it’s still fairly easy to find what you’re looking for.

Once you've adjusted the stock screener by either sector or industry, you’ll have to take a quick look at each one by one.

Clicking on the name will take you to the summary page for the selected stock. Then, you’ll scroll all the way to the bottom. In that bottom right corner, you’ll see a section labeled business development. That’s where you’ll see the BDC designation.

|

These additional steps only take an extra minute. Plus, you’ll notice that directly above business description is the corporate info section. There you will find a clickable link to the BDCs website, and you’ll be able to see what particular companies that BDC invests in.

I highly recommend that you check out these income powerhouses to see how they can supercharge your portfolio.

Best,

Kelly Green