Oil Hits Multiyear Highs, So Let’s Look at the Ratings

It’s been two months since I took the opportunity to write to you about energy stocks … but it seems like a lot has changed.

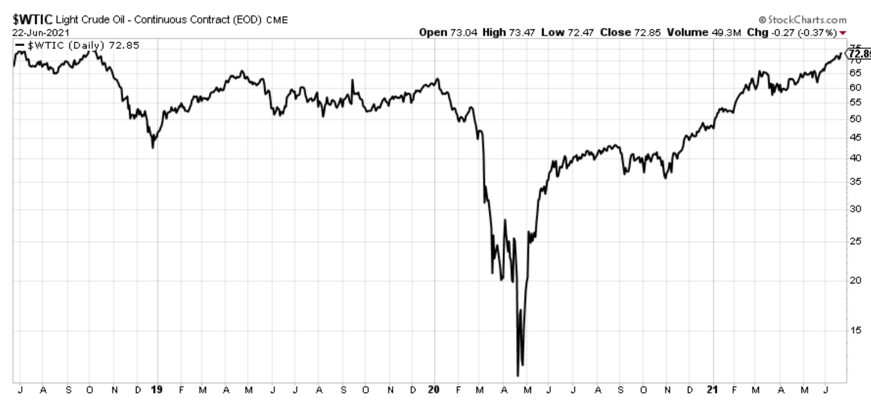

Back in April, oil prices hit and remained at pre-pandemic levels.

That was promising, but oil companies were still recovering from the hit of last year. At the time, there were only four stocks in the energy industry that had a “buy” rating.

Now, we’re seeing another run-up in oil prices. Organization of the Petroleum Exporting Countries (OPEC) and its allies are forecasting higher demand and boosted output.

Both Brent and West Texas Intermediate (WTI) futures are seeing the highest level since 2019.

|

The global reopening of the economy is key for the crude demand outlook, and it’s starting to happen. We could even see crude production levels increase even more starting in August.

Now, when we head over to the Weiss Ratings website, there are 14 energy stocks in the “buy” range.

Seven of those are oil related stocks. All seven of them are in the lower end of that buy range, but they're a “buy” rating nonetheless.

Let’s take a look at the top three.

First up is Sunoco LP (NYSE: SUN) .the U.S.’s largest fuel distributor, who just re-entered the “buy” range in May.

What started as a small company 130 years ago now distributes motor fuel to 10,000 convenience stores, independent dealers, commercial customers and distributors in more than 33 states.

In May, the company announced solid first-quarter results and reaffirmed full-year guidance of $725-765 million.

Since the company is structured as a master limited partnership (MLP), it has to pass through most of its cash to its shareholders. Right now, that yield is 8.6%.

Shares are up 39% over the past six months, and 60.8% over the past year.

Next, we’ve got Delek Logistics Partners, LP (NYSE: DKL), who just re-entered the “buy” range in February.

The company is a growth-oriented MLP, formed in 2012 to own, operate, acquire and construct crude oil logistics.

These assets are integral to the success of Delek U.S. Holding Inc.’s refining operations as they are the basis for gathering, transporting and storing the company’s crude oil.

This oil can then be distributed and stored in select regions of the southeastern U.S. and West Texas for Delek and third parties.

For the first quarter, the company saw earnings before interest, taxes, depreciation and amortization (EBITDA) increase 21% compared to the same quarter last year.

This is always great news for investors since the company’s MLP status requires it to pass through so much money to investors.

Delek currently pays an 8.9% dividend to investors. Shares are up 43% in the past six months and 77% over the past year.

Finally, there’s MPLX LP (NYSE: MPLX), which just re-entered the “buy” range in May. This MLP was formed by Marathon Petroleum Corp. (NYSE: MPC).

It’s engaged in the processing and transportation of natural gas and NGLs, but also the transportation, storage and distribution of crude oil and refined petroleum products.

MPLX pays its shareholders a dividend of 9.2%. Plus, shares are up 42% in the past six months, and 83% over the past year.

I think we’re going to see many more oil companies join the “buy” ranks over the next few months as oil keeps rumbling higher.

I highly recommend you head over to the stock screener and see the others that are currently a “buy.” Or, scope out your favorite companies that are rated “hold.”

It’s easy to add them to your watchlist, and you’ll receive email updates if there’s a rating change.

These are certainly exciting times for oil, and it’s nice to have the ratings as a compass.

Best,

Kelly Green