Robinhood Markets Inc. (Nasdaq: HOOD) has been derided by traditionalists, regulators and even some users, yet its shares have been a big hit with investors.

On Tuesday, Fidelity reported that Robinhood became the top traded stock on its platform. The ticker is also among the most mentioned on r/WallStreetBets, the popular Reddit page.

Like GameStop Corp. (NYSE: GME), Robinhood is becoming a meme.

That means even higher prices look promising.

So-called meme stocks make no sense to older investors. Based on financial ratios and metrics, their soaring share prices can’t be justified by the outlook for the underlying business. That is all true and irrelevant.

Meme stocks are about gaming the system, full stop.

Let’s face it, GameStop is a struggling, brick-and-mortar video game retailer. Its business model is a casualty of the online gaming era. Despite this, shares rallied from $12.15 in December 2020 to a high of $483 one month later.

All the way up, hedge fund managers bet against the stock with short sales. Media pundits shook their heads in disbelief.

The professionals misunderstood what was happening. They couldn’t believe anyone would be foolish enough to pay $480 per share for a company that lost $1.6 billion the previous 12 quarters.

The GameStop rally was about organizing an epic short squeeze to force professional doubters to buy back short positions for huge losses.

Bloomberg reported in January that Citron Research and Melvin Capital — two of the most prolific GameStop short-sellers — lost billions on the wrong side of the meme stock.

Robinhood didn’t get to online trading first, but the company has certainly upped the ante. In 2013, founders Vlad Tenev and Baiju Bhatt had the genius idea of merging social media, smartphones and online investing.

Then, the Stanford students schemed up a way to let investors seamlessly purchase odd lots of shares for free — sort of.

Trading on Robinhood is not really free. Eliminating commission payable by customers means collecting them elsewhere. And that’s where the business gets a bit sketchy. Robinhood racks up fees from market makers in exchange for routing client buy and sell orders their way for execution.

The business is hated by financial services traditionalists. They feel the no-fee smartphone-centric platform gamifies investing by making transactions too easy, diminishing the value of traditional stock research.

Other doubters point to the record $70 million fine imposed at the end of June by regulators. That settlement was the result of users filing lawsuits because of poor execution during the GameStop rally.

The combination of doubt from pros, regulatory threats and user complaints attracted a lot of attention for short-sellers. When the initial public offering (IPO) debuted last week at $38, shares immediately began to attract short sale interest.

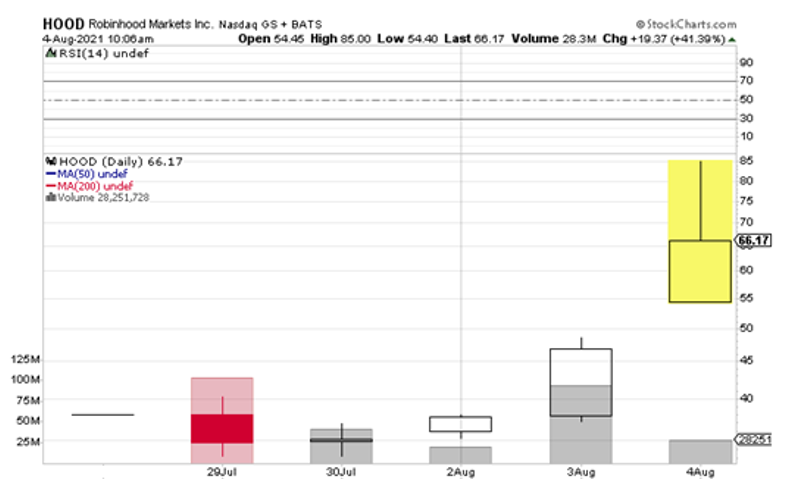

Gains on Tuesday pushed the share price to $46.80, up 24.2%. At Wednesday’s opening bell, the stock surged another 43%.

The Fidelity order flow news should be a red flag for professional short-sellers. The keen interest in the r/WallStreetBets message boards means the game is on. Small investors are organizing a short squeeze ... and from what we’re already seeing, it’s epic.

I’m not suggesting Robinhood will replicate the fortyfold returns that GameStop shareholders enjoyed in January 2021, but with the recent meme stock-like run-up in prices, investors need to be paying attention.

|

Remember, meme stocks are not grounded to the realities of fundamental valuations — they're about the game of skewering professionals.

Don’t be surprised if shares continue to shoot even higher.

Best wishes,

Jon D. Markman