Shining a Light on Utilities: Ignored Sector Has Opportunities if You Know Where To Look

I’ve been working on a project, taking a closer look at the performance of the S&P 500. It’s fascinating that it’s used as a benchmark of the stock market, and I’ve seen it used as a benchmark for the overall economy.

If you look closely, you’ll see that by design, the S&P 500 includes the largest companies … companies with massive market capitalization.

Since the index is weighted by outstanding shares and market cap, the actual weightings change daily, but only by small amounts. Even over periods of years, there hasn’t been much change.

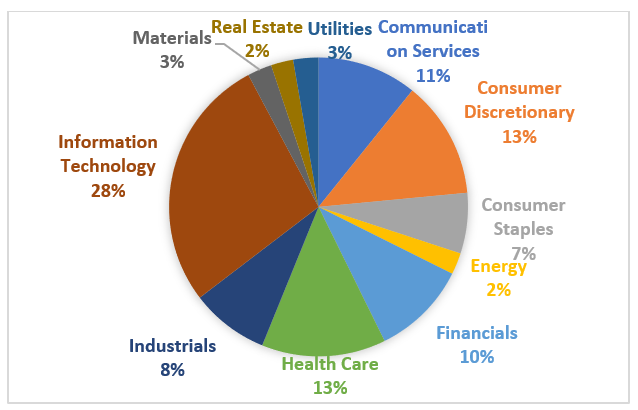

Look at the approximate weighting at the end of 2020:

|

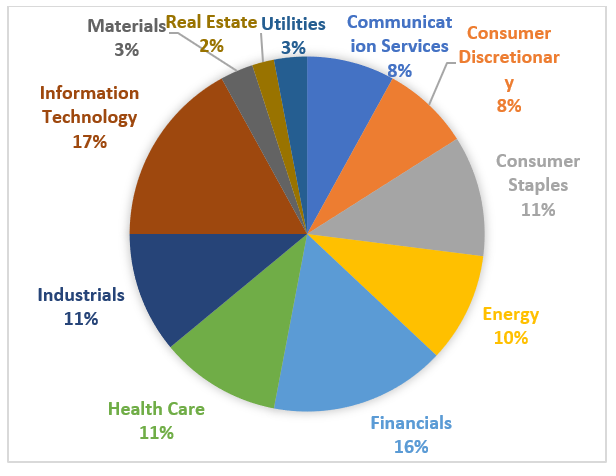

Then, compare that to the approximate weighting at the end of 2010:

|

Materials, utilities and real estate still make up the smallest percentages of the index, while information technology is still the largest.

Also, notice consumer discretionary and consumer staples seem to have switched sizes here.

I’ve mentioned it before: These two tend to be cyclical. There are times when consumers spend more on discretionary goods, and there are times when they tighten the purse strings and focus on essentials.

Utilities and real estate have always been two sectors that interest me — this undoubtedly comes from my background in income investing.

Utilities aren’t going anywhere. They’re essential. If you can find the ones paying out a dividend, you can almost guarantee that dividend will continue hitting your account for years to come. Real estate can be the same way.

Generally, if you’re looking at total returns, these two sectors underperform the market as a whole.

Yesterday, Mike used his column to look at real estate — a booming sector over the past year. Choosing the right real estate investments leaves little doubt you’ll be able to outperform the market. If you missed his piece yesterday, be sure to take a look.

Today, I want to focus on utilities. Specifically, which ones are rated a “buy” right now and what kind of gains they’ve seen so far in 2021.

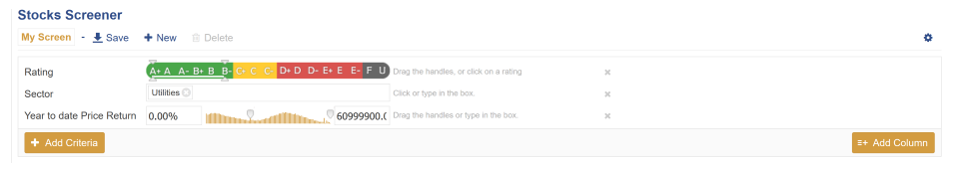

By now, you know what comes next: I’m going to head over to the stock screener on WeissRatings.com. I selected utilities as the sector and chose ratings above a “C+.”

Next, I added a filter for year-to-date price return, then added the value 0, meaning all these companies have had positive returns so far this year.

|

My search resulted in 38 stocks. Let’s take a quick look at the top three:

First is Hydro One Ltd. (TSX: H). This Canadian company provides energy transmission in Ontario, serving approximately 1.4 million customers and providing telecommunications support services for its transmission and distribution businesses. The company was founded in 2015 and has paid a dividend since 2016. Right now, its dividend is around 3.3%, which is not too shabby for such a stable, “boring” company. Share prices are up 8% year-to-date and 12% over the past year.

Next, we’ve got Evergy, Inc. (NYSE: EVRG). The company provides electricity for 1.6 million customers in Kansas and Missouri. Evergy has paid a dividend since 1992! It’s currently paying a solid 3.2% and shares are up 25.7% in 2021.

Finally, there’s Kenon Holdings Ltd. (NYSE: KEN), a Singapore-based subsidiary of Ansonia Holdings. The company’s power generation plants operate on natural gas and diesel. Kenon Holdings also operates a shipping fleet of 87 vessels, plus it designs and manufactures automobiles in China. The company seems to have its hands in a little bit of everything. And we can’t ignore its tempting 5% dividend yield. Share prices are up 27% in 2021 and up 100% over the past year.

While it may be true that utilities generally underperform the market, it seems that if you pick the right ones, there’s money to be made.

There were 35 other companies in my search results we didn’t even look at.

Thanks to the Weiss Ratings, we can see that there are many utility choices for whatever you’re looking to add to your portfolio.

Best,

Kelly Green