In the grand scheme of things, 147 days doesn’t seem like a long time. It’s not even half of a year. But, when you think about this particular moment in time, where we are today is a lot different than where we were on Oct. 1.

We’ve started a new year, inaugurated a new president, seen the development and rollout of several COVID-19 vaccines … in some ways, it actually seems like more time has passed.

But that’s not all that’s changed.

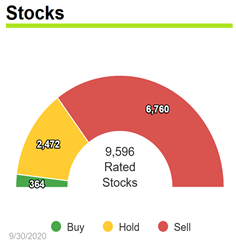

Back on Oct. 1, I wrote to you and included this screenshot:

|

At the time, only 364 of the 9,596 stocks that we rated were labeled a “Buy”. And out of those 364, only two of them were in the “A” range: Dollar General Corp (NYSE: DG) and WestBond Enterprises Corp (TSX: WBE).

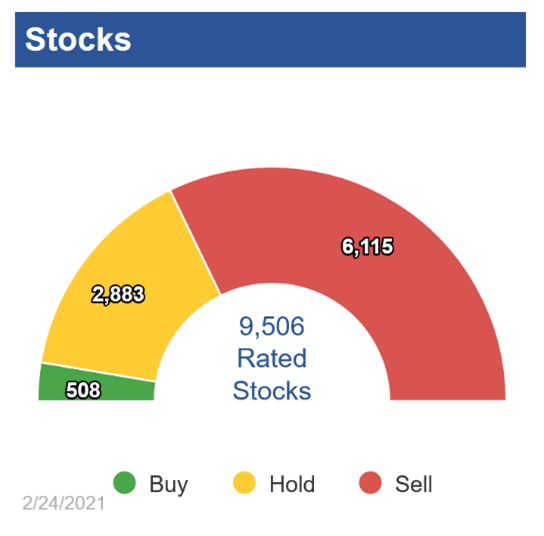

So yesterday when I sat down and opened the Weiss Ratings website, I noticed that green segment seemed to be growing a bit. Here’s a current copy of the same data:

|

That slice of “Buy”-rated stocks has grown to 508. The ratings system is saying that there are 40% more stocks rated “Buy” now than just 147 days ago.

Now, you could say, “Well of course! Look at how well the market has been doing.”

But the Weiss Investment Ratings looks at so much more than just the stock price. The ratings system looks at the potential reward and the potential risk. It uses the company’s most recent financials and takes into consideration factors such as cash flow going down or debt going up.

So, I of course wanted to take a closer look.

The first thing to notice right off the bat is that there are no “A”-rated stocks right now. Every stock in that’s categorized as a “Buy” is in the “B” range. Some are “B+” and some “B-”, but all in that “B” range.

The second thing I noticed is that both of the previously “A”-rated stocks have slid.

Dollar General didn’t downgrade too far. It’s sitting there among the top-rated stocks with a “B+”. The ratings system noticed that the company saw a decline in operating cash flow and earnings per share in its last quarterly release. But overall, it’s still a solid buy.

WestBond Enterprises, on the other hand, slid to a “B” rating. Again, still a “Buy” rating, but the stock might not be as strong as some of the other companies right this second.

So, let’s see which other companies are hanging out with Dollar General at the top of that buy list right now.

Of course, we’ve got Walmart Inc. (NYSE: WMT). At a time when customers were looking for affordable prices along with flexible shopping options such as delivery and curbside, the stores delivered — financially, that is. Even though the company had to increase spending on PPE, its core business was essential and not affected as much as others.

Then there’s AstraZeneca PLC (Nasdaq: AZN). The company was recently upgraded as its earnings per share (EPS) increased 57% and its total revenue increased 12.65%. AZN is the maker of one of the COVID vaccines being used right now, so cash will continue to flow into this solid balance sheet.

There are five other stocks that earned a “B”-range rating. All of them are in the information-technology sector. They are:

- Microsoft Corp. (Nasdaq: MSFT)

- Cadence Design Systems, Inc. (Nasdaq: CDNS)

- Booz Allen Hamilton Holding Corp. (NYSE: BAH)

- Advanced Micro Devices, Inc. (Nasdaq: AMD)

- Logitech International S.A. (Nasdaq: LOGI).

I can’t even pretend to be surprised. I’ve said it before, and I’ll say it again: The past year has made many people realize that technology is the future. Remote schooling, remote working, robotic assistance with cleaning tasks. All these things will continue to be a part of our future.

I’m going to be keeping an eye on how the distribution of ratings changes. For me, it’s a much more accurate way to monitor the strength of the market than stock prices. And don’t worry, I’ll keep you up to date, too.

Best,

Kelly