The Single Most Profitable Post-Election Investments

|

|

TODAY AT 2 p.m. Eastern: URGENT CANNABIS INVESTOR BRIEFING with Senior Analyst Sean Brodrick and Founder Martin Weiss. For your free ticket, be sure to click here before 12 noon! |

This is hot. It’s exploding right now. And it’s demanding swift action.

I’m talking about choice cannabis stocks, which I believe are the single most profitable post-election investment.

Just consider the pile-up of market forces now driving them higher …

Market force No. 1

Election Landslide

Recreational marijuana initiatives just passed in Arizona, Montana, South Dakota and New Jersey. And proposals to legalize medical marijuana passed in South Dakota and Mississippi.

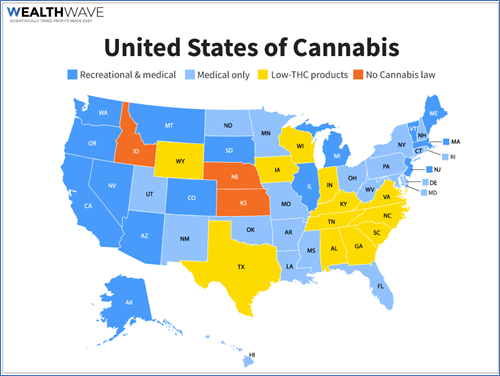

Now, at the state level, cannabis is at least partially legal in every state except Idaho, Nebraska and Kansas.

|

In many states (dark blue on the map), it’s legal for both recreational and medical purposes.

In many others (light blue), it’s legal strictly for medical use.

And in some (yellow), it’s legal for medical use provide the content of addictive THC is limited.

“With the passage of these initiatives, one-third of the population now lives in jurisdictions that have legalized cannabis for adult use, and 70% of all states have embraced cannabis for medical use,” says Steve Hawkins, executive director of the Marijuana Policy Project.

This brings the nation closer to legalization on the federal level than ever before.

Despite growing support for cannabis in the U.S., federal legislation for legalized pot may be off the table for now, particularly with the possibility of Republicans retaining control of the U.S. Senate.

But a divided government may bode well for the enactment of the Secure and Fair Enforcement Banking, or SAFE, Act, which would enable nationwide cannabis banking, writes senior policy analyst Jaret Seiberg at Cowen & Co.

When that happens, it could open the floodgates to Wall Street institutional money, which has been anxious to move into cannabis.

Market force No. 2

New York Is Next

New York is already gearing up. Axel Bernabe, Assistant Counsel to New York Gov. Andrew Cuomo, recently said in an interview that cannabis legalization legislation will (again!) be introduced through the state budget in January, with the goal being to enact the reform by April.

After California and Florida, New York is the big enchilada of state legalization. According to a 2018 estimate by New York City Comptroller Scott Stringer, legalizing marijuana in New York could create a $3.1 billion market. And it could give the state a windfall of $435.7 million in annual tax revenue. New York City alone could gain $336 million in badly needed tax revenue.

Market force No. 3

Soaring Growth

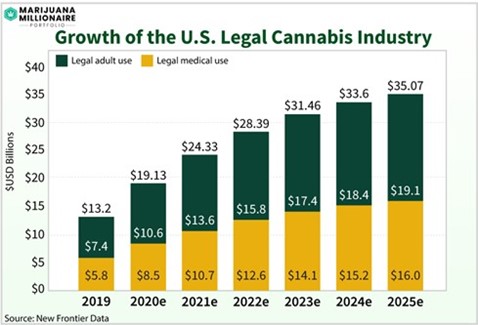

The total U.S. legal medical and adult-use cannabis market could hit $35 billion by 2025 according to the latest report by New Frontier Data, a widely respected research firm covering the cannabis industry.

|

Important: These projections are based solely on the state markets that already had legal medical and/or recreational marijuana as of August.

The projection — currently at a compound annual growth rate of 18% per year — will likely accelerate now that more states have legalized marijuana on the state level.

Your Immediate Action Item …

If you haven’t done so already, be sure to grab your free ticket to our Urgent Cannabis Investor Briefing.

It’s your last chance … because the free ticket window closes at 12:00 p.m. Eastern today, just a few hours from now.

Then, Weiss Ratings founder Martin Weiss and I will start promptly soon thereafter.

We will name the three cannabis stocks at the very top of our Weiss rankings.

And we will show you how you could use his hot sector to pull out an average of up to $20,000 per month in spendable cash.

But, if you want to join us, be sure to click here before noon, or you’ll miss your chance.

All the best,

Sean Brodrick