The Top 7 ETFs for Buying and Selling Gold

We all know how it is. As insecurity and uncertainty grips the men and women of Wall Street the gold barometer swings. UP goes the price of gold and then the fever gains hold and the rest of us start to wonder what we are missing out on, so we buy as well.

Guess who gets out first as the fever breaks? Those wonderful folks on Wall Street!

So given the warnings of the volatility of gold investing that could cost you your golden parachute, investing in gold cannot be easier than through an ETF. It offers you choices including:

- Those that invest in gold bullion GLD or IAU for example

- Those that don’t, such as GYEN and GEUR

- Those that believe in risking everything on the turn of a card and leverage the bet such as DGP and UGL

- Short sellers that believe that the dollar price of gold is but a mirage that will disappear so sell, sell, sell and while you are at it maybe leverage the sell with DZZ and DGLD

Using the Weiss Ratings ETF Screener you can look at all of these ETFs and, once you have selected one, compare them to similar ETFs at the click of a (mouse) button.

Stock

Constellation Brands (STZ) the beer, wine, and spirit producer, importer and marketer of brands including Robert Mondavi and Svedka Vodka is suffering from a post dividend hangover, down to $135.61 on Friday. Despite this blip it has been on a steady climb for the past 24 months, up from $77.98 on February 10, 2014. Investors will say “cheers” to that although the 0.89% yield is a little Scrooge like.

Using the industry comparison tab you can see how you can compare many of the key statistics for Constellation with other Food, beverage and tobacco companies. You can also use the other comparison tabs, to look at similar stocks, compare against three stocks that you choose, and a sector comparison tab.

Contellation Brands has an A (BUY) Weiss Investment Rating.

Mutual Funds

With the mumbling about how the markets are slip sliding away if you feel that you want to look at reallocating where your money goes and you like the diversity of risk in a mutual fund you can take control. The mutual funds screener gives you access to a selection called category.

Category identifies funds according to their actual investment styles as measured by their portfolio holdings. This categorization allows investors to spread their money around in a mix of funds with a variety of risk and return characteristics.

Looking at the consumer defensive category there are currently 20 funds of which 17 are currently rated a BUY. Don’t forget that when you select a fund to look at the “top holdings” tab gives you not just what holdings they have, but the ratings and direct links to the underlying investments where rated.

Credit Unions

What are credit unions?

Credit unions are not-for-profit financial cooperatives that exist to serve their members rather than to maximize corporate profits.

How do they differ from banks?

|

Banks |

Credit Unions |

|

|

Access |

Practically anyone is free to open an account or request a loan from any bank. There are no membership requirements. |

Credit unions are set up to serve the needs of a specific group who share a “common bond.” In order to open an account or request a loan, you must demonstrate that you meet the credit union’s common bond requirements. |

|

Ownership |

Banks are owned by one or more investors who determine the bank’s policies and procedures. A bank’s customers do not have direct input into how the bank is operated. |

Although they may be sponsored by a corporation or other entity, credit unions are owned by their members through their funds on deposit. Therefore, each depositor has a voice in how the credit union is operated. |

|

Dividends and Fees |

Banks are for-profit organizations where the profits are used to pay dividends to the bank’s investors or are reinvested in an effort to increase the bank’s value to investors. In an effort to generate more profits, bank services and fees are typically more costly. |

Credit unions are not-for-profit organizations. Any profits generated are returned to the credit union’s members in the form of higher interest rates on deposits, lower loan rates, and free or low-cost services. |

|

Management and Staffing |

A bank’s management and other staff are employees of the bank, hired directly or indirectly by its investors. |

Credit unions are frequently run using elected members, volunteer staff, and staff provided by the credit union’s sponsor. This helps to hold down costs. |

|

Insurance |

Banks are insured up to $250,000 by the Federal Deposit Insurance Corporation, an agency of the federal government. |

Credit unions are insured up to $250,000 by the National Credit Union Share Insurance Fund, which is managed by the National Credit Union Administration, an agency of the federal government. |

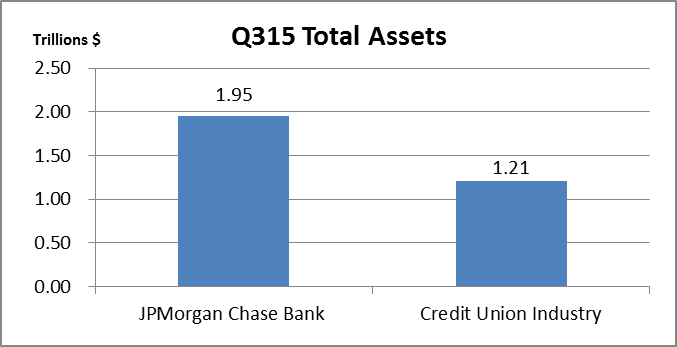

For the most part, credit unions offer identical products and services as banks but on a much smaller scale. Just to see how small credit unions are compared to banks, let’s take a look at some third quarter 2015 numbers.

Although with a 2.7 percent year over year decrease in assets, JPMorgan Chase Bank remained the largest bank in the U.S. in Q3, 2015; holding $1.95 trillion in assets as compared to $1.21 trillion of the ENTIRE credit union industry.

One bank is larger than the entire credit union industry!

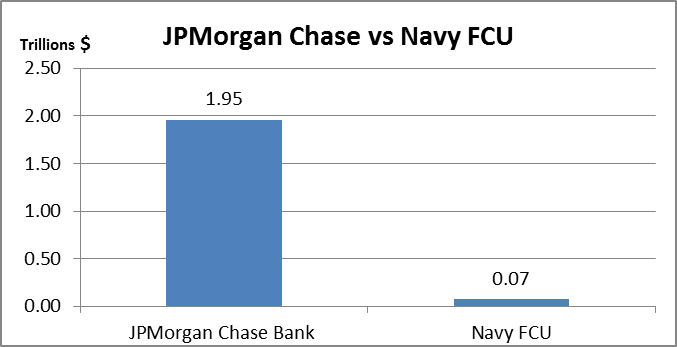

Navy Federal Credit Union, the largest and one of the highest rated credit unions by Weiss didn’t even come close to competing against the top bank with only $72 billion in assets in the third quarter.

Banks

Assets of the top 10 largest U.S. banks represented 55.1 percent of the entire U.S. banking industry in Q3, 2015, totaling to $8.3 trillion.

|

Company Name |

State |

City |

Total Assets in Millions |

Weiss Safety Rating |

|

OH |

Columbus |

1,954,125.0 |

C |

|

|

NC |

Charlotte |

1,616,426.0 |

C+ |

|

|

SD |

Sioux Falls |

1,579,174.0 |

C+ |

|

|

SD |

Sioux Falls |

1,337,821.0 |

B |

|

|

OH |

Cincinnati |

410,889.9 |

C+ |

|

|

DE |

Wilmington |

351,502.4 |

C+ |

|

|

NY |

New York |

302,197.0 |

C+ |

|

|

VA |

McLean |

254,436.1 |

C+ |

|

|

MA |

Boston |

242,408.0 |

B- |

|

|

DE |

Wilmington |

241,083.5 |

C |

|

|

Total |

8,290,062.9 |

The above list only shows the bank asset size, but with the new and improved Weiss Ratings website you can compare additional data side by side:

- Select the desired bank (let’s use Bank of America, NA in this case) and then click on Comparison tab found on the left hand side of each bank’s page.

- Now you can add three more banks and compare their financials side by side.

- You may also compare a bank against the entire industry using the Industry Comparison

Insurance

Weiss Ratings upgraded 129 property and casualty insurers and downgraded 11 based on its analysis of third quarter 2015 results. Weiss, the nation’s leading independent provider of bank, credit union and insurance company ratings, analyzed over 2,300 insurers providing property and casualty coverage.

Weiss Ratings recommends that consumers do business with institutions receiving a Weiss Safety Rating of B+ or better. Currently, 59 property and casualty insurers, or 2.5 percent, are rated B+ or better, meriting inclusion on the Weiss Recommended List.

You may also check out Weiss Ratings’ Recommended Insurers by Sate. Simply select your state and type of insurance that you’re interested in and our list will show you companies recommended by Weiss.

Recent Company Failures

|

Institution Name |

Industry |

State |

Total Assets in Millions |

|

Credit Union |

MI |

68.8 |

|

|

Credit Union |

OH |

1.72 |

|

|

Credit Union |

WI |

0.2 |