I remember when Shopify Inc. (NYSE: SHOP) was a $100 stock.

It was the fall of 2017, and I was with another financial publishing company. Indeed, I was recruited to help entrepreneur, venture capitalist and FinTwit (that’s short for “financial Twitter”) luminary Howard Lindzon launch a monthly newsletter.

Howard’s first pick for subscribers to what we called “Peloton” (yeah, we got there before the exercise-machine folks …) in August 2017 was Zendesk, Inc. (NYSE: ZEN).

His second pick, in the September 2017 issue, was Shopify … at $110.92, based on SHOP’s closing price on Aug. 31, 2017.

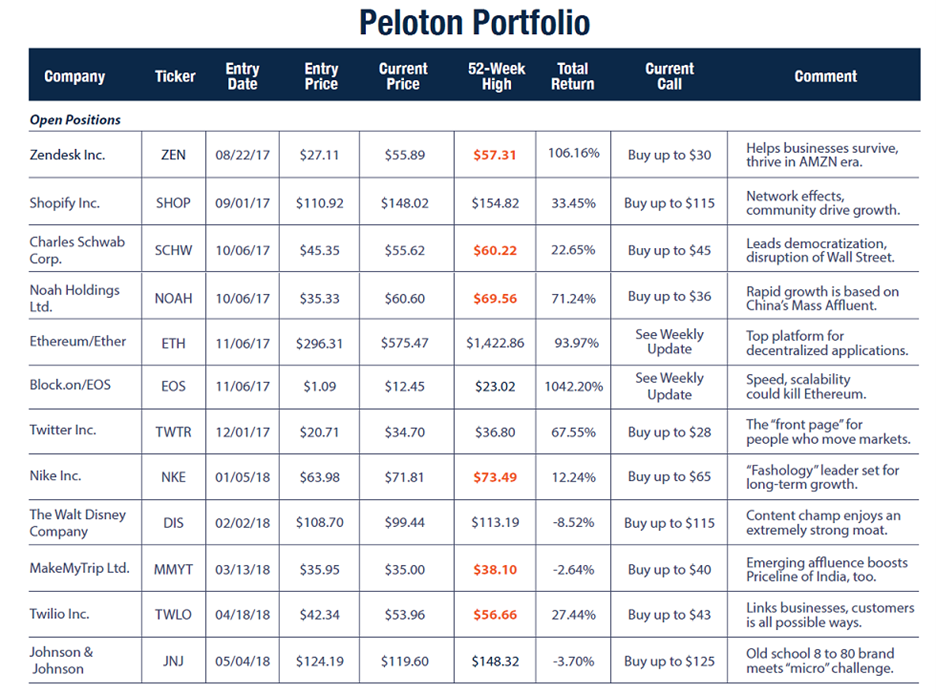

Here’s a screenshot of the portfolio table we published in the June 2018 issue:

|

Shortly after we published the original recommendation, Shopify was the subject of a hit-job research report by a notorious short-seller, and the share price fell from a post-initial-rec intraday high of $123.94 on Sept. 18, 2017, to as low as $89.35 by Oct. 10, 2017.

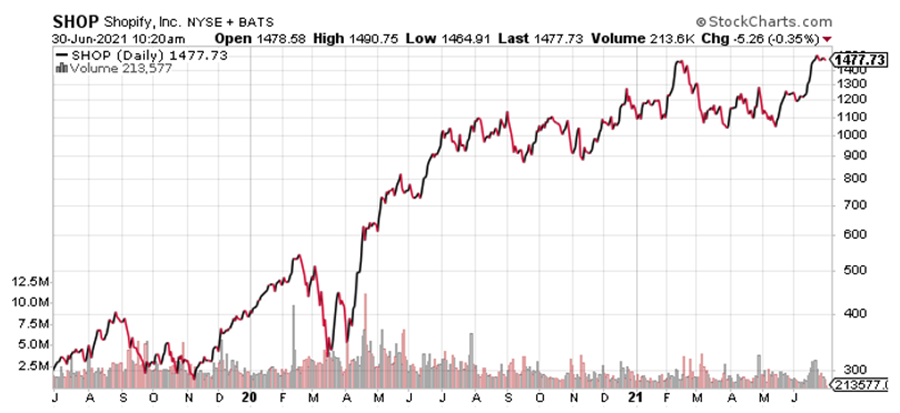

Well, as Jon Markman details in the June 30, 2021, issue of Pivotal Point, Andrew Left of Citron Research got it way wrong. A closing price north of $1,450 per share heading into the long Fourth of July weekend is all the evidence necessary to support that claim.

In fact, far from a “good ol' get-rich-quick scheme,” Shopify looks like it could one day earn its way onto Jon’s “Power Elite” list:

Few investors originally saw it coming, yet a once small e-commerce software developer out of Canada is on the verge of becoming the industry behemoth.

Managers at Shopify Inc. (NYSE: SHOP) announced on Tuesday that the e-commerce platform would no longer take commissions from developers with less than $1 million in sales. The developer-friendly play is a bid to strike while the iron is hot.

Many investors still don’t know or understand Shopify. The Ottawa, Canada-based company is an unusual success story.

The company builds software and services to help main street businesses move their storefronts online. Marketing gurus call this sort of thing an omnichannel, the ability for customers to buy products both online and in physical stores.

In the beginning, Shopify merchants had to do their own fulfillment. That meant schlepping products down to the local FedEx Corp. (NYSE: FDX) or post office.

However, in June 2019, The Financial Post reported fulfillment was coming in-house. Shopify managers also announced new customer-friendly online tools and a software developer kit that made it easier to embed applications on small business websites.

The additions made Shopify a full cloud-based e-commerce platform.

Mom and pop shops could easily monitor their web, mobile, social media and physical storefronts. The new tools take the hassle out of managing inventory, processing orders and building customer relationships. And the new omnichannels gained access to robust data analytics, financial reporting tools and financing, too.

All of these developments coincided with rapid changes at Amazon.com, Inc. (Nasdaq: AMZN).

Under its Marketplace and Fulfilled by Amazon business segments, third-party sellers rented warehouse space and had their online orders processed and shipped for a fee.

The strategy was a win for customers who got more choices. Merchants obtained all of the operational scale benefits of fast processing and cheap shipping. And Amazon.com secured a fully stocked store while actually earning a fee to hold inventory.

The business model is a cash cow that other large technology companies would love to duplicate.

Facebook, Inc. (Nasdaq: FB) announced Shops in May 2020. Walmart Inc. (NYSE: WMT) Marketplace came only a month later. TikTok For Business began in October 2020, an ambitious plan to bring e-commerce to its social media members. And at the Google I/O conference in May, Alphabet, Inc. (Nasdaq: GOOGL) CEO Sundar Pichai announced the search giant was working on a technology partnership with Shopify.

The kicker? All of these companies share Shopify as their backend partner.

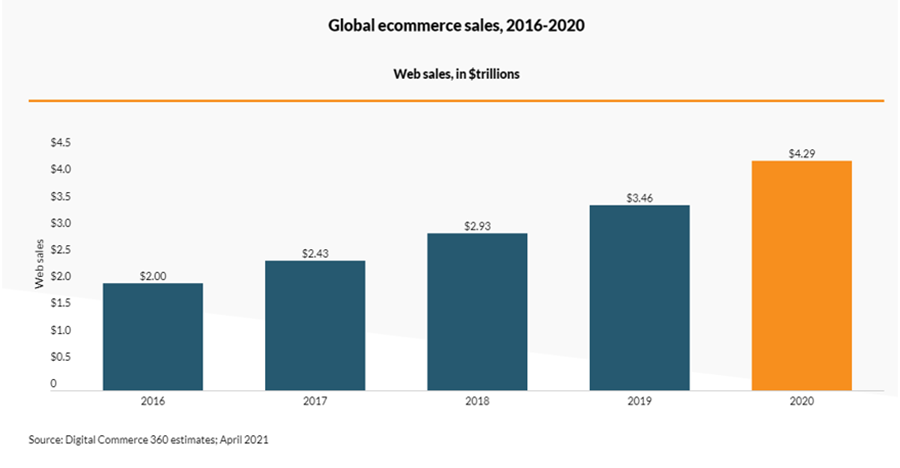

The global e-commerce market in 2020 was worth $4.3 trillion, up 44%, according to research from Digital Commerce 360. And Statistica, another data analytics company, shows that online sales are projected to reach 17.5% of overall sales by 2021.

That mind-boggling sector growth is one thing, but what makes Shopify so attractive to big partners like Facebook, Walmart, TikTok and Google is the strength and scale of its software offering.

Building a robust store at Shopify is a plug and play operation that gives third-party sellers everything they need to quickly establish a presence online. It’s the perfect backend. All of the heavy lifting has been done.

Shopify managers carved out a nice, scalable business that doesn’t threaten its big partners.

That’s why getting smaller developers on board is so important.

Shopify managers want to ensure growth by making sure developers have the tools and the right incentives to keep helping clients choose Shopify.

At the Unite 2021 conference on Tuesday, the company announced new application programming interfaces (APIs), more developer tools and frameworks and very newsworthy elimination of commission on the first $1 million in developer sales.

It’s a better deal for makers than at Amazon.com, Apple, Inc. (Nasdaq: AAPL) and Google.

The new storefront APIs will put Shopify servers within 50 milliseconds of every buyer on Earth, according to managers. Hosting has been expanded to every continent.

Developers earned $233 million in 2020, more than 2018 and 2019 combined. And there are now more than 6,000 available apps in the Shopify App store.

Shares trade at 297 times forward earnings and 53.6 times sales. While this may seem expensive, the more important metric is the size of the market and the likelihood Shopify will use its partnerships with big tech and developers to grow market share.

Longer-term investors should consider buying Shopify into any near-term weakness.

For continuing coverage of companies that find ways — year after year, through good economies and bad — to create shareholder value, check out Jon’s newsletter, The Power Elite.

Best,

David Dittman