Three ETFs Under $100 to Ride the Next Leg of This Historic Bull Market Higher

They're all beating the S&P 500 this year and poised to keep outrunning the bull

This run-up is remarkable. Wall Street barely blinks an eye at news from 1600 Pennsylvania Avenue that would have sent lesser bull markets shaking all the way down to their cloven hooves.It's been a week of milestones. Today marked the 3,454th day the bull has been running — besting the longest bull market on record that ended in March 2000. And the small-cap Russell 2000 and S&P 500 both hit all-time highs this week.

That's thanks to solid earnings across most industries … truly innovative companies … winning management teams … and, interestingly, fewer stocks to trade.

That's right. The bull's stamina is partly due to the fact that it's simply leaner.

In the wake of the financial crisis, private-equity shops and investment bankers borrowed money for next to nothing. And they used it to buy stocks and even whole companies to take private. And with so much venture capital sloshing around, fewer companies see a need to go public at all.

It's no wonder, then, that Exchange-Traded Funds (ETFs) have exploded in popularity. ETFs are one of today's hottest investment classes because of the relative safety and good returns they offer.

Here at Weiss Ratings, we rank upward of 1,900 ETFs. We also offer an ETF screening tool that's designed to help you find the best exchange-traded product for your needs.

In honor of this week's market milestones, our team set out in search of ETFs that can help you ride the next leg of this historic bull market higher.

Not only did we find three fantastic candidates with "Buy" ("B" or better) ratings that are all trading under $100, but most are much cheaper than that. Plus, it's the potential returns they can make that we don't want you to miss out on.

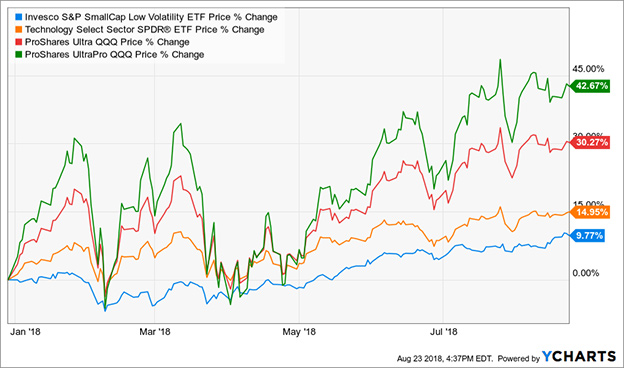

They're all handily beating the S&P 500 this year, too. The broader-market index is up just 6.9% in 2018. But this trio of ETFs is up 9.8%, 15% and 30.3%, respectively.

|

|

XSLV is up 9.8%, XLK is up 15%, QLD is up 30.3% and TQQQ is up 42.7% year-to-date. |

The criteria we used to find these ETFs is shown below.

• At least a "B" Weiss Rating

• 6-month return of at least 10%

• 1-year return of at least 20%

• 3-year return of at least 60%

• 5-year return of at least 100%

• A closing price of under $100 a share

Pick #1: Invesco S&P SmallCap Low Volatility ETF (XSLV, Rated "B"). This fund tracks the S&P SmallCap 600 Low Volatility Index, which focuses on 120 of those 600 small-market-cap-stocks. By focusing on stocks with the lowest volatility, the fund aims to give you the returns without the roller coaster ride.

XSLV has an expense ratio of 0.25%. It comes with fair levels of risk and offers some compelling potential rewards. The six-month return is 15.5%, one-year return is 21.4%, three-year return is 64.74%, and a five-year total return of 101.2%. So, if you had bought this fund five years ago, you could have doubled your money.

Moreover, the price was recently $51.02, making this ETF worth considering in any size portfolio.

Pick #2: Technology Select Sector SPDR (XLK, Rated "B"). This ETF offers another way to play the red-hot tech sector — this time without leverage. Along with lower levels of risk, XLK also offers some nice potential rewards.

XLK has an expense ratio of 0.13%. It has six-month return of 10.12%, a one-year return of 28.15%, a three-year return of 94.54%, and a five-year total return of 150.5%. Along with great returns this ETF comes with a $73.16 price tag, which is still well below our $100 target.

Pick #3: ProShares Ultra QQQ (QLD, Rated "B+"). This fund lets you make a leveraged bet on the tech sector. QLD offers 2x leverage. So, for every $1 move in the Nasdaq-100 Index, QLD seeks to return $2.

QLD has an expense ratio of 0.95%. Using leverage means you'll be exposed to additional trading risk. But that offers bigger potential returns. It has a six-month return of 16.93%, a one-year return of 52.62%, a three-year return of 186.79%, and a five-year return of 413.41%.

QLD has the highest price tag of the bunch, at $95.85.

BONUS — For Speculators Only

ProShares UltraPro QQQ (TQQQ, Rated "B+"). Like QLD, this ETF lets you make a leveraged bet on tech. But rather than a double-leveraged fund, this is a TRIPLE-leveraged way to bet on technology.

TQQQ has an expense ratio of 0.95%. It seeks to deliver three times the daily returns of the Nasdaq-100 Index. In other words, TQQQ should rise 3% for every 1% that index rises.

Three-times leverage is risky. And in a down market, it can be very risky. But this risk comes with equally outsized reward potential. The six-month return is 22.92%, the one-year return is 79.9%, the three-year return is 330.3% and the five-year return is 873.53%. Wow! And these ETF shares trade for $66.47 apiece.

So, if you want high rewards — and you have a stomach for risk — you can consider TQQQ for speculative investing dollars.

Keep in mind that leveraged ETFs are designed to be short-term trading tools. So be sure to keep a close eye on your account if you're trading them. While you can rack up gains fairly quickly, you can also lose them just as fast if you aren't ready to cash out and preserve capital.

Be sure to do your homework before investing in any ETF, especially one that offers leverage. And if you are interested in seeing what other ETFs you can find using our screener, consider joining other Weiss Ratings Platinum members in gaining exclusive access to this powerful tool.

You can save any screener you create, to refer back to at any time. And because this data is continually updated, Weiss Ratings automatically adjusts all data and ratings for you.

So if you haven't tried this amazing tool, just start by clicking here. This tutorial will walk you through everything you need to know to generate your custom screener.

Best,

Gavin Magor

Director, Weiss Ratings

Weiss Ratings LLC financial analyst Shane Moore contributed to this report.