I usually like to take this time to look at a particular section of the stock market that’s in the headlines and see which stocks in that sector are performing the best, according to the Weiss Ratings.

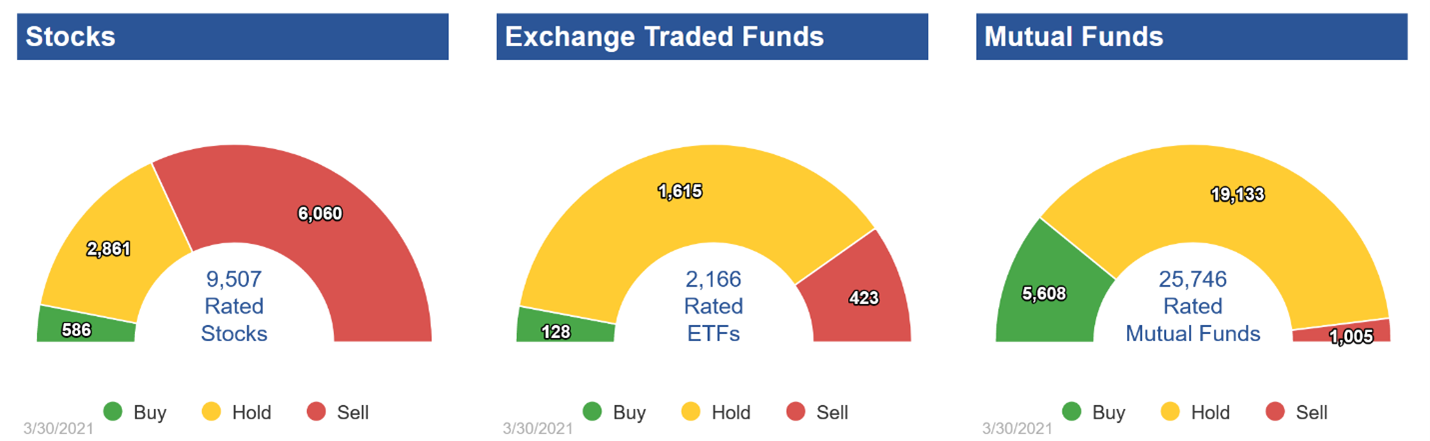

But that’s not all these tools are good for. We also apply Weiss Ratings to exchange-traded funds (ETFs) and mutual funds. This means that you can search for specific companies on our website, or you can use the screener to sort through specific parameters for each type of investment.

|

Out of all the times that I’ve written to you over the past year, I think I’ve only mentioned ETFs once. But today, we’re going to take a closer look.

Exchange-traded funds have been around since 1993 and were popular with investors looking for alternatives to mutual funds. Although similar to mutual funds, ETFs are passively managed, and so they can have lower fees than their counterparts.

Generally, ETFs are considered to be low-risk investments. This is not only because they are generally lower in cost, but because they hold a basket of stocks, they can be useful in building a more diversified portfolio. If one stock in an ETF experiences weakness, there won’t be too much loss realized by the ETF as a whole, allowing investors to ride out short-term, targeted volatility.

Plus, since they trade like a stock on an exchange, it’s still pretty simple to buy and sell when you want to.

If you look back at the sectors overview above, you’ll see that there are 128 ETFs rated with a “Buy” signal right now. So, let’s take a look at the top four and see how they might be useful in our portfolio.

First up is the iShares Silver Trust (NYSEArca: SLV). This is the oldest ETF containing physical silver. Yes, the fund attempts to reflect the performance of the price of silver. It does so by holding physical silver held by a third party in New York and London — allowing investors to easily access the precious metal without having to own their own (and pay for its storage!).

I know, I know. I just said above that ETFs are passively managed. This one is an exception. We’ve seen inflationary warning signs flash in recent weeks. If that continues, precious metals will start looking more and more attractive to investors.

Shares are up 4% over the past six months and 75% over the past year.

Second is the Technology Select Sector SPDR Fund (NYSEArca: XLK). This particular fund works to track with the Technology Select Sector Index.

Its top holdings are Apple Inc. (Nasdaq: AAPL) and Microsoft Corp. (Nasdaq: MSFT). It also holds other big tech names such as Adobe Inc. (Nasdaq: ADBE), International Business Machines Corp. (NYSE: IBM) and PayPal Holdings Inc. (Nasdaq: PYPL).

It’s no secret that these companies, like so many other technology companies, outperformed over the past year despite the overall economic weakness due to pandemic shutdowns.

In fact, some companies may have prospered because of everything that was going on as many people found they became more reliant on technology as they transitioned to doing everything from their computers and smartphones.

Analysts don’t think this trend will go away when the pandemic finally ends, however. They say this digital shift was coming anyway. That lockdown just sped up the work-from-home/stay-at-home trend.

Shares are up 13% over the past six months and 62% over the past year.

Next up, we have the Credit Suisse X-Links Silver Shares Covered Call ETN (Nasdaq: SLVO). This fund holds a position in the iShares Silver Trust I mentioned earlier, then sells call options on its position. It collects a premium every time a contract is sold. If the contract isn’t executed, great. Another can be sold on the same block of shares.

If the contract is executed, then that block of SLV shares will be sold, and money is made. Selling covered calls really can be a win-win strategy when done correctly.

This fund has a solid buy rating, and shares are up 12% over the past six months. Over the past year, shares are up 48%.

Finally, we have the Direxion Daily Semiconductor Bull 3X Shares (NYSEArca: SOXL). This fund seeks to achieve 300% of the daily performance of the PHLX Semiconductor Sector Index. This index measures the performance of companies engaged in the design, distribution, manufacture and sale of semiconductors.

We’ve looked at the semiconductor sector before. Semiconductors are a hot item right now as demand continues to increase and the supply deficit continues to expand. Companies are trying to get new plants online as quickly as possible. But even then, the process will take months, and demand is only going to increase in that time.

On top of regular market bullishness, this ETF attempts to achieve 300% of the daily performance of the benchmark fund. It does this by using a variety of financial agreements, such as swap agreements, and will also hold securities included in the benchmark.

This strategy seems to be working. Shares are up 111% over the past six months and 488% over the past year.

Silver, technology, semiconductors ... all sectors that have plenty of potential at the moment. And the ETFs mentioned above are a great way to get into these new sectors without exhaustive research or high levels of risk.

Plus, all four have solid “Buy” ratings and plenty of future potential.

Best,

Kelly Green