Weiss Ratings’ Accuracy Essential with Hurricane Season Approaching

|

|

As you saw in last week’s story, everyone living in vulnerable states needs to pay attention to tropical threats during the hurricane season. And we believe that at Weiss Ratings, we can help you accurately assess the risk that insurers face from land-falling storms.

You see, it’s not enough to suggest that all insurers can withstand the rigors of multiple claims because of one big hurricane. It would be just as bad to suggest that every insurer is at risk of failure. Neither of these scenarios is true. A consumer who is looking for some independent guidance as to where they might be best served by a homeowner’s insurer needs accurate, factual information to make an informed choice.

So this is where we step in. Weiss Ratings provides quarterly Safety Ratings for thousands of insurance companies each year. Weiss Ratings strives for fairness and objectivity in its ratings and analyses. This ensures that each company receives the rating that most accurately depicts its current financial status, and more importantly, its ability to deal with severe economic adversity and a sharp increase in claims.

In order for these ratings to be of any true value, it is important that they prove accurate over time. One way to determine the accuracy of a rating is to examine those insurance companies that have failed, and their respective Weiss Safety Ratings. A high percentage of failed companies with high, “A” ratings would indicate that Weiss Ratings is not being conservative enough with its “Secure” ratings, while conversely, a low percentage of failures with low, “Vulnerable” ratings would show that Weiss Ratings is overly conservative.

Over the past 24 years (1993 – 2016), Weiss Ratings has rated 320 P&C insurance companies that subsequently failed. The chart below shows the number of failed companies in each rating category, the average number of companies rated in each category per year, and the percentage of annual failures for each letter grade.

|

| *Percentage of Failed Companies per year = (Number of Failed Companies) / [(Average Number of Companies Rated per year) x (years in study)] |

On average, only 0.08% of “Secure” companies fail each year. On the other hand, an average of 2.04% of the companies Weiss Ratings rates as “Vulnerable” fail annually. That means that a “Vulnerable” property and casualty insurer is 25.5 times more likely to fail than a “Secure” one.

At Weiss Ratings, we consider the words “Average” and “Fair” to mean just that – average and fair. So, when we assign our ratings to insurers, the largest percentage of P&C insurers receive an average “C” rating. As a result, you can be sure that a company receiving a Weiss “B” or “A” rating is truly above average. Likewise, you can feel confident that companies with “D” or “E” ratings are truly below average.

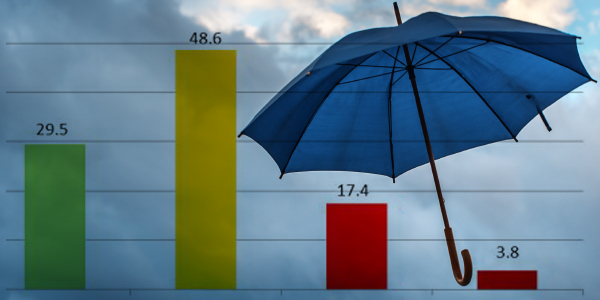

Percentage for Property and Casualty Insurers in Each Rating Category

The distribution above clearly shows that we do not simply stuff all of the companies we rate into the “Vulnerable” insurer bucket. Only 21.2% of property and casualty insurers are considered “Vulnerable,” while 78.9% of insurers are considered “Secure.”

We believe these facts should give you confidence in our ratings and we recommend you follow your insurance companies by signing up and using the Weiss Ratings Watchlist. That way, we can notify you if there is a change of rating and a potential safety issue.

Think Safety,

Gavin Magor

Insurance Insights Edition, By Gavin Magor, Senior Financial Analyst Gavin has more than 30 years of international experience in credit-risk management, commercial lending and insurance, banking and stock analysis and holds an MBA. Gavin oversees the Weiss ratings process, developing the methodology for Weiss’ Sovereign Debt and Global Bank Ratings. Gavin has appeared on both radio and television, including ABC and NBC as an expert in insurance, bank and stock ratings and has been quoted by CNBC, The New York Times, Los Angeles Times, and Reuters as well as several regional newspapers and trade media. |