Telefonaktiebolaget LM Ericsson (publ)

ERIC

$11.17

-$0.01-0.09%

NASDAQ

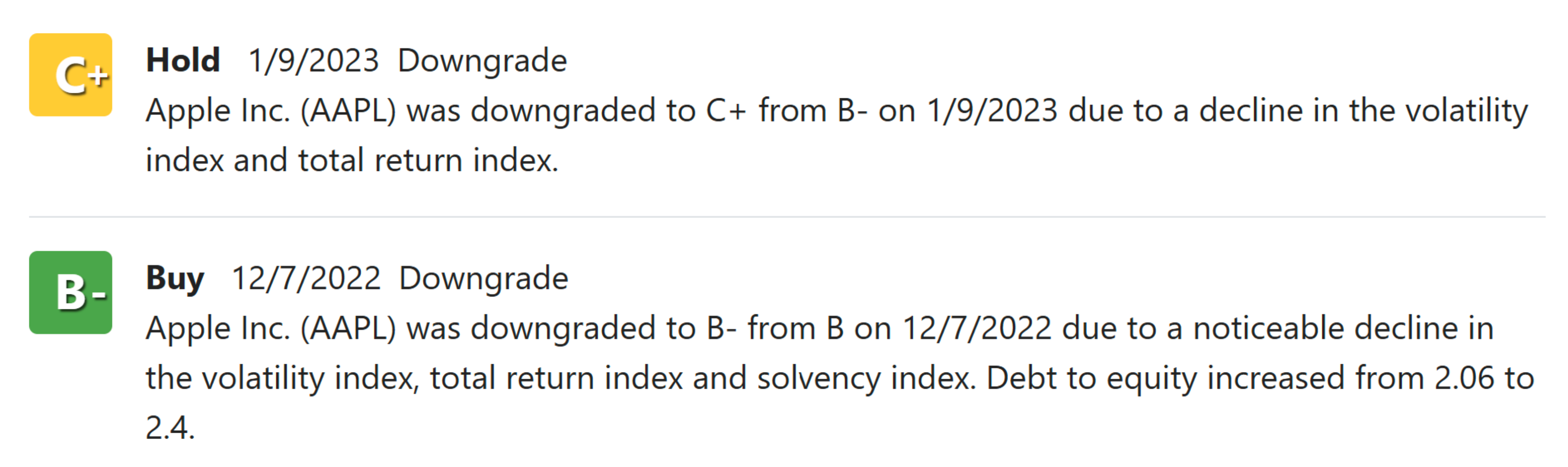

Recommendation

Dividend Power Score

Prev Close

Volume

Avg Vol (90D)

Market Cap

Dividend & Yield

P/E (TTM)

EPS (TTM)