Banco Santander, S.A.

SAN

$12.36

-$0.58-4.48%

NYSE

Recommendation

Dividend Power Score

Prev Close

Volume

Avg Vol (90D)

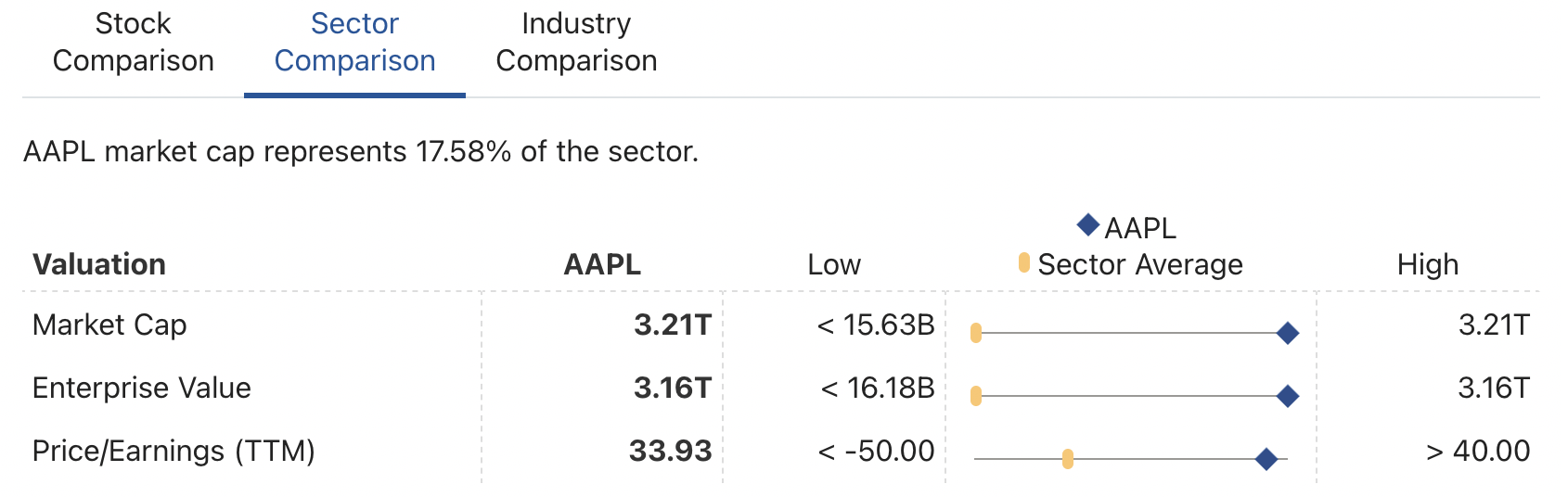

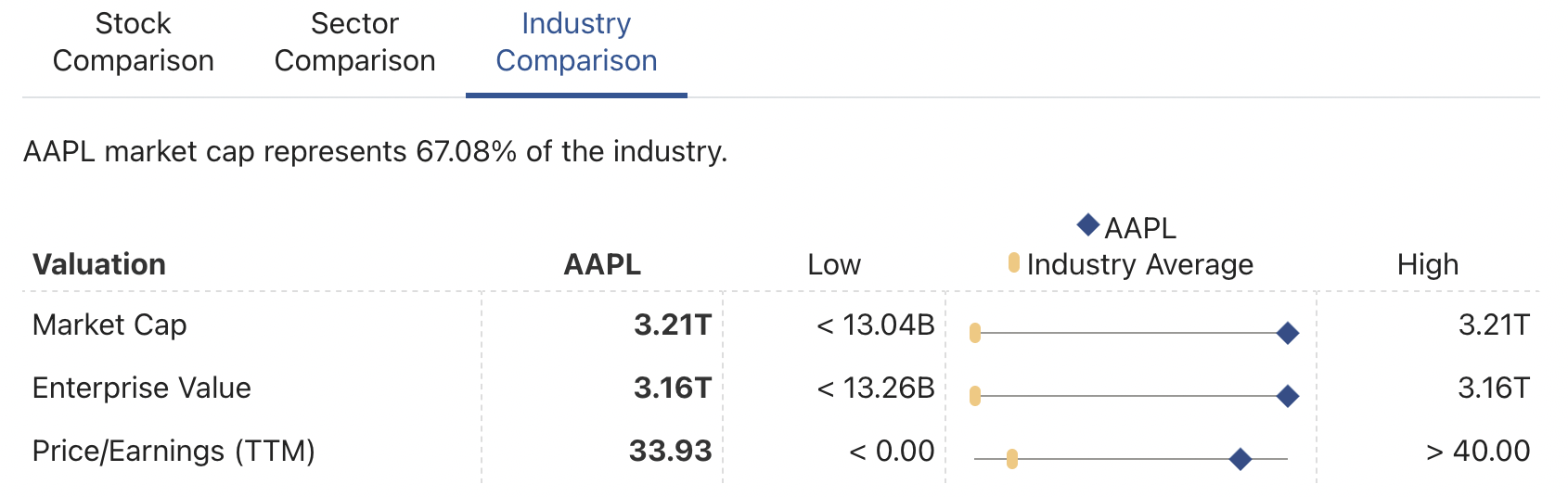

Market Cap

Dividend & Yield

P/E (TTM)

EPS (TTM)