On Wednesday, marijuana became recreationally legal in Canada. There were hiccups — there was just one legal store in the entire province of British Columbia. But where it was legal, people lined up overnight. Heck, the Shopify e-commerce platform saw its cannabis store orders blur to more than 100 orders per minute!

Now there’s talk, despite earlier worries of oversupply, that Canada won’t have enough legal cannabis to meet demand this year.

Many investors celebrated the day by selling the news. The Horizons Medical Marijuana Life Sciences ETF (TSX: HMMJ), a basket of leading Canadian pot stocks, dropped 2.1% on the day, though it rallied well off its lows and surged 2.2% in early trading today.

I think many investors will regret running out the doors too early. The Great Green Rush into cannabis has barely begun. In the U.S. alone, the marijuana market is expected to explode to $47.3 billion by 2027. That’s according to ArcView Market Research and BDS Analytics. And worldwide, cannabis sales could hit more than $200 billion by 2032.

Today, I’m going to tell you about two areas of the North American cannabis market that are on the launchpad.

Area #1: Medical Marijuana Sales

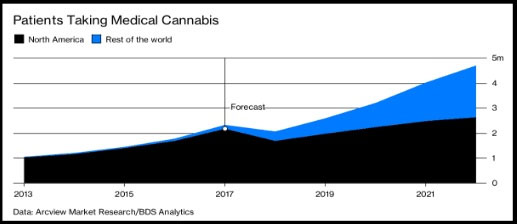

The number of people using medical marijuana is expected to soar. And more than 20 countries — including Germany, Mexico and Australia — have approved the use of medical marijuana.

Indeed, the number of patients using prescription marijuana is projected to double in the next four years.

As a result, the global medical pot market could be worth more than $50 billion by 2025, up from $8 billion in 2017 — and 10 times the projected size of Canada’s total marijuana sector. That’s according to an estimate from PI Financial Corp.

There is a loser in this: Global pharmaceutical companies are terrified that medical cannabis will be substituted for their prescription opioids.

So, going long medical marijuana companies and short pharmaceutical giants that manufacture opioids is one potential trade. There is another …

Area #2: Mmm-mm Edibles

When Canada legalized marijuana recreationally, it left a giant gaping hole: cannabis edibles. Those aren’t legal in Canada. Yet.

That gives the advantage to many U.S. states that have already legalized edibles. I told you about America’s advantage in this area in my recent article, “Let’s Beat Those Canadian Potheads at Their Own Game”.

But Canada will legalize edibles. Probably next year. And after that, edible sales in the U.S. and Canada are going to shift into high gear:

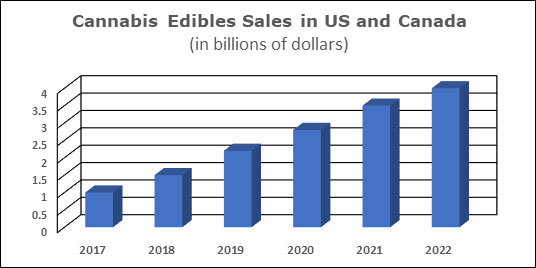

Spending on edibles in U.S. and Canadian markets hit $1 billion in 2017. That’s according to a new report released by Arcview Market Research in partnership with BDS Analytics.

Research says that edible sales will continue to grow, reaching $1.5 billion in 2018 … $2.2 billion in 2019 … $2.8 billion in 2020 … $3.5 billion in 2021 … and eventually topping $4.1 billion in sales in 2022.

From $1 billion to $4.1 billion in five years — wow! You can see the potential.

There are plenty of ways to play these two explosive investment opportunities. Some are in the ETFMG Alternative Harvest ETF (NYSE: MJ). That’s a fund that holds a basket of the best cannabis stocks in the world. And despite Wednesday’s sell-off, it is holding its uptrend nicely.

You can also buy individual stocks. I’ve recommended some to my subscribers in the past — and done very well — and we’ll trade more going forward.

If you’re doing this on your own, do your due diligence. But recognize that these mega-trends aren’t the only things pushing select pot stocks higher. My Supercycle Investor subscribers currently have bets on a fantastic foursome of marijuana movers and shakers …

One just secured a major medical sales license. Another saw its revenue more than triple last year. Yet another just signed a $9 million deal to supply marijuana to another company. And the fourth is greasing the wheels of the “budding” CBD oil market. You can get all these names, and more, when you click this link here.

The Great Green Rush is on. The legalization in Canada is just the first wave. Grab your surfboard, and get ready to ride the big one. It’s going to be awesome.

All the best,

Sean