There’s a staring contest going on in the global oil markets right now. On the one side is the Russia-OPEC alliance. On the other is U.S. oil producers. You can get crushed if you get caught between the two. But there is also the opportunity for extraordinary profits.

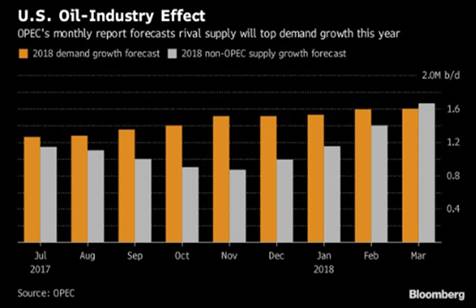

First of all, I wrote a story in March explaining how U.S. oil production and exports were rising faster than the Russia-OPEC alliance could cut production. We know this because OPEC says so. They recently put out a chart showing that non-OPEC supply growth is rising faster than demand.

The blame rests squarely on U.S. producers, who aren’t cutting back production. In fact, they’re expanding it.

The good news is that the U.S. has plenty of low-priced producers. I’m talking about companies that plenty of money at current oil prices … and will continue to make money if prices fall.

And we know where to look for these companies. Here’s a chart that shows the AVERAGE operating expenses in each of the major U.S. oil basins …

You can see that operators in the Permian’s Midland basin, Central Oklahoma’s SCOOP/STACK shale play (I don’t come up with these names), and the Permian’s Delaware basin have the lowest operating costs.

You’ll see that Permian is on this chart three times. That’s because it is one of the largest, most structurally complex oil-and-gas regions in North America.

The Permian covers an area about 250 miles wide and 300 miles long in west Texas and southeast New Mexico. That’s more than 75,000 square miles!

In any case, the Permian, or at least certain parts of it, is a great place to find, develop and pump oil. It’s dirt-cheap.

So, now that we know where to look, what companies do we look for?

I’d suggest those companies that are raising their capital expenditure budgets. After all, they’re doing it for one reason: They make money!

And here is a handy chart of those companies boosting capex …

EOG Resources (NYSE: EOG) is boosting its capex the most. Coincidentally, it has a large Permian Basin presence (along with other areas from southern Texas to the Canadian border).

Chevron (NYSE: CVX) is No. 2. This company has plenty of offshore and foreign exploration plays, so it’s not strictly leveraged to shale. But it is one of the largest producers of oil and natural gas in the Permian.

Anadarko (NYSE: APC) is No. 3. And sure enough, it’s a major force in the Permian’s Delaware Basin.

EOG and Chevron made a lot of money in the most recent quarter. Anadarko didn’t. But that will change this year.

And if these companies have lower costs — and they do — then you can’t blame them for spending more money.

Next, we must figure out the direction of oil prices.

I’ve made no secret of the fact that I believe oil prices are headed lower in the short term. Speculators can play that for profits. Longer-term investors will grin, bear it and ride it out.

Longer-term, there are some developments afoot that could cause the price of oil to swing wildly.

The Russia-OPEC alliance is supporting prices by keeping a lid on production. That should be extended at the end of the year. If the production caps aren’t extended, that’s bearish.

On the other hand, we’ll probably see Iranian oil and gas production in jeopardy sooner rather than later.

For one thing, missiles are raining down on Saudi Arabia. They’re fired from Yemen — where the Saudis are conducting an ugly little war. But the Saudis blame Iran for the missiles. The two nations are hereditary enemies. And the Kingdom’s foreign minister accused Hezbollah, the Lebanese Shiite militant group aligned with Iran, of smuggling missile parts into Yemen.

Add to that, President Trump made John Bolton his National Security Adviser. Mr. Bolton is one of the architects of the Iraq War. And he strongly believes Uncle Sam should open a can of whup-ass on Iran. He makes no secret of his views. You can read them HERE.

Looking at this, I think the odds favor a potential embargo of Iranian oil and nat-gas exports. If that doesn’t work, we’ll probably see armed conflict.

Iran exports 2.13 million barrels of oil per day. That’s not a lot. But, Saudi Arabia exports much more. About 7 million barrels per day. And it exports a lot of refined products, too. And the Saudi peninsula is well within the range of missiles fired from Iran.

So, add this all up, and a potential conflict is a bullish force for oil prices.

Now, add in that U.S. oil companies are leading the way on new technological improvements that lower the cost of oil production all the time. This means the better oil producers should be able to ride out a dip in oil prices quite well. And they will be well positioned for the next leg higher when it comes.

And if John Bolton has anything to say about it, probably sooner than later.

Not all oil producers will do well. In fact, heavily indebted oil companies, and companies with higher production costs, could be in for a world of hurt.

But choosy investors, who are highly selective in their picks, could do very well indeed.

Best,

Sean