3 Reasons Why the Commodity Boom Is Just Getting Started

Iron prices are at their highest level since 2011 … steel prices are at a record high … copper stays stubbornly near the new highs it hit in February … crude oil roared to more than $65 in March and remains strong … palladium is banging on overhead resistance … corn, up … soybeans, up … everything is up, up, UP!

Globally, commodity prices are roaring, along with a revitalized global economy. And yet, no sooner does that happen than party poopers come out to take away the punch bowl and say prices are near a peak. Don’t believe them!

For example, Deutsche Bank Aktiengesellschaft (NYSE: DB)’s research arm put out a note warning that growth, as measured by the Institute for Supply Management (ISM)’s manufacturing index, typically peaks 10 to 11 months after a recession ends. In other words, now.

Fat chance!

To me, it looks like 2021 could see the best economic growth in nearly four decades. And what do you think that will do to the price of commodities? Bang, zoom! To the moon, Alice!

Let me give you three more reasons, all commodity-focused, why this boom is just beginning.

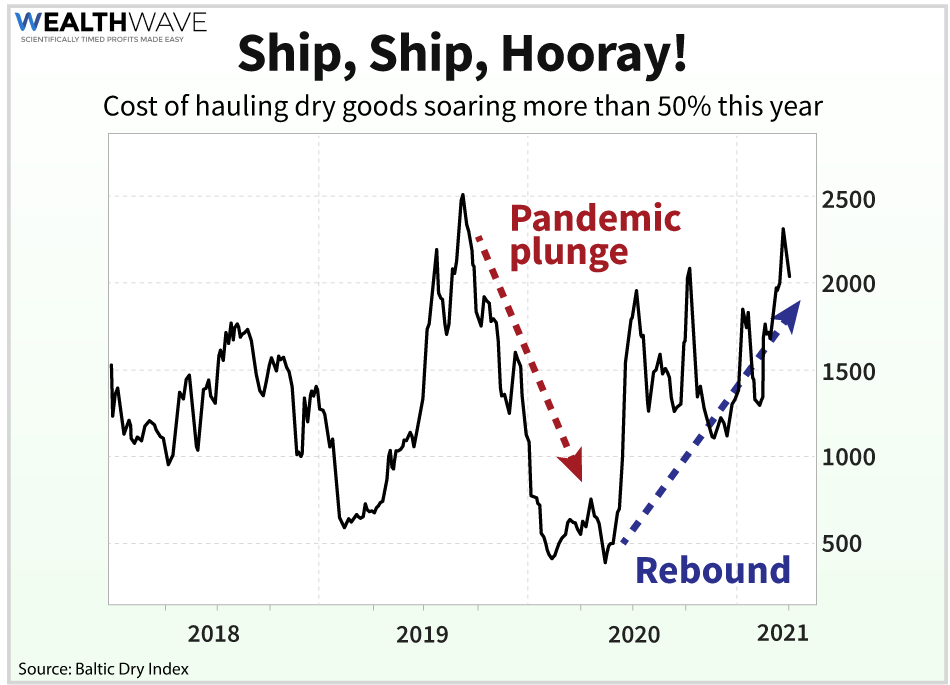

Reason 1: Shipping Rates Are Soaring

The Baltic Dry Index tracks the cost of shipping goods around the world, and the cost of hauling dry goods has soared more than 50% this year.

International shipments are so big, the cost of hauling in Panamax ships — ships that fit the size limit of the Panama Canal — jumped to the highest level in more than a decade.

Reason 2: The Economy Is on a Roll

Meanwhile, the Fed is raising its expectations for U.S. growth this year. And an ISM survey showed the U.S. services industry activity surged in March to a record high. That data also followed Friday’s report that revealed U.S. non-farm payrolls jumped by 916,000 jobs in March wa-a-ay above expectations of 647,000.

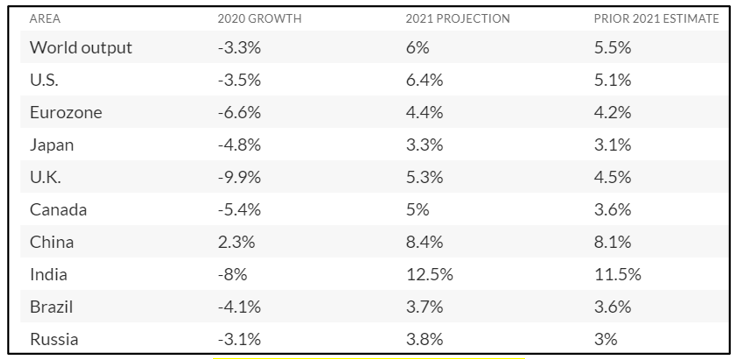

Meanwhile, the International Monetary Fund (IMF) just hiked its U.S. outlook in 2021 to 6.4% this year from 5.1%. The U.S. should see solid 4.4% growth in 2022. And the IMF raised growth forecasts all over the world …

As global economies grow, what do they need?

Iron, steel, copper, aluminum, oil, gas, rare-earths, corn, wheat and more!

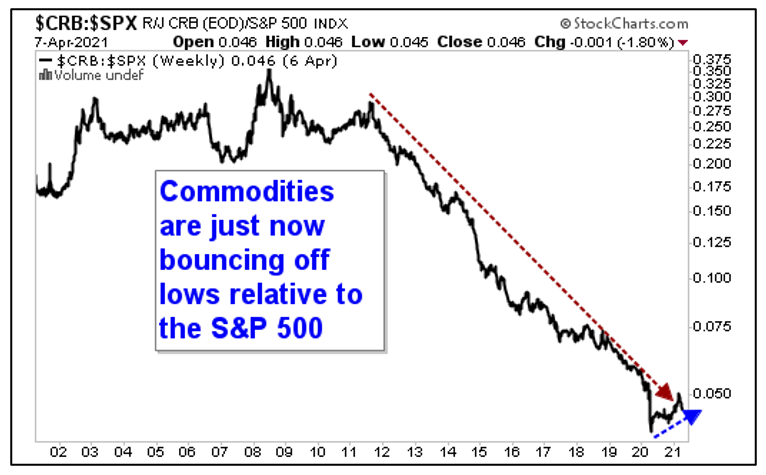

Reason 3: Commodities Are at Lowest Price to Stocks … Ever!

The S&P 500 is the most expensive relative it has ever been compared to commodity prices. That’s according to longtermtrends.net, which has nice charts on the subject.

For me, talking about 150 years of prices seems like too long of a timeline. But let me show you the price of the CRB Index — a basket of leading commodities — divided by the S&P 500 over the past 20 years.

Wow! You can see the CRB Index just put in a bottom relative to the S&P 500 in the depths of the pandemic last year.

Sure, some of this is due to the steady rise of stock prices. But here’s the thing: Even if we ignored the effects of inflation — which are considerable — for the CRB Index to rally back to the peak it hit in June 2008, it would need to rally 61%.

That’s not taking into account soaring demand due to a global economic boom … the commodity-hungry infrastructure plan that President Biden just rolled out … or looming supply/demand squeezes in all sorts of commodities due to years of underinvestment.

So, you add it all up and, commodities are just starting their bull run.

There are easy ways to play this move, including the Invesco DB Commodity Index Tracking Fund (NYSE: DBC). It has a total expense ratio of 0.93% and is very liquid.

In my premium publications, I’m recommending stocks that are leveraged to this boom. Because I know they’re going to zoom.

Do your own research. In my opinion, pullbacks can be bought. This big bull run has a long way to go.

All the best,

Sean