You might remember the Esso gasoline commercials from the 1960s, advising consumers to “put a tiger in your tank!”

In the ‘70s, Esso became part of the company now known as ExxonMobil (NYSE: XOM) here in the States. However, you’ll still see the name in Asian and European markets.

Many investors believe fossil fuels would go away, just like Esso did.

That’s because ambitious climate goals, clean energy and green technology all seem to put an expiration date on the ancient hydrocarbons.

The Quick-and-Dirty of Energy Investing

I’m personally a big believer in the electric vehicle (EV) megatrend. Especially in the lithium that goes into the batteries that will drive this trend forward. Accordingly, I have my paid-up subscribers investing for this inevitable future.

In the meantime, I also know we’ll use oil, gasoline and other nonrenewable resources for many years to come. And I have them investing in select names in this sector, too.

Just this week, crude oil hit a seven-year high. Nat-gas made multi-year highs, too. And if investors are smart, they’re thinking about what stocks to buy to ride this wild tiger of a market.

While oil may zig and zag, I don’t think we’ve seen the top. Not yet.

The smart money is buying oil stocks. I agree this is the right move to make, right now.

In fact, let me give you three great reasons to put a tiger in YOUR tank today.

1. Demand Targets Keep Going Higher

Global oil demand is expected to reach pre-pandemic levels by early next year as the economy continues to recover.

OPEC+ sees global oil demand averaging 100.8 million barrels per day (bpd) in 2022, exceeding pre-pandemic levels, while the International Energy Agency (IEA) expects it to average 96.1 million bpd in 2021 and 99.4 million bpd in 2022 … versus 90.9 million bpd in 2020.

• What about Wall Street’s estimates? They’re even more bullish.

JPMorgan (NYSE: JPM) expects oil to hit $84 a barrel by the end of the year. Bank of America (NYSE: BAC) says Brent Crude, the international benchmark, might hit $100 a barrel in six months.

Goldman Sachs (NYSE: GS) earlier put out a $90 price target, and its head of energy research, Damien Courvalin, said in press reports this week that “When you head into winter with critically low inventories, it has the potential to be a crisis.”

And a crisis can rip the lid off prices.

2. Lack of Drilling Raises Urgency

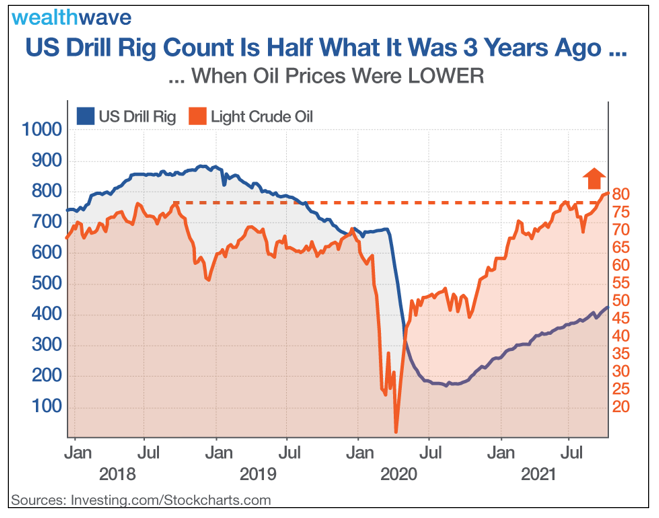

The U.S. oil rig count is rising, but it’s still only about half of what it was three years ago. And that’s weird, because oil has already rallied to the heights of three years ago … and then gone even higher!

Why?

Because oil companies have less incentive to take big risks like the kind they take in drilling.

President Biden is setting a goal to decarbonize the economy by 2050, even though power demand is expected to increase 60% by then. There’s even talk of taking away oil and gas tax incentives in the next tax bill.

That gives companies less reason to make big, long-term, or even short-term, investments in fossil fuels. Ultimately, that hurts future supply. So, the less popular oil becomes, the more it could cost.

3. Many Oil Stocks Are Bargains

It’s not just oil rigs that aren’t keeping up with the price of oil.

Many oil stocks are still beaten-down bargains … despite the recent rally.

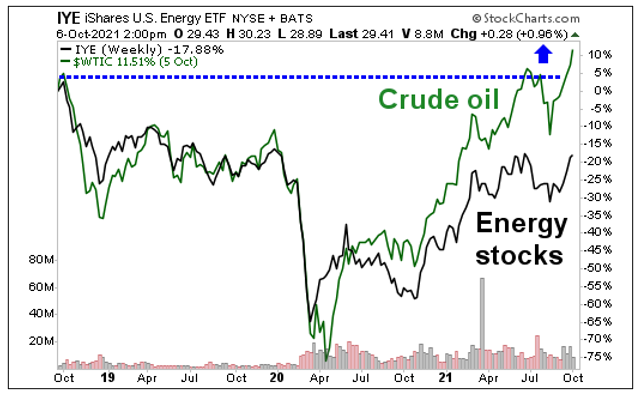

Let’s look at a chart comparing the percentage moves in the U.S. crude oil benchmark and the iShares U.S. energy ETF (NYSE: IYE), which tracks the performance of the Dow Jones U.S. Oil & Gas Index. I like it for this comparison because it’s heavily weighed towards domestic U.S. oil and gas.

You can see that crude oil recently surpassed its price from three years ago by 11.5%.

• Meanwhile, the IYE is still DOWN 17.88% from highs it made three years ago.

If you want to own more oily stocks to make the most of the rally, the IYE is a perfectly fine way to play it. Or, for the best bargains, you can do the research on individual stocks for even more potential.

Just be careful: Riding a tiger carries plenty of risks.

But for smart investors, the rewards can be worth roaring about.

All the best,

Sean