Wow, the stock market rallies for a couple days, and suddenly the bears are on the run. The bulls are back in full force, baby! This rebound is gonna rock!

Maybe.

Look, I have more long than short positions in my own portfolio. However, I am gradually shifting and using rallies to do it. I’m …

• Adding more gold miners (including juniors)

• Adding more dividend-payers (and –growers)

• Exiting momentum plays

Why? Because despite the recent rally, the odds favor a big, bad bear being right around the corner. Let me show you some charts to make my case.

Warning #1: Market Risk is Flashing Red

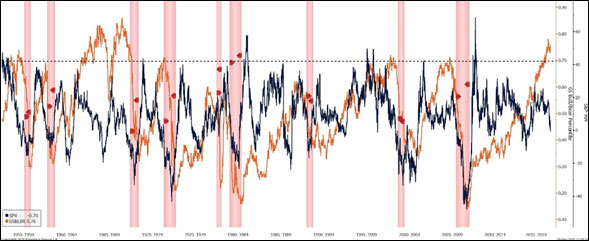

The Goldman Sachs Market Risk Indicator, aka the Bull/Bear Indicator, stands at 76%, which is the highest reading since June 1969. Each time it has hit 70% or higher, equity year-over-year returns turned negative.

Image credit: FX Street

The blue line on the chart is the S&P 500, the orange line is the Goldman Market Risk Indicator, and the pink areas are recessions.

Goldman’s bull/bear market indicator considers the unemployment rate, manufacturing data, core inflation, the term structure of the yield curve, and stock valuation based on the Shiller P/E ratio.

The bottom line is a peak at these levels has been a reasonable indicator of future recession.

And sure, there can be a few months’ lag time between this indicator sounding the warning and the U.S. sliding into recession. The problem is, the market discounts recessions before they happen.

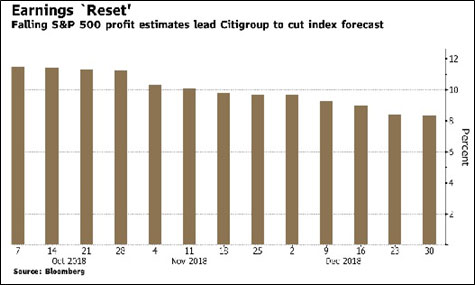

Warning #2: Falling Earnings Estimates

Citigroup isn’t waiting for the market to get worse. It’s already lowering its year-end target for the S&P 500. The reason is that analysts’ average profit growth estimate for the benchmark index is shrinking over time.

That’s not a bullish trend. And this shrinking projection of the S&P’s bottom line led the firm to lower its S&P 500 year-end estimate to 2,850 from 3,100.

Now, 2,850 is higher from recent prices — about 11.5% higher. So the bulls can take cheer from that. But I’m seeing shrinking earnings projections and remembering that the big banks are often late to the party. I expect we’ll see more earnings growth and year-end price targets to come.

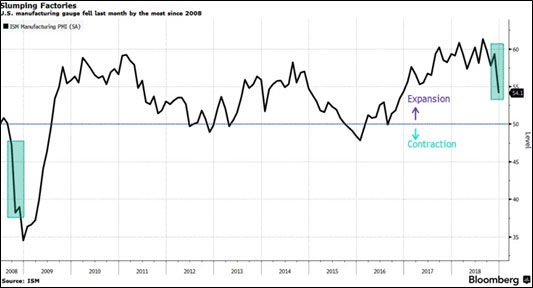

Warning #3: Manufacturing Slumps

Partying bulls are also quick to forget that some recent economic data is bad … and some is worse.

For example: Last month, the Institute for Supply Management (ISM) index dropped to a two-year low.

The drop was led by new orders, which slumped the most in almost five years. And the drop in production was the steepest since early 2012. Just 11 of 18 industries reported growth, the fewest in two years.

But that’s just the tip of the iceberg. On Tuesday, we got the ISM non-manufacturing (services) gauge. That also slowed by more than expected. It dropped to 57.6, the lowest since July.

Both these indicators are still in expansion mode, but they are slowing fast.

Some indicators are aren’t just warnings; they’re flashing red …

For example, housing sales. November home sales — the latest posted — fell 7% from a year earlier, the biggest drop since May 2011.

The fact is, the market is floating higher only because Fed Chairman Jerome Powell groveled to the markets on Friday. That’s when he promised traders “flexibility” on interest rates. He said that officials were watching anxious financial markets, and that they would adjust their plans if recent volatility caused the economy to slow more than anticipated.

As a result, the market is now pricing in NO rate hikes in 2019. Zip, nada. The market is floating higher on easy money. But that may be illusory.

All in all, it looks very dangerous to me. I would like to be more bullish, but I haven’t seen anything to change my mind yet. So, I’m loading for bear in the broad markets, and I’m stocking up on “golden bullets” for the rallying precious metals markets. I’m helping my subscribers do the same — click here to see how.

You can follow your own instincts. I’m not saying you should panic. But you should look at your portfolio positions and decide if you want to hold them if the bears start to roar again.

All the best,

Sean