You can’t turn on the TV without hearing that stocks are overpriced by this or that metric. Well, let me tell you, there is a market right now that is priced in pennies compared to where it is going to be down the road. And investors with steel in their spines will want to buy it.

So, let me tell you how to do that … in four charts.

You’ll need that steel because this market could dip and zoom like the Devil’s own rollercoaster. But it’s cheap. Oh boy, it’s cheap.

The market I’m talking about is energy metals. The metals that go into lithium-ion batteries, which in turn are the fuel source for electric vehicles.

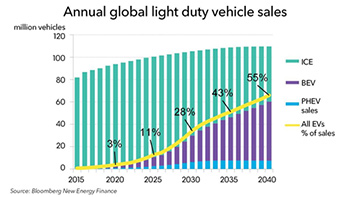

According to a new forecast from Bloomberg, by 2040, more than half of all new car sales will be electric. At the same time, EVs will account for a third of the automobiles on Earth. That’s about 559 million vehicles.

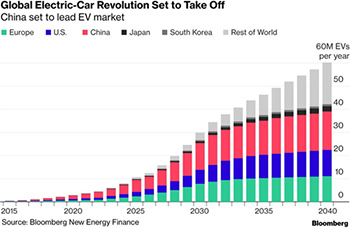

The global market for light-duty EVs — which include passenger cars — will increase from about 1 million units last year to 60 million units by 2040. That’s according to the report in Bloomberg New Energy Finance.

Here’s a chart showing how EVs will increasingly make up a larger share of the cars on the road:

Bloomberg NEF says that EVs will be 55% of the cars sold by 2040, if current trends hold.

Not surprisingly, China will lead the way. The country recorded 72,000 passenger EV sales in April — a 136% increase from a year earlier. Compare that to the 19,700 sold in the U.S. When it comes to EVs, America is not in the driver’s seat.

Carlos Ghosn also has something to say about EVs. Who’s he? Only the head of the world’s largest car company, the Renault-Nissan-Mitsubishi Alliance.

Ghosen says that “range anxiety” is overstated. Customers who buy EVs aren’t as worried about how far the cars can go as analysts think. In fact, Ghosen says EVs that travel roughly 200 miles on a single charge is more than enough.

What Ghosen says customers really care about is EVs that are more affordable. According to Bloomberg’s report, “cost parity” for EVs will arrive in the mid-2020s. That means that they’ll cost about the same as gas guzzlers.

Ghosen’s company is the parent company of Nissan, which makes the Leaf EV. The Leaf is now the best-selling electric car in the world. Sorry, Tesla.

The second generation of the Leaf zoomed into the U.S. market earlier this year with a base price just under $30,000 and a range of about 151 miles. In 2019, a Leaf with a range of 225 miles will roll out.

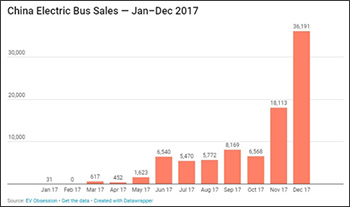

So, EV cars are shifting into higher gear. But when it comes to demand for the metals that go into EV batteries, you should really watch out for that bus!

By 2040, Bloomberg says 80% of the world’s bus fleet should be electric. And buses have big batteries — big, electric batteries.

In China, as you might guess, EV bus sales are already rip-roaring. Here are the figures from last year …

The trend is strong in this one.

Add up all the EV cars, buses and trucks. The shift from internal combustion engine (ICE) vehicles to EVs is projected to boost global electricity demand by 6% — and chip away at 7.3 million barrels per day of motor fuel demand.

That’s why the price of lithium and cobalt are at multi-year highs. And end-users — car manufacturers — are desperate to lock in supply. Heck, Tesla (Nasdaq: TSLA) just signed a three-year supply agreement with Australian lithium miner Kidman Resources — and Kidman isn’t even in production yet. If things go well — and half the time they don’t — Kidman will start producing battery-grade lithium in 2021.

Meanwhile, Chinese firm Tianqi Lithium Corp. just agreed to buy a 24% stake in Chilean lithium company Sociedad Quimica y Minera de Chile SA (NYSE: SQM). SQM is in the Wealth Supercycle portfolio.

We’ll probably see more takeovers among the world’s 100 small-but-serious lithium explorers/developers and 25 cobalt companies.

Nonetheless, can you guess who is NOT enjoying the massive rise in cobalt and lithium prices? Cobalt and lithium miners.

Many blame a report from Morgan Stanley that predicted a surplus of lithium in the near future. To get there, the Morgan Stanley analysts expect that every lithium project will come online, and do it on-time. Anyone in mining can tell you there’s a word for that: “impossible”.

Meanwhile, Morgan Stanley is also using a demand curve for lithium that is quite conservative. Do you know what all past projections for lithium demand have in common? They’ve all been too low. Way too low.

Still, the market sold off, and arguing with price action is fruitless. But now, lithium stocks seem to be finding a bottom. And that brings me to your opportunity. It’s in the Global X Lithium ETF (NYSE: LIT), a basket of leading lithium-leveraged stocks.

You can see that during the initial bull market, LIT roared higher. But nothing goes up in a straight line, so it went into correction. It sure looks like the correction is over. LIT is ready to roar again.

Whatever you buy, do your own research. Do you have steel in your spine? Are you ready to shift into higher gear with the EV megatrend? The flag for the next race is waving. What are you waiting for? It’s time to zoom-zoom!

All the best,

Sean

P.S. Hurricane season is on its way. But I’m getting my subscribers prepared for something bigger. I’m calling it “Tsunami 2020.” It will hit in seven big waves. Electric Vehicles are just the first wave. And in my next Wealth Supercycle issue, I’m detailing all seven mega-trends that we will be surfing to mega-profits. Grab your surfboard now and you’ll be able to jump on the brand-new trade I’m unleashing this Friday!