As I mentioned a few weeks ago, America is the undisputed champion when it comes to ethanol production.

And where does all that ethanol come from?

From one of your favorite dinner sides ... CORN.

Which — along with soybeans, wheat, oats and rice — are mostly traded via futures contracts on what was formerly the Chicago Board of Trade (CBOT), and which, in 2007, merged with the Chicago Mercantile Exchange to form CME Group (Nasdaq: CME).

Agricultural futures were first traded in 1848 and give farmers a general idea of how much a certain product will sell for when it's time to harvest (or slaughter).

On the “other side” of the trade, investors and speculators add liquidity to these markets ... and can profit when the price changes in their favor.

- Corn represents the largest agricultural futures market in the world ... and it’s grown in almost every temperate and tropical region of the world.

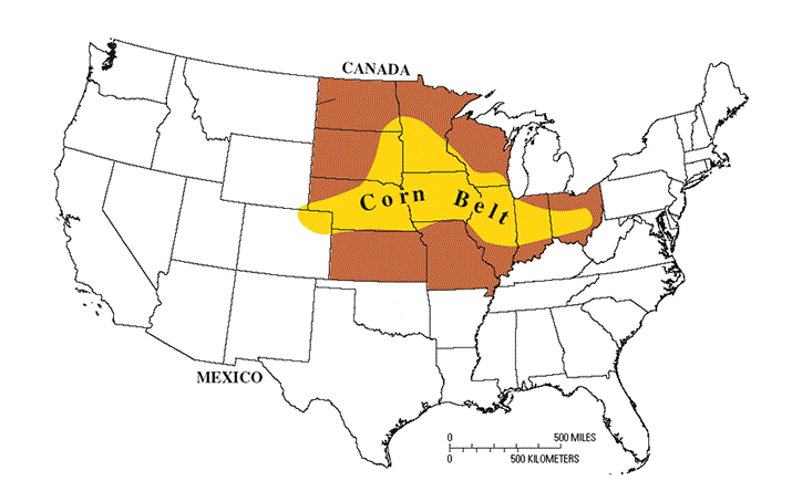

And while it’s grown in nearly every U.S. state, most is produced in the “corn belt,” which supplies over 40% of the world’s corn.

In fact, data from 2008 shows that half of the corn produced in America came from just four Midwestern states: Iowa, Minnesota, Nebraska and Illinois. Some Knead- to-Know Corn Facts:

- It was first domesticated in southern Mexico around 8,000 BC from a wild grass.

- Its cultivation had spread as far north as southern Maine by the time of European settlement of North America.

- Native Americans taught European colonists how to grow the indigenous grain.

- Since its introduction into Europe by Christopher Columbus and other explorers, corn has spread to all areas of the world suitable to its cultivation.

- About 95% of harvested corn is “dent corn” ... named for the indentation in the kernel caused by shrinkage of the starch.

- The cultivation of corn in the Corn Belt is so intense, scientists think it could be influencing the weather of the region ... even counteracting the effects of climate change. The summer temperature in the Corn Belt has actually dropped by a full degree Celsius, while rainfall in the region has increased by 35%. Scientists believe this is because photosynthesis of all that corn is adding so much more water vapor into the air.

Despite its popularity, only 8-10% of the corn crop ends up on the American dinner table. Most (55-60%) is used for livestock feed, 10-20% is exported ...

... and 35-40% is used to produce ethanol.

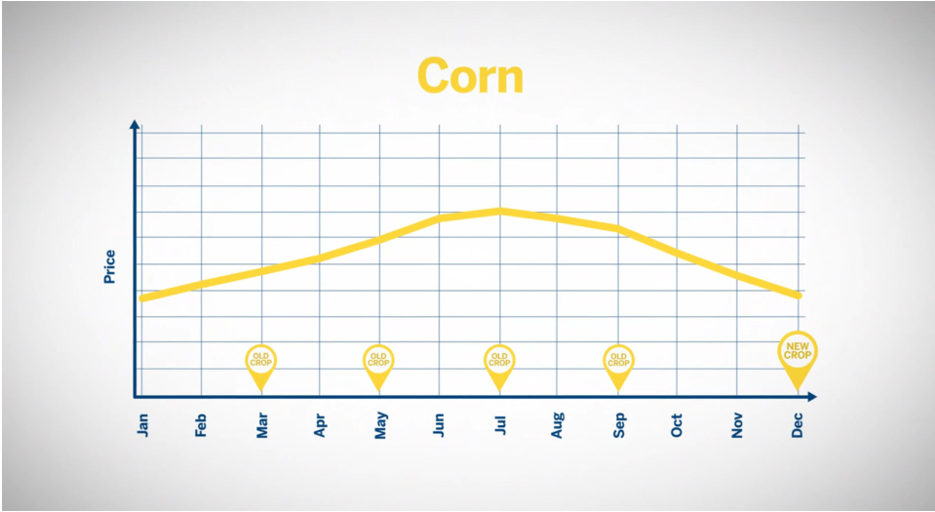

As with all commodities, corn’s price is the intersection of supply and demand, which are affected by many factors ... one of the main ones being “seasonality:”

Old Crop vs. New Crop

During corn’s spring planting season, the source of grain available for sale is from the previous harvest — the “old crop.” Supply is typically lower, so the grain tends to be priced higher.

During the harvest months — normally November and December — the “new crop” comes to market. Supply is generally higher, so the price of corn tends to be at its lowest.

The tendency is for prices to be high around July due to the uncertainty around new crop production. It then declines from mid-summer into the harvest season.

Knowledge of this pattern is how many speculators reap mega-profits trading corn futures.

The price of corn has surged 41% over the past year alone.

But you don’t have to trade futures to get in on this trend.

One potential option is with the Teucrium Corn Fund (NYSE: CORN). It provides investors an easy way to gain exposure to the price of corn futures in your brokerage account.

Seeing as corn is used throughout the global economy to produce feed, fuel, starch, sweetener and even plastic ...

And that its demand is rising exponentially due to the expansion of the global middle class ...

And since corn prices have a low correlation with U.S. equities ...

It’s an attractive way to potentially diversify your investment portfolio. As always, remember to do your own due diligence before buying anything.

All the best,

Sean

P.S. With food prices soaring, I recently recommended a great pick to capitalize for my Wealth Megatrends subscribers.

I can’t give out the name here, but if you’d like more information on that pick, click here now.