Ever been caught in a riptide? Even for the strongest swimmers, that power can be overwhelming. Now, imagine if you could harness that energy. That’s why using ocean power to produce electricity is the next wave in renewable, green energy.

• Wave power is a means of producing electricity by converting energy from Earth’s oceans into clean energy.

Oceans cover more than 70% of Earth’s surface. On a typical day, 23 million square miles of tropical seas absorb the radiation equal in heat content to roughly 250 billion barrels of oil.

If less than one-tenth of 1 percent of this energy could be converted into electricity, it would supply all the electricity consumed in the U.S. daily ... TIMES 20!

Think about all the waves rippling across millions of square miles of ocean.

The potential energy of waves off the coasts of the U.S. is thought to be as much as 2.64 trillion kilowatt-hours (kWh) per year, equivalent to about 66% of the nation’s power generated in 2020.

• And this energy can be converted to the 60-hertz (Hz) frequency ... meaning it can be added to the utility grid.

While currently lagging wind and solar in commercial development, wave power could potentially hold more promise than either of those renewable energy sources:

• As waves originate from storms far out to sea — and can travel long distances without significant energy loss — the energy produced is steadier and more predictable, both day to day and season to season.

• Water is 850 times as dense as air, so wave energy contains roughly 1,000 times the kinetic energy of wind, allowing for less conspicuous devices in a fraction of the space.

• Because wave energy needs only 1/200th the land area of wind and requires no access roads, infrastructure costs are less.

• Wave energy devices are quieter and can be less visually obtrusive than wind turbines, which typically run 40–60 meters in height and require remote siting (and, consequently, high transmission costs). In contrast, 10-meter high wave devices can be integrated into breakwaters in busy port areas, producing power close to where it’s needed.

• When made with materials developed for offshore oil platforms, ocean wave devices (which contain few moving parts) should cost less to maintain than those powered by wind.

• And unlike wind and solar, power from ocean waves is produced around the clock.

The world’s first commercial wave energy plant was developed by Wavegen off the island of Islay, Scotland, in 2000. Installations now exist or are being constructed in several other countries, including Portugal, Norway, China, Japan and Australia. The U.S. has wave farms off the coasts of New Jersey, Oregon and Hawaii.

• And this past July, the U.S. Department of Energy (DOE) — in support of the Biden administration’s efforts to build a clean-energy economy by 2050 — announced $27 million in federal funding for research and development of commercial wave energy.

With improving technology and economies of scale, wave generators are anticipated to produce electricity at a cost comparable to wind turbines, which currently produce at around 4.5 cents per kWh.

Diversifying Your Portfolio With Ocean Power Stocks

With the ability to generate so much energy, companies are racing to develop the technology to capture it.

But given how wave energy generation is so new, it’s no surprise there are only three pure-play stocks available.

And only one is at the top of my watchlist: Ocean Power Technologies (NYSE: OPTT).

This company, worth $115 million, specializes in an autonomous (not grid-connected) device called the PowerBuoy, which uses the latest technology to generate, capture, store and use energy from ocean waves.

Initially designed for the U.S. Navy, the PowerBuoy proved its durability by surviving Hurricane Irene. And the new hybrid PowerBuoy can generate power from solar panels, too!

Also of note ... the stock made waves with the company’s February acquisition of 3Dent Technology, giving it access to advanced offshore engineering abilities.

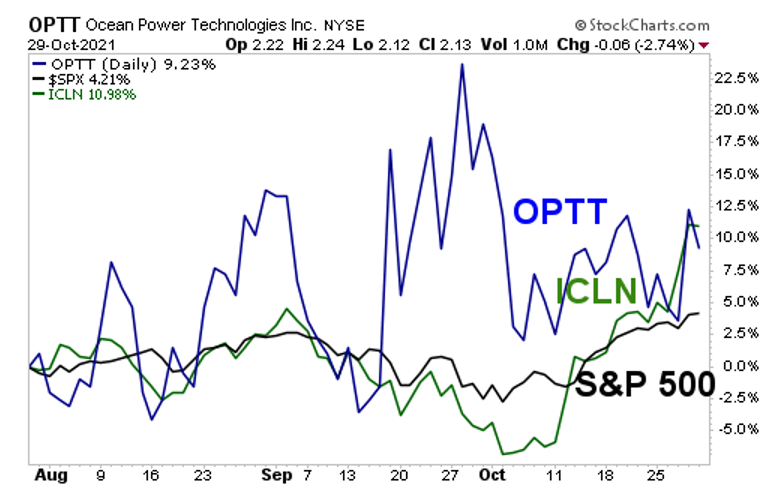

Let’s look at a three-month price performance chart comparing OPTT with its benchmark, the iShares Trust - iShares Global Clean Energy ETF (Nasdaq: ICLN) and the S&P 500:

|

You can see that both OPTT and ICLN have DOUBLED the S&P 500’s performance over this time frame. To be sure, OPTT is much more volatile. And it’s way off the highs it hit earlier this year.

So, it offers a ride akin to stormy seas. But it could be setting sail for profits. As always, be sure to do your due diligence before making any investment.

But so long as the sun shines, energy from the sea will always be there to provide endless potential for the companies capable of harnessing it.

All the best,

Sean