There's no doubt that the U.S. dollar is stairstepping lower. But like the classic metal toy, it's downright indestructible.

I've gotten lots of reader mail since Dr. Martin Weiss and I unveiled our Shocking Forecasts for 2022–2024 last week.

And I want to share one of those questions — about what's going to happen to the U.S. dollar during that time — along with my answer.

Adele T. asks:

"I just finished watching the three-part series you and Martin recorded. Before I go 'all-in' and subscribe to Supercycle Investor, I would like your feedback regarding my one critical reservation …

"Do you agree or disagree that the U.S. dollar is headed in the general direction of complete collapse?"

First, I want to thank Adele and everyone who watched our videos and took some time to give us feedback.

If you haven't had the opportunity to watch them yet, or if you want to catch the replay and write down our predictions and the ideas we revealed that could provide your portfolio with a healthy layer of profit and protection, you can catch them here:

Part 1: The Next Great Convergence

Part 2: The Four Horsemen of the Economic Apocalypse

Part 3: The Windfall Profit Opportunity of a Lifetime

Now, let's get right to the heart of Adele's question … because I suspect many of you saw how the Russian ruble dropped to near zero practically overnight, and you wonder whether — and how soon — that could happen here, too.

My Prediction: The Dollar Will Be the Last Wobbly Giant Standing

Some people are out there predicting an imminent U.S. dollar collapse.

Don't listen to them. The U.S. dollar is not in danger of imminent collapse.

Sure, it treads the same descending stairwell as all fiat currencies, as it's being printed into irrelevance.

But that decline is a slow slump, like a Slinky on Xanax.

The greenback is depreciating slowly, going down one stair at a time. But like its springy steel counterpart, it's as close to indestructible as a mass-produced plaything can get.

How is that possible?

For one thing, the Federal Open Market Committee is already raising its benchmark interest rate.

On March 16, the Fed lifted its target for its effective federal funds rate — essentially the cost of overnight lending of reserves between commercial banks — for the first time since 2018.

While that's far behind inflation, that's still ahead of the European Union (EU), which may not start raising rates for another year.

What about Japan? Japan has a NEGATIVE target rate.

Meanwhile, Fed governors are trotting out to talk about how they want FASTER and more frequent interest rate hikes. The next one could come as soon as May.

Going back to the doomsayers, you'll see them claim that Russia and China are going to make their own currency.

They say a new Sino-Russian super dollar will supersede and topple the U.S. dollar as a reserve currency.

I have a word for that, and it's what you find at the south end of a northbound bull.

You see, China needs the U.S. and the rest of the world as a market. It can't afford to suddenly have a strong currency — not if it wants to keep selling us more and more made-in-China junk.

And China needs economic growth to maintain the social peace, which is something Beijing prizes above all else.

Also, it's highly unlikely many nations would trust a currency controlled by China and Russia. No one outside of their borders would want to see them in charge of the world's reserve currency.

That would be like giving Lex Luthor the keys to Ft. Knox!

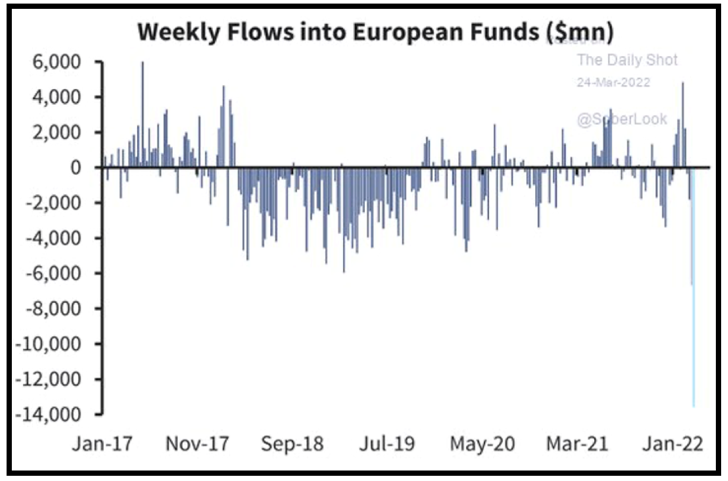

Finally, let me talk about something that is going on RIGHT NOW that helps support the dollar's dominance. Investors are fleeing European equities on a massive scale.

Why is this happening?

Because Russia invaded Ukraine and is now threatening the use of chemical weapons … along with nukes. NUKES!

You're damned right that European investors are going to take their money and run.

So, where is that money going? Into the U.S. market!

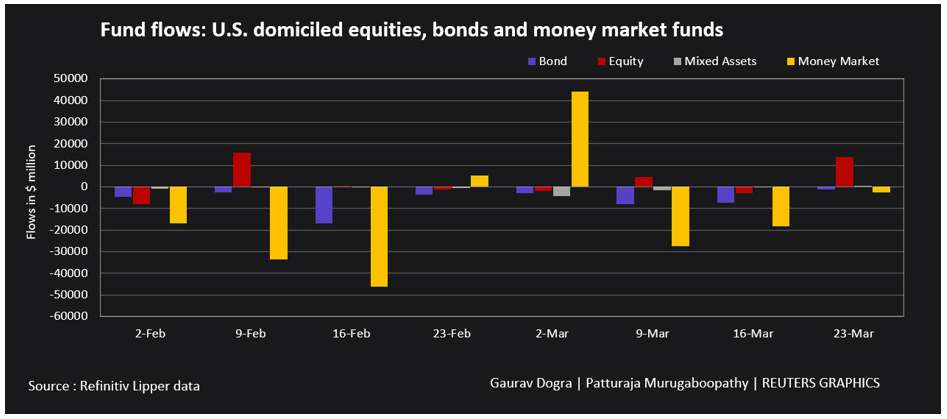

"U.S. equity funds witnessed big inflows in the week to March 23 as markets focused on a Federal Reserve rate hike and Russia's avoidance of a bond default.

"U.S. investors purchased equity funds of $13.88 billion, which was their biggest weekly net buying since Feb. 9, Refinitiv Lipper data showed."

What currency do you need to buy U.S. equities?

U.S. dollars!

This fits very nicely with the thesis we at Weiss Ratings have been pounding the table about: money would flee other markets around the world and seek refuge in the U.S.

That's just what we told you would happen. And that's exactly what is happening.

Anyone who tells you otherwise is either badly misinformed or an out-and-out charlatan.

Let me circle back to my point that the U.S. dollar faces the same woes as all fiat currencies ...

It surely does. But it will be the last wobbly giant standing, while all the others crash into the dust.

And for my money (and yours), I don't believe it will pay to bet against it.

All the best,

Sean