Boy, OPEC really likes to spit in everybody’s breakfast, don’t they?

The oil cartel and its allies, collectively known as OPEC+, agreed on Wednesday to reduce their target oil production by 2 million barrels a day in November.

The fact is, so many OPEC members are producing less than their targets that this actually works out to a cut of 900,000 barrels a day. Still, it’s a kick in the teeth for a world already squeezed by inflation, including high oil prices.

Now, for the good news.

That 900,000 barrels a day about equals what the Biden administration is releasing from the Strategic Petroleum Reserve every month — and they could release more. That’s one reason why oil prices didn’t skyrocket on the OPEC news.

It’s something members of my trading service, Wealth Megatrends, are positioned for as the world pushes toward decarbonization.

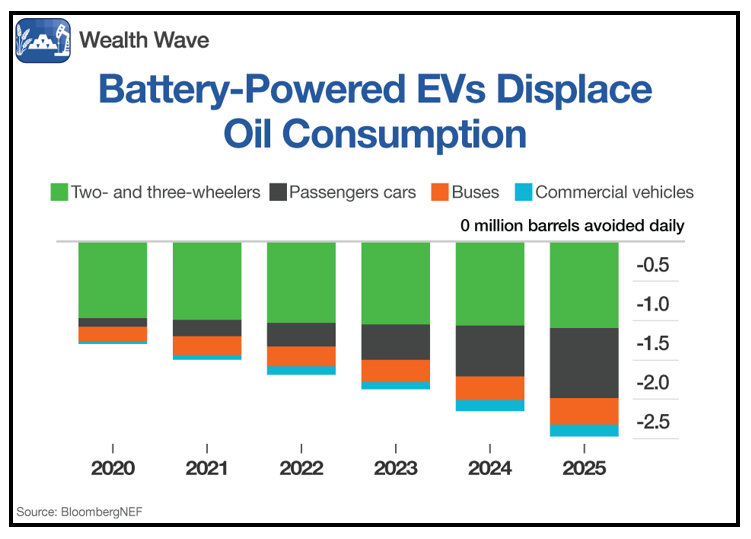

Another reason is that the surge in electric vehicle sales is already taking a bite out of global oil consumption. Just look at this chart:

Click here to see full-sized image.

What the chart shows is that EVs of all types — everything from electric scooters to passenger and commercial vehicles and buses — ALREADY displace 1.5 million barrels of oil consumption per day.

What’s more, according to Bloomberg’s New Energy Finance, EVs should displace nearly 2.5 million barrels of oil daily by 2025.

More predictions from Bloomberg NEF:

- The global fleet of internal combustion engine cars on roads will start to shrink in 2024.

- New production of ICE cars probably peaked in 2017. By 2025, deliveries will have dropped roughly 19% from their high point, as EVs take over more share.

- BNEF expects gasoline demand to peak in 2026, and total oil demand from road transport to crest the following year.

So, you can see why OPEC is lashing out. It must be scary to see the future creeping up on you in the rearview mirror.

And ..

EV Sales Are Shifting Into High Gear

Globally, consumers bought 6.6 million plug-in vehicles in 2021. Sales are forecast to triple by 2025. That could lead to 469 million passenger EVs on the road by 2035.

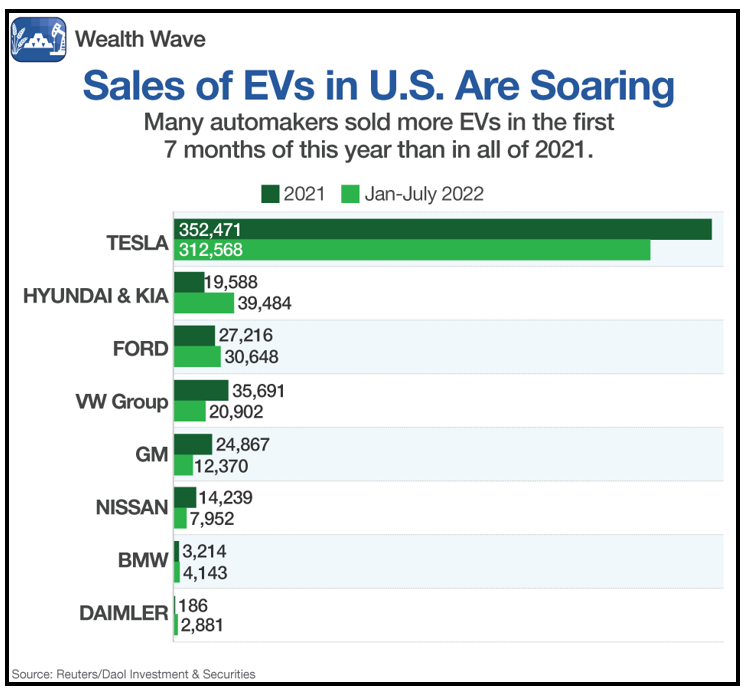

Sure, China and Europe are zooming ahead but they’ve been doing that for a while now. Though slowpoke America is finally moving into the fast lane. Look at sales of EVs in the U.S. so far this year.

Click here to see full-sized image.

Multiple automakers sold more EVs in the first seven months of 2022 than they did in all of last year. New tax breaks help. And now, Ford (F) and General Motors (GM) are rolling out new EVs. That’s one more thing that tells me sales will go zoom-zoom!

How Investors Can Play It

EVs are powered by lithium-ion batteries. Those batteries are made from lithium, nickel, cobalt, copper and zinc.

There are new types of batteries in the works, but those are years away. So, the current battery metals are good bets.

Lithium, of course, is leading the pack higher:

Click here to see full-sized image.

Wow, look at that!

Thanks to a surge in prices in 2021, the price of lithium carbonate used in batteries is up 229% in a year. The price surge slowed down this year.

That slowdown triggered a wave of selling in lithium stocks as skittish investors bailed out. It’s their loss, as lithium demand will stay strong for years.

These stocks were already good investments. Now, the better ones are downright CHEAP!

Find Out More!

I’ll be talking about opportunities in lithium and other battery metals and more at the New Orleans Investment Conference next week. It’s a great conference, and some of the stocks I’m going to talk about could be fortune makers. I hope you can attend. You can find out more information HERE.

Plus, you can buy individual stocks like I’m going to talk about in New Orleans. Or you could buy an exchange-traded fund that tracks stocks leveraged to battery metals. A good one is the Global X Lithium & Battery Tech ETF (LIT).

LIT holds a basket of stocks, including lithium miners Albemarle (ALB) and Sociedad Quimica y Minera De Chile (SQM), but it doesn’t stop there. LIT invests in the whole lithium/battery/EV pipeline, from miners to refiners and battery- and EV-makers. It has a total expense ratio of 0.75%.

Here’s a performance chart of LIT compared to the S&P 500 over the past 6 months:

Click here to see full-sized image.

It’s been a tough time for the broad market, and the falling indices drag even the strong stocks in LIT down.

But LIT has only lost half as much as the S&P 500. And when the next turn higher comes, I expect the power of these undervalued lithium-leveraged stocks to be unleashed.

I’ll be talking more about this in New Orleans. I hope to see you there.

In the meantime, if you’re looking for a place to hide from the S&P 500’s bear market, battery metals stocks are a great choice. That’s because EVs are the road to the future — and they’ll help America beat OPEC at its own game.

As always, be sure to conduct your own due diligence beforehand.

All the best,

Sean

P.S. The New Orleans Investment Conference is a blockbuster of an event, and a smorgasbord of actionable wealth-building ideas. The speakers are a who’s who of brilliant people. To see the line-up, and find out how you can attend, CLICK HERE.