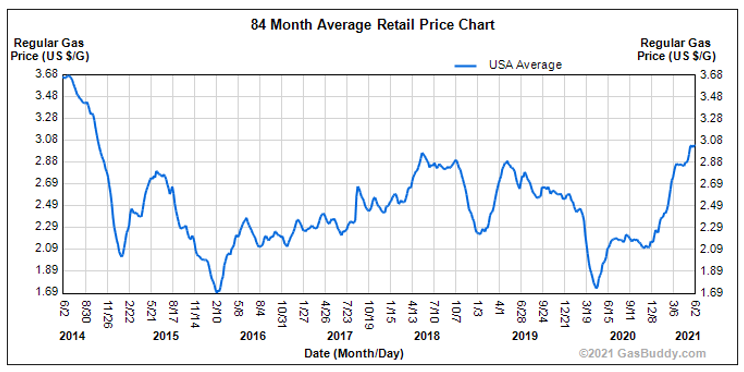

You’ve probably noticed that gasoline prices have headed higher and higher. According to GasBuddy, the average price across the nation is currently $3.04 per gallon. That’s over 16 cents higher than a month ago, and $1.17 per gallon higher than a year ago.

But that’s not the only record we’re breaking. Just look at this chart …

Heck, the prices at the pump are already at their highest level in seven years.

And you know what? Prices are going higher! The good news is there’s still time to get ahead of the wave and invest.

Why do I think prices are going higher? This past week, OPEC+ — the original OPEC members, led by Saudi Arabia, as well as a group led by Russia — had a meeting. It lasted only 20 minutes, their shortest meeting ever. They decided to raise production quotas — and the market didn’t even blink.

When news hits that should drive the price of something lower, and it goes higher, that’s very bullish.

In May, the OPEC+ cartel added a collected 600,000 barrels per day (BPD) to the group’s production ceiling. This month, it will increase another 700,000 BPD, and in July nearly 850,000 barrels more. And, as I said, the market knows this and doesn’t care. Prices are going higher.

Here are some forces I see at play …

Rising Demand

The International Energy Agency (IEA) forecasts global oil demand will jump roughly 5 million BPD this year.

Analysts at the energy consultant Wood Mackenzie wrote: “Demand growth is outpacing supply gains even with the agreed month-by-month OPEC+ production increases taken into account.”

Tighter Supply

In the U.S., gasoline stockpiles, or “stocks,” have dropped for three weeks in a row. Since we’re heading into summer driving season, that likely means that stocks are going to head lower.

And globally, OPEC is looking for oil demand to jump by 6 million bpd in the second half of the year. This will drive oil stocks much lower.

According to the OPEC+ forecast, global oil stocks will fall below their five-year average for the 2015-2019 period by the end of July. And that will signal an end to the glut that started during the pandemic.

Oil Supercycle Ahead!

Schlumberger Limited (NYSE: SBL) CEO Olivier Le Peuch told an investor conference on Wednesday: “In the context of the growing economic rebound, this upcoming industry cycle can potentially be characterized as a supercycle.”

Le Peuch said that the uptrend will push his company’s free-cash-flow margins above 10%, compared with a pre-pandemic level of about 8%.

Nice!

Lurking Risks

There are risks to this bullish forecast …

A resurgence of the COVID-19 pandemic is probably the biggest risk. We’ve seen hot spots flair up around the globe, fighting the general global trend of lower infection rates.

The other risk is one posed by higher oil prices themselves. According to economists, every 10% increase in gas prices lowers consumer confidence by about 1.5%. And each 50-cent increase in the price of gasoline sucks about $60 billion from consumers’ wallets.

Finally, there’s the “Iran Factor.” Iran is currently under sanction by western nations over its nuclear weapons research. If Iran and the West can work out a new deal, then 69 million barrels of oil that Iran has floating in storage on oil tankers could start being exported to the West.

So far, however, the market isn’t worried about any of these things. Indeed, the fact that the market isn’t worried about them only builds the bullish case.

How You Can Profit

Meanwhile, margins at refiners are widening as oil and gasoline prices go higher. And the VanEck Oil Refiners ETF (NYSE: CRAK) is breaking out.

Look at this weekly chart of CRAK …

You can see how CRAK pushed above highs last seen in 2019. The oil market may just be recovering. Refiners are already zooming down the road to riches.

So, a good way to play this move would be CRAK or one of its component refiners. Just remember to do your due diligence before buying anything.

The next oil boom is here. You’re about to get kicked right in the gas pump. You can wince and complain, or you can get busy and profit.

All the best,

Sean