It’s the Bus You Don’t See That Turns You into Road Pizza

When it comes to one investment, most investors are like an oblivious pedestrian walking across a busy highway. Cars go honk-HONK! The pedestrian finally starts to notice where he is. Then, WHAM! A bus comes along and turns that pedestrian into road pizza.

Friends, I don’t want you to be road pizza. Please, please, look at the charts I have here, which document the growth of a megatrend that is barreling ahead like a runaway bus. I have an opinion, and I feel strongly about it. Look at these charts and make up your own mind.

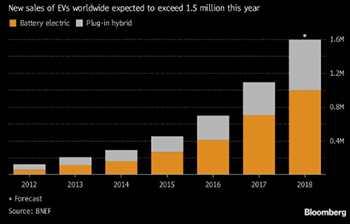

First, let’s all agree that 2017 was a heck of a year for electric vehicles (EVs) and plug-in hybrids. Sales hit 1.1 million last year. This year, they’re headed even higher.

Worldwide, new sales of electric vehicles will reach 1.59 million this year. That’s according to a forecast from Bloomberg New Energy Finance (BNEF).

That means in just the two years, total sales of EVs and plug-ins will hit 2.68 million.

Most of the new sales will be pure-battery models as opposed to plug-in hybrids. China is in the driver’s seat on this. Government policies in that country favor EVs. Sales in China are expected to be more than Europe and North America combined.

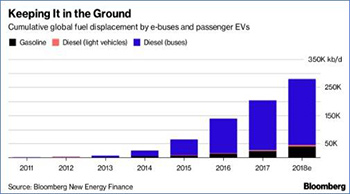

Here’s another way to measure sales. We are actually starting to see EVs impact global oil demand. Here’s another chart …

Last year, the combined gasoline and diesel “displacement” of EV cars and buses amounted to 200,000 barrels per day bpd. You can see that buses are displacing a heck of a lot more diesel than cars are replacing gasoline.

That’s because buses are bigger and heavier — and in many municipalities, they run all the time. For every 1,000 battery-powered buses on the road, about 500 barrels a day of diesel fuel will be displaced from the market. That’s according to BNEF calculations.

This year, the volume of petroleum-based fuel that electric buses take off the market, combined with rising gasoline displacement from EV cars, may rise 37% to 279,000 barrels a day.

That’s about as much oil as Greece uses. And this trend is just getting started.

This, again, is driven by China. Electric bus fleets there are huge, and getting bigger.

So how big is the EV megatrend, and how fast is it growing?

Global EV sales broke 1 million in 2017. They are accelerating. Sales jumped 314,000 last year after rising by 247,000 in 2016. This year, sales are expected to rise again, by an additional 583,000.

To put it another way, the first million EV sales took 20 years. The next million EV sales took 18 months. The next million, 8 months.

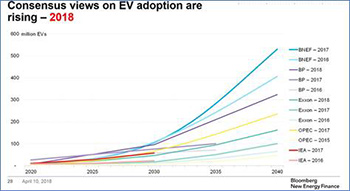

And now we get to a point that I like to pound the table about. The expectations of EV sales are BIG. But every EV sales forecast so far has been too low. Every. Single. One.

You can see on this chart how estimates of EV adoption changed over time. The blue line at the top is the most recent one.

But is that picture big enough and fast enough?

In February, industry analysts at Ark Invest wrote that: “The consensus forecasts for EV sales are ignoring the investments to which auto manufacturers already have committed. As a result, EV forecasts for 2022 probably will quadruple during the next 2 to 3 years.

“For the past three years, EV forecasts have increased significantly, reaching nearly 4 million units on average for 2022. According to ARK’s research, global EV sales will be 4 times higher, roughly 17 million units, in 2022.”

Holy Electric Avenue, Batman. That would be HUGE!

So how do you play this? Well, there are some great car companies that are turning onto the EV highway. Ford (NYSE: F) … Volkswagen (OTC Pink: VLKAF) … Honda (NYSE: HMC) … Toyota (NYSE: TM) and more.

But you also might consider a metal. Without this metal, the EV megatrend would be going nowhere fast.

I’m talking about cobalt. I’ve written about cobalt a lot. Two examples are HERE and HERE. I’ve made my Supercycle Investor subscribers a lot of money on cobalt.

And you know who likes cobalt? China!

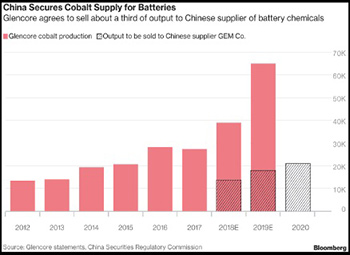

Chinese companies are racing around the world securing future cobalt supply.

A Chinese company, GEM, just signed a huge agreement with Glencore for three years’ supply of cobalt. Glencore is the world’s biggest cobalt miner.

GEM and its subsidiaries will buy 13,800 metric tons of cobalt from Glencore this year, 18,000 tons next year and 21,000 tons in 2020.

This led Glencore to warn that China’s control of cobalt is a huge risk for the world’s automotive industry. That didn’t stop Glencore from signing the deal, though.

The rest of the world seems to be sleep-walking as the Chinese do this. I guess they’ll never see that bus coming.

But you can be prepared. There are a fistful of North American cobalt stocks that are dirt-cheap right now. Heck, you can pick them up for pennies on the dollar.

If you’re doing this on your own, do your own due diligence. Be careful. But keep your eyes open. That bus is coming. And you don’t want to be road pizza.

All the best,

Sean